Sunway Berhad - Deeply Undervalued, Reasonable Dividends, High Net Assets, Strong Free Cash Flow....

James Ng

Publish date: Sun, 07 Feb 2016, 09:15 PM

(The information from various research reports is used.)

Sunway Berhad is noted for its superior and unrivalled 'build-own-operate' model. I set a target price of RM3.91 (PE 12 of FY16 EPS RM0.326, with the last traded RM2.94, potential upside is 33%). For FY16, Sunway sets target property launches of RM1.6b. Property launches of Sunway is well spread scross multiple areas namely Sunway Iskandar, Ipoh, Mont Kiara, Bangi, South Quay, and Jalan Peel. Management is confident hitting the expected sales target of RM1b for FY15 because their 9MFY15 sales already hit RM734m (effective RM564m). Don't forget it has the steady dividend income from 34.5% stake Sunway Reit and earnings from 51% stake Sunway Construction.

- Sunway South Quay

- Sunway Velocity

- Sunway Damansara

- Medini Iskandar

- Daiwa JV

- Pendas, Iskandar

- Sunway Lenang

- Sunway Wellesley

- Paya Terubong

- Sunway Hillds

- Balik Pulau

- Sunway Cassia

- Sunway Semenyih

- Kelana Jaya Land

- Total worth RM6.8b

- Miltonia Residences

- Arc, Tampines

- Lake Vista

- Sea Esta

- Royale Square

- Mount Sophia

- Avant Parc

- Total Worth RM315.9m

- Tianjin Eco City

- Sunway Guanghao (China)

- Sunway OPUS Grand India

- Sunway MAK Signature Residence (India)

- Total Worth RM266.5m

- Monash University

- Sunway Pinnacle

- Sunway Velocity Shopping Mall

- Sunway University Campus

- Monash Residence Hostel

- Total Worth RM1.3b

- 34.5% stake in listed Sunway REIT RM1.5b

- 51% stake in listed Sunway Construction RM923m

- Sale of 70% stake in 13 acres land to Daiwa RM24.7m

- Trading & Manufacturing Asset RM415.1m

- Quarry Division Asset RM165.9m

- Other Division Asset RM1.1b

Review and Outlook of Business Performance:

- stronger operating profit in most of its divisions (construction +69%, property investment +44%, quarry +66%; due to improvements in margins)

- property investment emerged as the largest EBIT contributor at RM40m, accounting for 33% of 3QFY15 EBIT given the higher contribution from Sunway University New Academic Block and Sunway Pinnacle.

- the 51% stake construction division was exceptionally strong, with EBIT being boosted mainly by a reversal of over-elimination of intra-group profit in the previous quarter.

- the Emerald Residence and Emerald Boulevard shops have recorded booking rate of 50% and 60% respectively (previewed 25 Nov at Sunway Iskandar), which is satisfactory in this challenging environment.

- reduction in net interest cost (-79%)

- lower minority interest contrition (-20%)

Aggressive Share Buy back by Company:

As you could read, it bought back 1.17% of issued shares!

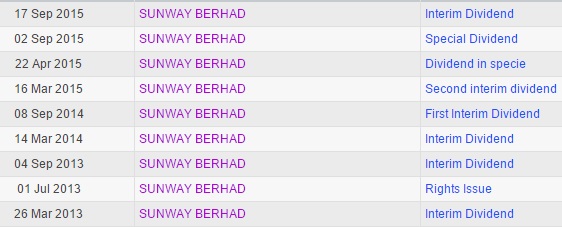

Consistent Cash Dividends Payout:

Dividends of RM0.11, dividend yield of 3.7%.

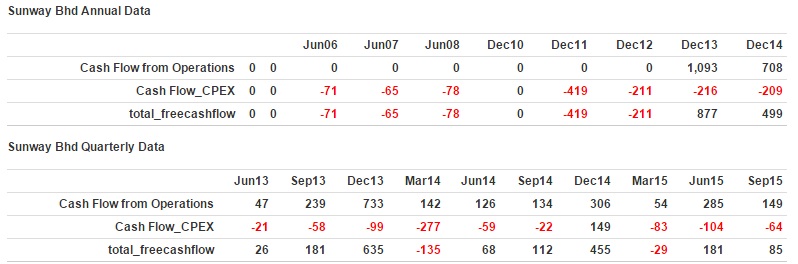

Superior Free Cash Flow:

Even in this challenging environment, it still maintain strong FCF.

