TOPGLOV buys back more shares for third consecutive day, spent RM209m so far this week

gloveharicut

Publish date: Fri, 13 Nov 2020, 09:02 AM

{{{PM me to join GLOVE Private Discussion Room}}}

I invite you to read my blog and make a smart GLOVE decision.

https://klse.i3investor.com/blogs/gloveharicut/blidx.jsp

I am reproducing the The Edge article to my blog.

This post don't have any value added content.

Compile here for my own record.

Please skip if you don't like it.

https://klse.i3investor.com/servlets/stk/annshrtxn/7113.jsp

https://www.theedgemarkets.com/article/top-glove-buys-back-more-shares-third-consecutive-day-spent-rm209m-so-far-week

Top Glove buys back more shares for third consecutive day, spent RM209m so far this week

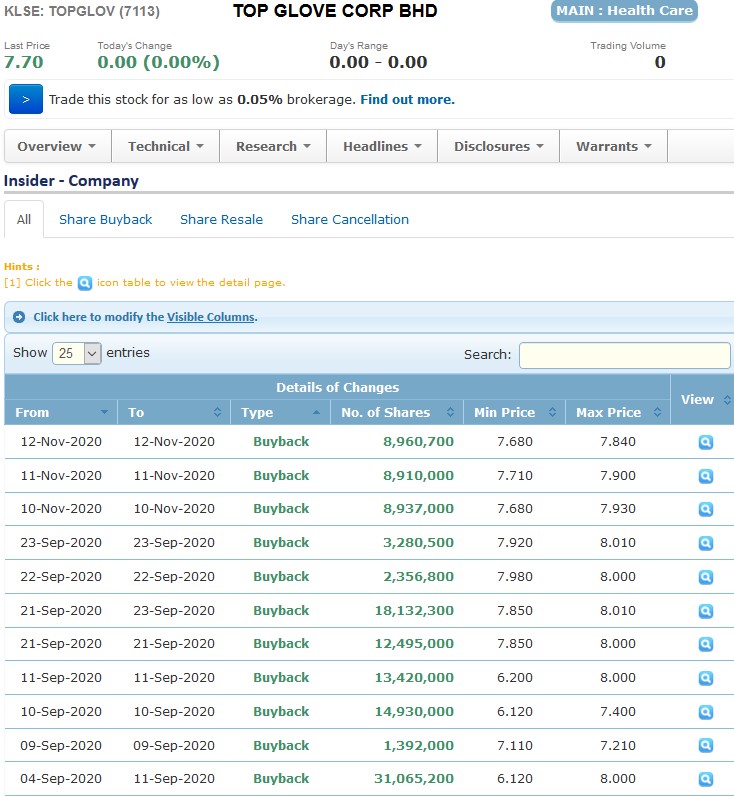

KUALA LUMPUR (Nov 12): Top Glove Corp Bhd continued buying back more shares on the open market as its share price drifted nearly 20% down from the recent peak of RM9.60.

The glove maker’s latest filing to Bursa Malaysia shows it bought back an additional 8.96 million shares, representing a 0.83% stake, for RM69.72 million.

This chunk of 8.96 million shares were bought at the price between RM7.68 and RM7.84, which was the day’s high.

This is the third consecutive day this week that Top Glove mopped up shares. The group has spent roughly RM209.52 million over the span of three days, which is close to the net profit of RM227.1 million that it earned in the first half of the financial year ended Aug 31, 2020 (FY20).

The group posted a record annual profit of RM1.86 billion for FY20 which boosted its cash pile to RM1.21 billion as at Aug 31. In addition, Top Glove’s investment securities ballooned to RM1.67 billion.

In September alone, the group had spent about RM355 million to buy back its shares in six transactions. This means that Top Glove has in total paid RM564.5 million on buying back shares.

Shares of Top Glove today fell 16 sen or 2.04% to close at RM7.70 with a market capitalisation of RM63.09 billion. The counter has been trending downwards so far this week, following Pfizer Inc's announcement of a viable COVID-19 vaccine candidate on Monday.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on gloveharicut

Created by gloveharicut | Sep 20, 2022

Created by gloveharicut | Aug 30, 2021

Created by gloveharicut | May 04, 2021

Created by gloveharicut | Apr 19, 2021

Discussions

Topglove had updated the CBP status in the annual report on 12/11.

Dividends had been declared on 23/9 and paid on 3/11.

Which part you are not clear?

2020-11-13 16:43

It's share buyback is bigger than Mah Sing investment in new glove factory? What a sarcastic jokes. 拿钱砸死你。

爽啊啊啊

2020-11-14 12:18

dusti

Motive not clear. Could consider better. Dividends for faithful shareholders. Can Management explain. Also, what is latest regarding US sanction.

2020-11-13 15:07