LBS Bina-Long forgotten gem? (Part 3/3) 林木生控股土地生黄金

GemDigger

Publish date: Sun, 14 Sep 2014, 05:35 PM

In Part 2 I have mentioned about the increment in value of the land that LBS Bina owns is about RM 70 million a year on book value.

http://klse.i3investor.com/blogs/gemdigger/

On 11 September 2014, Hong Leong investment bank has published a research report about LBS Bina.

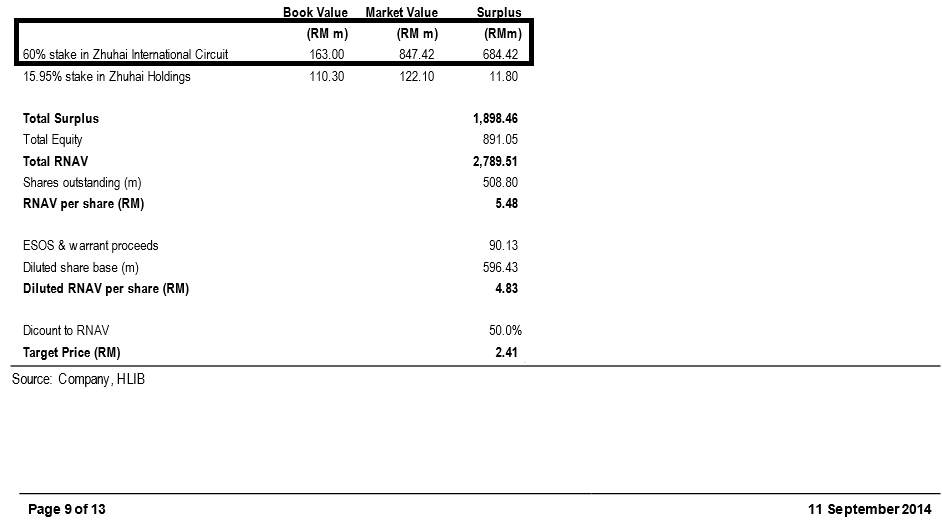

Just the stake in Zhuhai International Circuit alone the difference in book value and market value is about 6 times (684 million)!

The forecasted appreciation of land value at RM70 million a year is only on book value, which can be far more undervalued than market value.

Referring to write up for BREM : http://klse.i3investor.com/blogs/treasures/44100.jsp

大胆超廉价买地赚大钱

廉价地产好股大胆买进可致富。

一人的信心,力量不大;千万人的信心加起来就是一股强大力量,大到可把比特币推高上千倍。

今日,大马股市地产股,不少在资产价值方面最强,最有增值潜能,但股价大平卖,只因为市场人士还缺乏信心。

在股市,“先知先觉赚大钱,后之后觉赚小钱,不知不觉赚不到钱。”

免责声明

本文分析仅供参考,并非推荐购买或脱售。投资前请咨询专业金融师。

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lets dig for Gem

Discussions

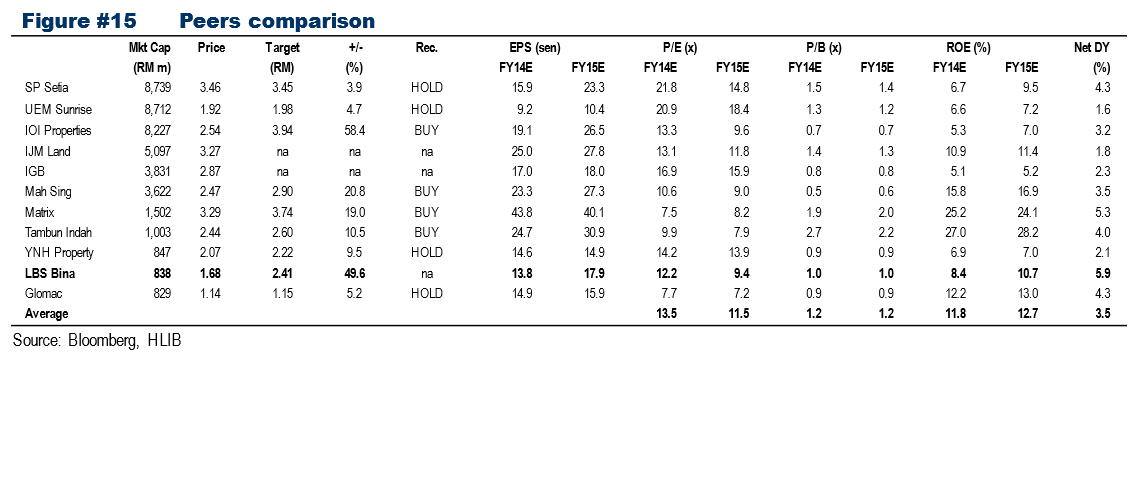

It is entirely up to management decision. At least last year when they monetize, we can enjoy 6 sen special dividend up to 2017. If they monetize in next year or 2016 when Zhuhai bridge completes (land price soars), I think early dividend yield will be more than current 5.9 percent as stated in HLIB research.

