Hidden Gem in Malaysia Stock Exchange

JAKS RESOURCES: 25 years recurring income, order book RM2.5bn, FY2019 revenue RM1.1bn

James Ng

Publish date: Mon, 02 Oct 2017, 04:56 PM

- JAKS eyes IRR of 12% for RM7.1bn Vietnam plant. The break-even should be slightly longer than eight years. Jaks will enjoy recurring income from this IPP for 25 years from the date the plant commences commercial operation in 2020.

- The key profit driver for the next few years is its Vietnam EPC construction work (estimated RM1.63b). The work is progressing on schedule and is expected to be stronger in the coming quarters. Construction work should pick up towards a 28% completion rate by the end of 2017.

- Its long-term incentive plan (LTIP) share option scheme for its employees also encourage them to buy and hold shares for long-term price appreciation.

- Outstanding orderbook is estimated at RM2.5bn (note its market cap only RM612m), key contracts including the Sungai Besi-Ulu Kelang Elevated Expressway (SUKE) job (RM509m). Management remains optimistic that Jaks should be able to replenish close to RM500m of new local orders by end of 2017.

- Unbilled sales of property stood at RM194.1m. Construction work on the Pacific Star project has speed up, is on schedule to be completed by end-2018.

- Its net profit for FY2019 is forecasted to be RM91.6m (EPS RM0.209), compared with net loss of -RM13m in FY2016.

- Asset disposal still on the cards. Jaks is selling four parcels of freehold land totalling 5.988ha in Selangor to Sunway for RM167.59m and a piece of freehold industrial land measuring approximately 1.214 hectares for a total cash consideration of RM26m. Equity value of Pacific Star + Pacific Star Retail Podium is RM300m, and equity value of Evolve City Mall is RM230m. Should it successfully proceed with the disposals as planned, Jaks would be in a strong net cash position.

- Total borrowing has lowered from RM531m to RM492m, and cash is RM77m.

-

Massive share buying from CEO:

-

-

-

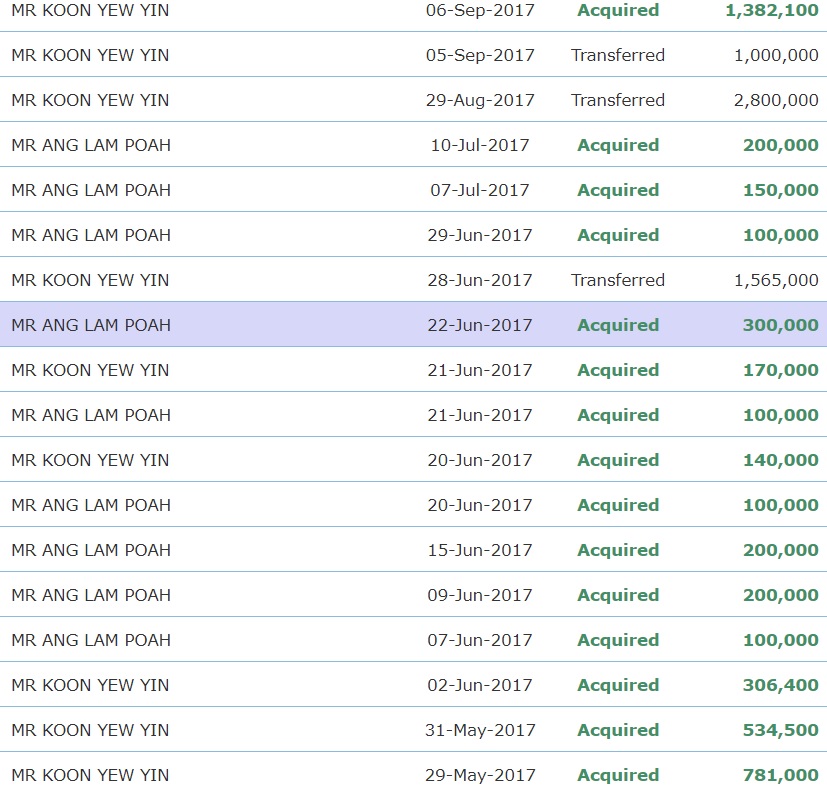

Massive share buying from Mr. KYY:

-

-

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Hidden Gem in Malaysia Stock Exchange

Chin Well Holdings berhad - Superior Free Cash Flow, Minimal Capex, Net Cash, Good Dividend...

Created by James Ng | Mar 10, 2016

Pantech Group Holdings Berhad - Earnings Accelerating, Large PVF Tendered, New Hot-Dip Factory...

Created by James Ng | Feb 08, 2016

Sunway Berhad - Deeply Undervalued, Reasonable Dividends, High Net Assets, Strong Free Cash Flow....

Created by James Ng | Feb 07, 2016

Discussions

1 person likes this. Showing 4 of 4 comments

Promise after promise. You think i am a girl ah? Can so easily be duped? Show me the results right now and right here!

2017-10-02 20:02

When I see this heading of the blog, I quickly turn away & not to read the article:

Hidden Gem Which You could Buy and Keep for Life

2017-10-02 22:45

The results were terribly bad & lousy even during the construction period, it will become worse once construction is done, because they need to start sell, pay load & serve interest.

http://klse.i3investor.com/servlets/stk/fin/4723.jsp

2017-10-02 22:46

aslm

"RM8.6bn of 25 years recurring income, order book RM2.5bn, FY2019 revenue RM1.1bn"

Talk too far from now. Take care of your near term business first (Property Segments)

2017-10-02 17:04