Protasco Bhd's RM48.6m Land-JV cash to Director Chong Ket Pen, 2 days after -RM44m Q4 loss report shock the market. Real reasons exposed.

tanhakka

Publish date: Sat, 02 Mar 2019, 01:56 PM

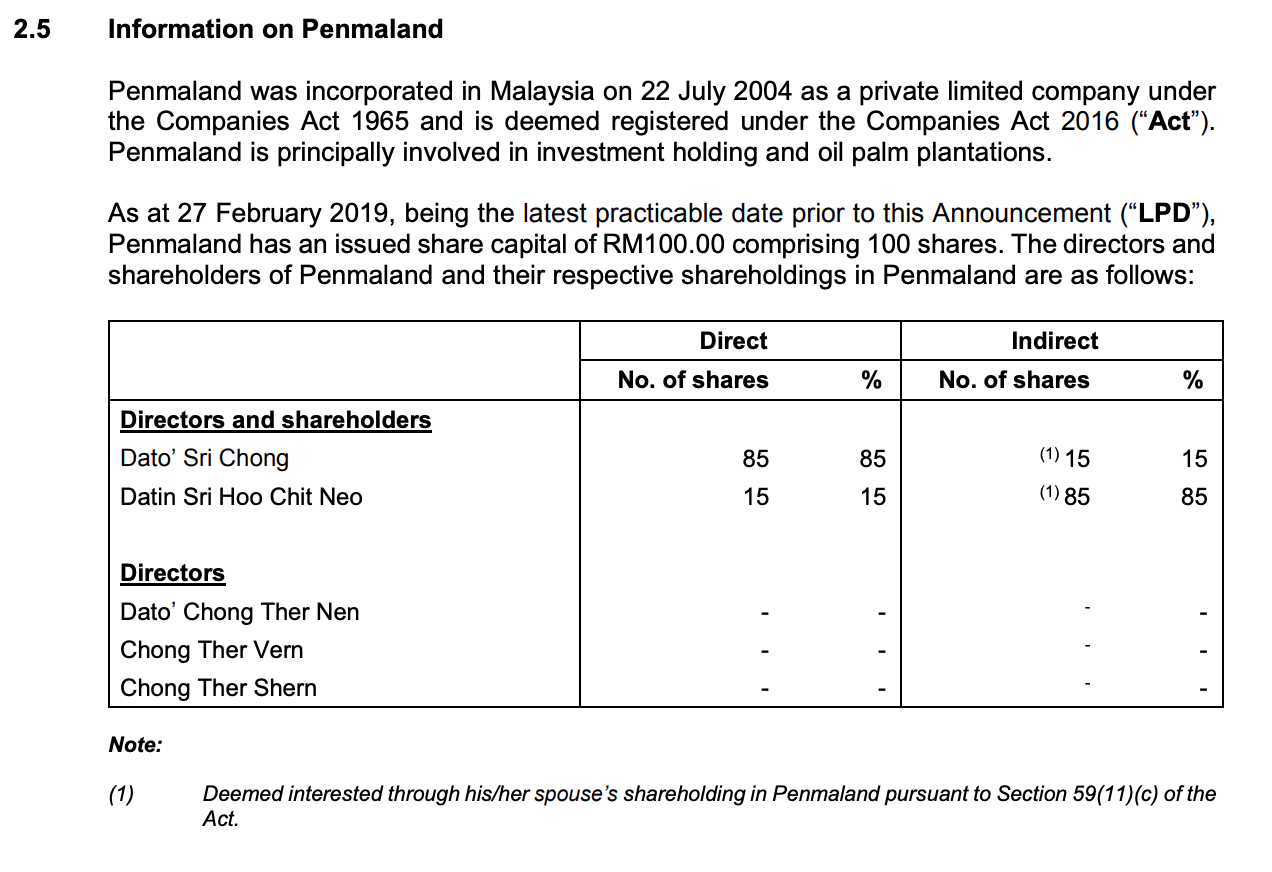

1st March 2019 - The full report of Protasco Bhd (Bursa 5070) RM48.6 million cash payout to Dato Sri' Chong Ket Pen, through his company Penmaland Sdn Bhd, where Chong Ket Pen held 85%, his wife Hoo Chit Neo held 15%, and 3 of his sons Chong Ther Nen, Chong Ther Vern and Chong Ther Shern held the directorship in Penmaland Sdn Bhd. as per Section 2.5 (below), is exposed as follows.

1st March 2019 - The full report of Protasco Bhd (Bursa 5070) RM48.6 million cash payout to Dato Sri' Chong Ket Pen, through his company Penmaland Sdn Bhd, where Chong Ket Pen held 85%, his wife Hoo Chit Neo held 15%, and 3 of his sons Chong Ther Nen, Chong Ther Vern and Chong Ther Shern held the directorship in Penmaland Sdn Bhd. as per Section 2.5 (below), is exposed as follows.

