Hidden Gem in Malaysia Stock Exchange

Pantech Group Holdings Berhad - Earnings Accelerating, Large PVF Tendered, New Hot-Dip Factory...

James Ng

Publish date: Mon, 08 Feb 2016, 01:33 PM

(The information from various research reports is used.)

The earnings of Pantech Group Holdings Berhad is accelerating because RAPID impact kicked in. I set a target price of RM0.705 (PE 8X of FY17 EPS RM0.0885, last traded RM0.565, potential upside of 25%)

Review and outlook of business performance:

-

It is well-positioned as a one-stop solutions provider in the supply of pipes, fittings and flow controls. It is in a niche market, which could result in high margins.

-

Has a global business network, which includes oil majors like Saudi Aramco and Petrobras.

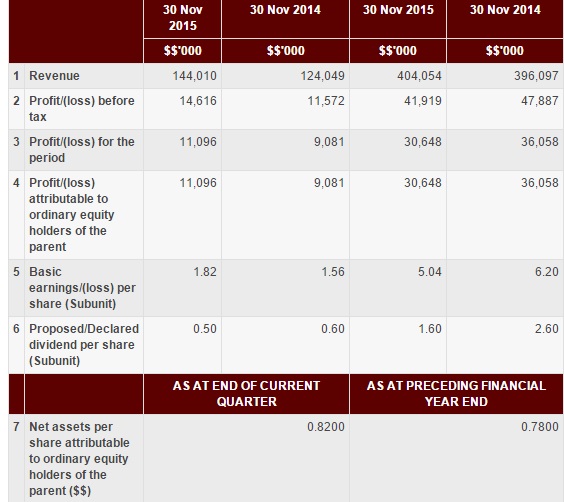

- 3QFY16 net profit increased 22.2% YoY and 6.4% QoQ to RM11.7m. Similarly, quarterly revenue gained 16.1% YoY and 18% QoQ to RM144m. Margin improved to 11.6% in 3QFY16 vs. 10.3% in 2QFY16.

- Revenue from Trading division improved 46% YoY and 26.3% QoQ to RM95.5m. Contribution from trading surged to 66% of total sales (3QFY15: 53%). Trading EBIT margin strengthened to 11.6% from 7.5% in 3Q15.

- 9MFY16 revenue from local operations grew 4% YoY to RM419.2m from RM404.3m.

- In 3QFY16, Pantech continued to benefit from FX gains (RM4m) arising from USD sales. This aided in boosting revenue (+19% QoQ, +2% YoY).

- Earnings are expected to pick up in 4Q with ongoing contribution from RAPID and also the company's internal cost cutting measures.

- PVF contracts tendered is estimated to be around RM500m.

- New JV to operate in FY18 - Pantech formed a 51:49 JV to venture into the hot-dip galvanising business. The JV will invest RM30m to build a new factory by end of FY17. Pantech will benefit as it can stop outsourcing the galvanising of its PVF products.

-

Business model is more resilient against oil price movements.

-

The bulk of earlier works of RAPID, which were mainly earthworks have been completed. Its physical presence in Johor, and a new warehouse adjacent to the RAPID suggests that it may win more supply contracts from RAPID to help the company survive the oil price volatility over the next 5 years. The USD16b RAPID is proceeding according to plan, with Petronas dishing out more contracts in recent months. Pantech has already begun supplying small volumes related to RAPID.

-

Any bottoming out of oil prices may prompt investors to refocus on Pantech.

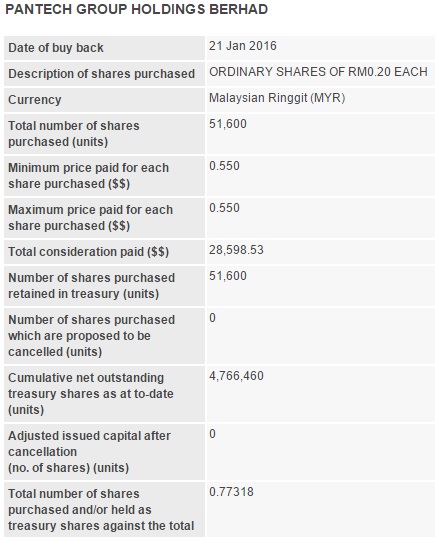

Aggressive share buy back:

As you could read, it has bought back 0.77318% of shares.

Distribution of 1 treasury share for every 100 existing ordinary shares:

Rewarding for shareholders is its priority.

It pays dividend every quarter. Dividends of RM0.021, dividend yield 3.7%, which is reasonable.

Its NAV is RM0.82, its price-to-book ratio is 0.69!

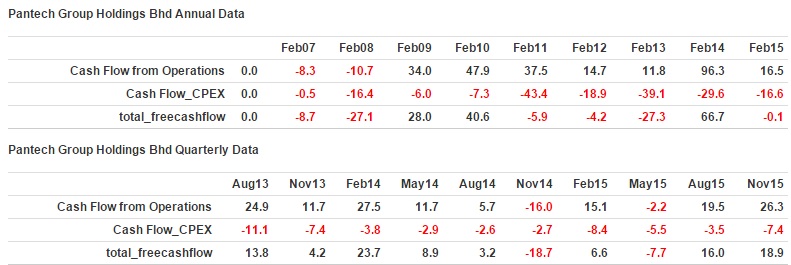

Its free cash flow is also strong, even in this challenging time.

The average annual return of tangible equity is 18.11%, considered good.

Based on the latest annual report, some of the substantial shareholders are:

- KOPERASI PERMODALAN FELDA MALAYSIA BERHAD 9.828%

- Citibank New York 3.06%

- EMPLOYEES PROVIDENT FUND BOARD 2.1%

- Phillip Capital Management Sdn Bhd 0.82%

- Pacific Pearl Fund 0.72%

- Affin Hwang Select Balanced Fund 0.68%

- SAHAM AMANAH SABAH 0.67%

- Dimensional Emerging Markets Value Fund 0.58%

Hope you enjoy reading!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Hidden Gem in Malaysia Stock Exchange

JAKS RESOURCES: 25 years recurring income, order book RM2.5bn, FY2019 revenue RM1.1bn

Created by James Ng | Oct 02, 2017

Chin Well Holdings berhad - Superior Free Cash Flow, Minimal Capex, Net Cash, Good Dividend...

Created by James Ng | Mar 10, 2016

Sunway Berhad - Deeply Undervalued, Reasonable Dividends, High Net Assets, Strong Free Cash Flow....

Created by James Ng | Feb 07, 2016