LBS Bina-Long forgotten gem? (Part 2-Turning Land into GOLD?)

GemDigger

Publish date: Sun, 14 Sep 2014, 02:07 AM

Previously I have written about LBS in the following links

http://klse.i3investor.com/blogs/gemdigger/59711.jsp

At the time of writing, it is only 4 months left until 2015. It is only matter of time for management to announce the 6 sen special div.

Anyway, the main point of part 2 is as written below:

Few months ago when BREM was reported to have land value of RM8.72 per share, the share price shot from RM1.56 to highest RM2.80. The main idea was, land is getting more expensive and valuable over time, you can just get rich by holding on a company which owns huge landbanks which was not reevaluated over long time. My thought was, why not LBS?

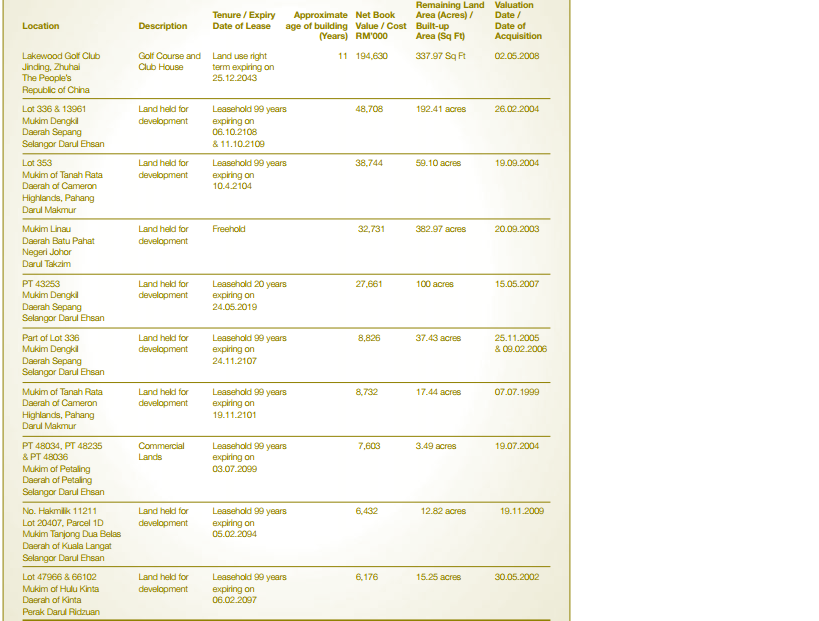

I started looking into the annual report of 2010, comparing the net book value of the list of major properties.

In 2010, 10 major plots of land the total net book value is RM380 million.

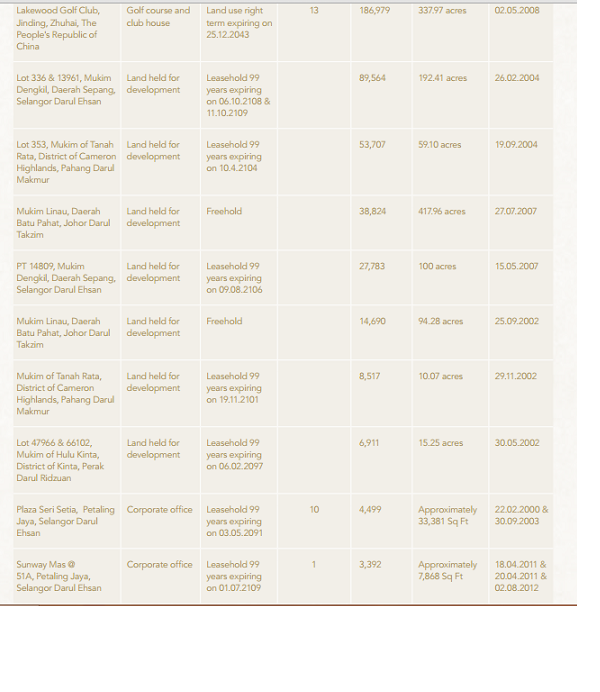

Jumping to 2012, the net book value of 10 major land held is RM434 million.

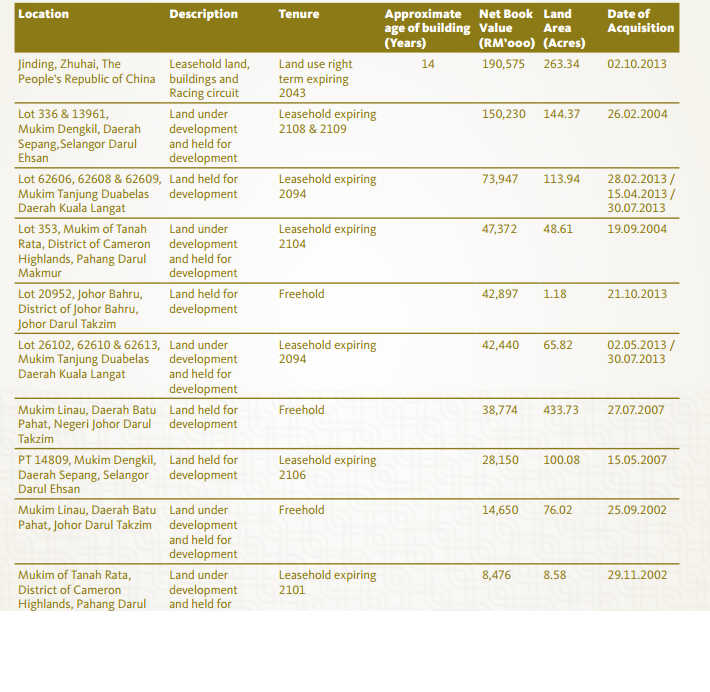

In the 2013 annual report, top 10 net book value of the land held is RM637 million.

Total reported land area is 1255 acres while in the latest report by RHB, total land area is estimated at 1787 acres. They might have acquired some land through acquisition of subsidaries.

From 2010 till 2013, the net book value of the lands held has increased by RM257 million, which is about 70%.

Just comparing the plot of land at 2nd row: Lot 336 & 13961, Mukim Dengkil , Daerah Sepang, Selangor Dahrul Ehsan

Price in 2010 was RM48 million while price reported in 2013 was RM 150 million. Increased by 100% each year!!

In financial terms, net book value will never equal to the market value, the reasons are as belows

http://www.investinganswers.com/financial-dictionary/financial-statement-analysis/net-book-value-2303

So far as I know, LBS Bina has never carried out re-evaluation of land or asset to boost its earnings. The net book value might be undervalued compared to the market value.

Does RNAV of RM5.05, TP of RM3.03 given by CIMB last year (2013) unrealistic?

RHB has given TP of Rm3.39 in the recent report titled LBS Bina- Deeply undervalued...

Has Mr Market overlooked LBS Bina who is sitting on pieces and pieces of land of gold?

The author of Nanyang Shang Pao has written a point for BREM, just hold on the share to get rich because of the appreciation of the land value.

For me, why not LBS BIna? At RM1.72, you will hold onto China land plus landbanks in Malaysia which appreciates at the average rate of RM70 million a year. It is just up to management how they are going to utilise the landbank value.

In 2013, they sold land in China and we enjoy 6 sen special dividend each year as a commitment by management until 2017.

The directors are accumulating their shares whenever possible. Will more landbanks be sold? Only time will tell.

For time being, I will hold on to my LBS shares and anticipate for more dividend surprises.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

cytew

fututec 7161 is a better choice

2014-09-14 16:58