Here are the highlights of the RM48.6 million cash-upfront Land JV proposed announced today for Protasco Bhd to pay Dato Sri' Chong Ket Pen despite the firm recorded a huge -RM44 million loss and alarming poor balance sheet of RM633 million debt as of 31 December 2018 4th quarter report.

Is ill-gotten power, money, and shares to self-approve Related Party Transaction (RPT) being legalised?

On behalf and for the benefit of accounting-knowledge incompetent minority shareholders of Protasco Bhd, let's finish stripping the report below before Protasco being stripped yet another RM48.6 million by the same person - Dato Sri' Chong Ket Pen.

Protasco RM48.6 million cash-buy land JV announcement:

http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=92937&name=EA_GA_ATTACHMENTS

Protasco -RM44 million Q42018 loss announcement:

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6077565

The announcement of RM48.6 million cash-buy land-JV paying to Dato Sri' Chong Ket Pen news just 2 days after Protasco Bhd announced -RM44 million 4th Quarter loss, the worst operating loss in Protasco's history also led by Dato Sri' Chong Ket Pen.

On behalf of the Board of Directors of Protasco (“Board”), RHB Investment Bank Berhad (“RHB Investment Bank”) wishes to announce that DCRSB had on 1 March 2019 entered into a conditional joint development agreement (“JDA”) with Penmaland to jointly develop the Tampin Land into a mixed residential development (“Development” or the “Project”).

On behalf of the Board of Directors of Protasco (“Board”), RHB Investment Bank Berhad (“RHB Investment Bank”) wishes to announce that DCRSB had on 1 March 2019 entered into a conditional joint development agreement (“JDA”) with Penmaland to jointly develop the Tampin Land into a mixed residential development (“Development” or the “Project”).

Note: * Section 2.1.4(i)

Penmaland’s entitlement Penmaland is entitled to receive from DCRSB a fixed total sum of RM48.60 million in cash, which is equivalent to approximately 13% of the estimated aggregate gross development value (“GDV”) of the Project of RM371.59 million and shall be paid in stages in the following manner:

|

Section 2.5 listed Chong Ket Pen and wife Hoo Chit Neo, both holding 85% and 15% respectively the shares of Penmaland Sdn Bhd, and 3 of Chong Ket Pen' sons as directors, namely Chong Ther Nen, Chong Ther Vern, and Chong Ther Shern.

8. APPROVALS REQUIRED

The Proposed Joint Development is subject to and conditional upon the following approvals being obtained:

(i) shareholders of Protasco at an EGM to be convened; and

(ii) any other relevant authorities and/or parties, if required.

The Proposed Joint Development is not conditional upon any other corporate proposal undertaken or to be undertaken by Protasco.

9. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED WITH THEM

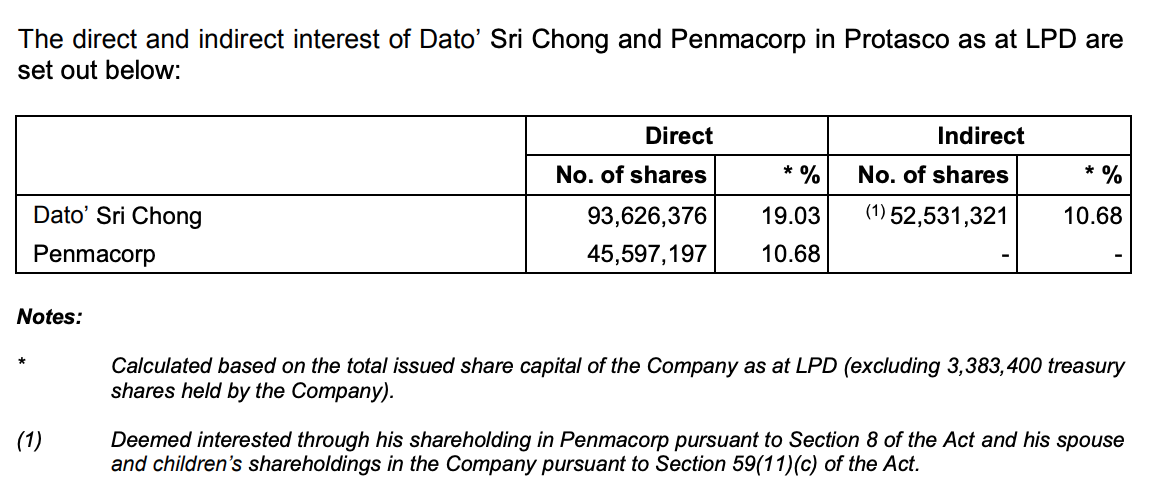

Dato’ Sri Chong Ket Pen, the Executive Vice Chairman/Group Managing Director of Protasco, is also a director and major shareholder of Penmaland. He is also a major shareholder of Protasco through his direct interest as well as indirect interest through Penmacorp Sdn Bhd (“Penmacorp”) as well as his spouse and children’s shareholdings in Protasco. As such, Dato’ Sri Chong Ket Pen is deemed interested in the Proposed Joint Development. In addition, Dato’ Sri Chong Ket Pen is also the director and major shareholder of Penmacorp, which in turn is a major shareholder of Protasco.