2014-09-14 19:54

Hi GemDigger, correct me if im wrong. I don't have much research done on LBS Bina except those written by you and published by broker house. My viewpoint is that yes there are certain value for that 60% stakes on ZIC, and they can estimate it based on the 2 lands LBS dispose last year, however my thought is that to create a catalyst, LBS either can reevaluate the land and book a fair value gain on their earnings or just sell it to realize a gain.

Now if they decide to sell it. 1. it isn't an empty land, where LBS can readily build something on it to generate earnings or sell the land to another China developer 2. Since it is a racing circuit, if LBS plans to sell it to unlock the value, a buyer would buy it only if either because the racing circuit is generating a lot of money or they can demolish the race track and build something more valuable on that land, based on my rational.

What I am more interested in are those 2 lands that LBS just sold, based on mode of settlement, cash, shares in Zhuhai holdings and promissory notes all worth RM681m. Discounting back since some promissory notes will not be distributed until 2017, the whole thing should still worth about RM450m. Based on market cap of RM850m, now im just figuring out if the whole LBS is worth the remaining RM400m or a lot more lol. But do let me know if my assumption is way way wrong.

2014-09-14 21:04

The below is an extract from Hong Leong's report:

RNAV and valuation:

We value LBS based on a SOP approach, which is a combination of: (1) The RNAV of the equity portion of its Malaysian projects; (2) The market value of its 15.95% stake in ZHIG; (3) Its 60% stake in ZIC, based on the previous actual transaction price for its 197 acres of development land sold to ZHIG, which works out to a valuation of RM847m.

----------------------------------------------------------------------------------------------------------------------------

Here is my take:

LBS has a 60% stake of another 264acre land in Zhuhai that has yet to be sold. HLiB used the previous transacted price of RM123/sqft to value it. But land prices have shot up since 2013 and will go even higher once the Macau-Hong Kong-Zhuhai bridge is completed in 2016. But base on the average transacted price in 2013 and 2014 of RM683/sqft, this 158.4acre of land is worth RM4.71B. Divided by the number of LBS shares (fully diluted, say 600m), you will arrive at RM7.85/share.

2014-09-15 07:22

Another question: will lbs be required to spend few hundred million ringgit to build another international circuit elsewhere for the municipal government before it is allowed to develop or sell the existing circuit land????

2014-09-15 11:48

If I recall correctly, the racing circuit is not generating any profits. I doubt LBS will be build another circuit unless they are compensated in some form.

2014-09-15 13:42

this is exactly im trying to understand, this isnt an empty piece of land, people can estimate how much it is worth all they want, but the main question is for the share price to move, LBS must unlock it. To unlock the value, they either get someone to reevaluate and make paper gain, or sell it.

And common sense person will think, who wants to buy a circuit? unless it is making so so much cash, or unless the land is so valuable someone is willing to demolish the circuit to build some high end properties or casino etc, but how about the approval to demolish it?

2014-09-15 14:54

LBS is in no hurry to sell the ZIC land. With the HK-Macau-ZhuHai bridge nearing completion end of 2015 or early 2016, land prices near the Zhuhai exit will boom. That will be the time LBS will reap the highest profit unless an offer that is too good to refuse is tabled to them right now. You can draw the same parallels to the Seberang Perai Selatan land price appreciation before the 2nd link was complete and after.

2014-09-15 15:33

Exactly. How the management is going to unlock the value, we dont know. At least we can estimate the value of assets that the company owns. If you trust the value of the business, buy the share and grow with it.

If you look at the trend, the share price is supported at RM1.66. RHB has completed private placement at RM1.70 few months ago. You know the downside, why dont sit down and enjoy the show?

在股市,“先知先觉赚大钱,后之后觉赚小钱,不知不觉赚不到钱。”

2014-09-15 17:11

If LBS is required to spend a few hundred million dollars to build another international racing circuit for the municipal government before it can develop or sell the ZIC land, then it may not be able to extract much value from the ZIC land. Furthermore, this may take another 2 or 3 years' time, not to mention that LBS may first have to source the approval and money to develop a new racing circuit. So, there are still uncertainties especially involving China laws & regulations that LBS directors or the research houses need to clarify.

Otherwise, the investors may have to wait for a long while. Meanwhile, there are also many other undervalued property companies with less uncertainties to be considered too.

2014-09-16 07:48

Gemdigger,doing a private placement is good practice to support the share price. But who would want to take up a private placement if the share price does not move in the near term. So expect some near term upside.

2014-09-19 15:41

valueinvestor

This piece of info (the Zhuhai Intertional Circuit land) has been made known to the Investing Public some 1 or 2 years ago in one CIMB Research report. The big question mark is when it will monetize such asset. Another 2 or 3 years when the land has appreciated further so as to maximize the value???

2014-09-14 18:01