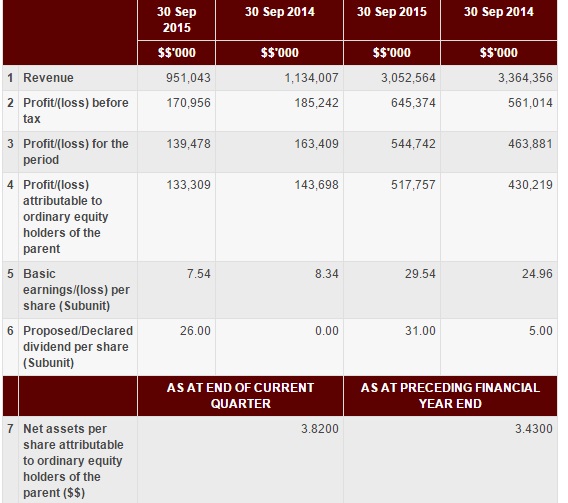

Low price-to-book ratio:

NAV is RM3.82, price-to-book ratio of 0.77!

Aggressive director share buy back since 1 December 2014:

The insiders keep buying Sunway shares.... could it be clearer than this?

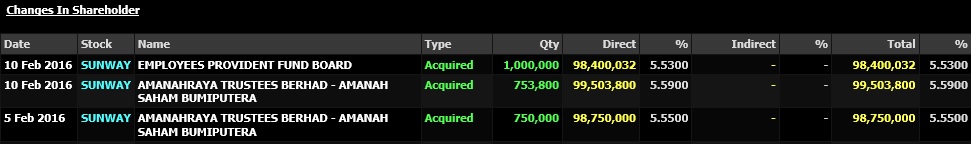

Amanah Saham Bumiputera and EPF keep acquiring...

High Return of Tangible Equity (ROTE)

Average annual ROTE is 15.1%!

- Skim Amanah Saham Bumiputera 4.92%

- Employees Provident Fund Board 3.87%

- Amanah Saham Malaysia 1.75%

- Eastspring Investments Berhad 1.28%

- AIA Berhad 1.28%

- Amanah Saham Wawasan 2020 1.23%

- Great Eastern Life Assurance Berhad 0.91%

- J.P. Morgan Bank Luxembourg S.A. 0.78%

- Demensional Emerging Markets Value Fund 0.77%

- Amanahraya Trustees Berhad - As 1Malaysia 0.75%

- Public Islamic Select Treasures Fund 0.6%

- Public Islamic Select Enterprises Fund 0.47%

- Amanah Saham Didik 0.46%

- VCAM Equity FD 0.37%

- Citibank New York 0.34%

- The Bank of New York Mellon 0.32%

- UBS AG 0.32%

- CBNY Emerging Market Core Equity 0.31%

- Amanah Saham Nasional 3 Imbang 0.29%

- Amanah Saham Nasional 2 0.28%

- JPMorgan Chase Bank, National Association (USA) 0.42%

Hope you enjoy reading!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-06-26

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-25

SUNWAY2024-06-24

SUNWAY2024-06-24

SUNWAY2024-06-24

SUNWAY2024-06-24

SUNWAY2024-06-21

SUNWAY2024-06-20

SUNWAYMore articles on Hidden Gem in Malaysia Stock Exchange

Created by James Ng | Oct 02, 2017

Created by James Ng | Mar 10, 2016

Created by James Ng | Feb 08, 2016

Discussions

shortinvestor77: I meant Sunway is a good company, and I seriously recommend it.

2016-02-18 08:25

JT Yeo

A thing about the Sunway FCF. Large portion of capital expenditure for property companies doesn't come from acquiring property, plant & equipment but comes from buying lands. A manufacturing buy more machines to produce more products; a property needs to constantly buy more lands to sell more house (products).

Therefore the FCF is normally 'overstated' as it doesnt include money spent acquiring lands for development purposes.

2016-02-07 21:53