YOCB, Has Ya All Forgotten Her?

GemDigger

Publish date: Tue, 28 Apr 2015, 08:13 AM

YOCB was trading at a high of RM1.39 before crashing to a low of RM0.80 in December last year. It has been hoovering at the range of RM0.80 to RM0.90

Business Overview:

Primarily Engaged in design and manufacturing of home linen and bedding accessories.

The company markets its product worldwide.

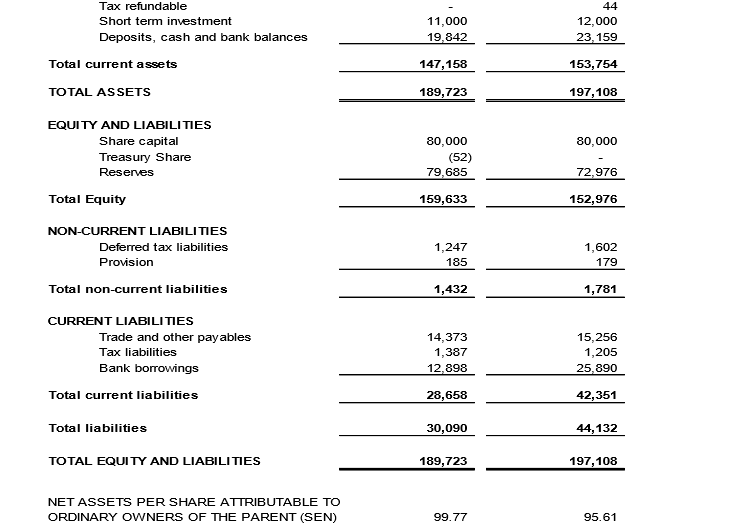

Balance sheet:

Sitting on net cash and investments of RM30 million while having borrowings of RM12 million only.

Strength:

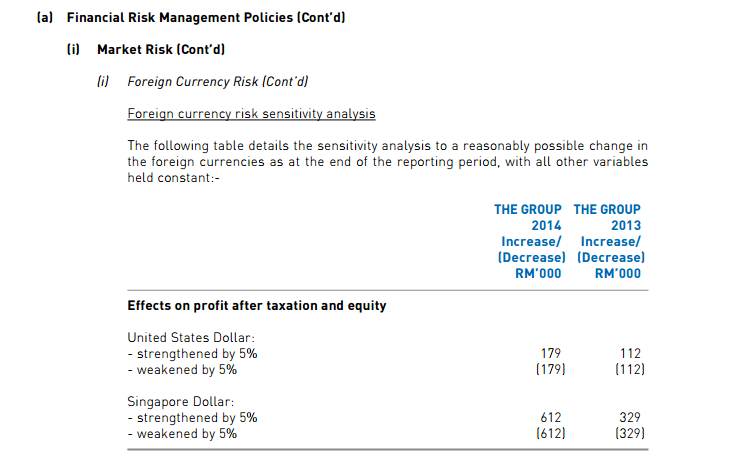

SGD and USD in upward trend which the company is benefiting from it. Below is the abstract from annual report pg 86.

EPS at 2nd quarter =6 sen, full year expected 12 sen or more.

Dividend = 4 sen. Yield = 4.6% at RM0.86

The company's profit margin, ROIC and ROE is at 10% , 14% and 12% respectively.

Current NTA=RM0.99, which gives dividend yield of 4%.

If the company payout more dividend than last year, there will be upside surprise.

Downside of the share price will be RM0.80, 52 weeks low.

Weakness:

Implementation of GST will hamper consumer consumption, which affects the revenue in short term.

Conclusion

TP=RM1 and above, depending on the coming quarterly result.

Downside RM0.80, which is trading below its NTA of RM0.99.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lets dig for Gem

Discussions

Noby how to determine the quality of earnings besides CFFO/NI? Is there any other metrics?

2015-04-28 13:05

I trypically look at free cashflow metrics. You can also look at price/fcf or fcf over invested capital.

2015-04-28 13:25

NOBY

Cheap from earnings perspective.. but problem is the poor free cashflows. Quality of earnings is also poor with cashflow from operations consistently lower than net profit. No idea why since its business is retail related,

2015-04-28 08:29