Accordingly, Dato’ Sri Chong Ket Pen has abstained and will continue to abstain from all Board deliberations and voting in respect of the Proposed Joint Development. Dato’ Sri Chong Ket Pen and Penmacorp will also abstain from voting in respect of their direct and/or indirect interest in Protasco on the resolution pertaining to the Proposed Joint Development to be tabled at an EGM to be convened and they have undertaken that they shall ensure that persons connected with them will also abstain from voting in respect of their direct and/or indirect interest in Protasco on the resolution pertaining to the Proposed Joint Development to be tabled at an EGM to be convened.

Save as disclosed above, none of the Directors and/or major shareholders of Protasco and/or persons connected with them have any interest, direct or indirect, in the Proposed Joint Development.

10. TRANSACTIONS WITH THE RELATED PARTY IN THE PAST 12 MONTHS

Save for the Proposed Joint Development, there has been no transaction entered into between the Group and Dato’ Sri Chong Ket Pen and/or persons connected to him for the 12 months preceding the date of this Announcement.

11. AUDIT COMMITTEE’S STATEMENT

The Audit Committee of Protasco*, having considered all aspects to the Proposed Joint Development including the salient terms of the JDA, basis and justification of the Proprietor’s Entitlement, rationale for and benefits of the Proposed Joint Development, prospects of the Tampin Land and the Development as well as the fairness evaluation of the Independent Adviser, is of the opinion that the Proposed Joint Development is:

(i) in the best interest of the Company;

(ii) fair, reasonable and on normal commercial terms; and

(iii) not detrimental to the interest of the non-interested shareholders of the Company.

Who are the (Dato Sri' Chong Ket Pen controlled) members of audit committee? Mr. Lim Yew Ting, Tan Yee Boon, and Suhaimi Bin Badrul Jamil (Chairman, appointed on 31 May 2018 after former chairman Dato' Mohd Nanif Bin Sher Mohamed resigned).

12. DIRECTORS’ STATEMENT

The Board (save for Dato’ Sri Chong Ket Pen), having considered all aspects to the Proposed Joint Development including the salient terms of the JDA, basis and justification of the Proprietor’s Entitlement, rationale for and benefits of the Proposed Joint Development, prospects of the Tampin Land and the Development as well as the fairness evaluation of the Independent Adviser, is of the opinion that the Proposed Joint Development is:

(i) in the best interest of the Company;

(ii) fair, reasonable and on normal commercial terms; and

(iii) not detrimental to the interest of the non-interested shareholders of the Company.

Who are the board of (Dato Sri' Chong Ket Pen controlled) directors? Led by Chairman Tan Sri Datuk Dr Hadenan Bin Abdul Jalil, Non-Independent Director Tan Heng Kui, ID Tan Yee Boon, ID Tham Wei Mei, ID Lim Yew Ting, ID Suhaimi Bin Badrul Jamil, and Executive Director Dato' Sri Su-Azian @ Muzaffar Syah Bin Abdul Rahman.

DATO’ MOHD HANIF BIN SHER MOHAMED which is also the "CHAIRMAN OF AUDIT COMMITTEE" resigned.

13. PERCENTAGE RATIO

The highest percentage ratio applicable for the Proposed Joint Development under Paragraph 10.02(g) of the Listing Requirements is approximately 30.16%, computed based on the estimated GDC of the Project (including the Tampin Land cost of RM48.60 million and financing cost, but excluding tax) over the audited consolidated total assets of the Company as at 31 December 2017.

14. ADVISERS

14.1 Principal Adviser RHB Investment Bank has been appointed as the Principal Adviser to Protasco for the Proposed Joint Development.

14.2 Independent Adviser In view that the Proposed Joint Development is deemed as a related party transaction under Paragraph 10.08 of the Listing Requirements, Public Investment Bank Berhad has been appointed as the Independent Adviser. The role of the Independent Adviser is:

(i) to comment as to whether the Proposed Joint Development:

(a) is fair and reasonable so far as the non-interested shareholders of Protasco are concerned; and

(b) is to the detriment of the non-interested shareholders of Protasco, and such opinion must set out the reasons for, the key assumptions made and the factors taken into consideration in forming that opinion;

(ii) to advise the non-interested shareholders of Protasco on whether they should vote in favour of the Proposed Joint Development; and

(iii) to take all reasonable steps to satisfy itself that it has a reasonable basis to make the comments and advice in subparagraphs (i) and (ii) above.

15. APPLICATION TO THE AUTHORITIES

Barring any unforeseen circumstances, the application to the relevant authorities in relation to the Proposed Joint Development is expected to be made within two (2) months from the date of this Announcement.

|

|

16. ESTIMATED TIMEFRAME FOR COMPLETION

Barring any unforeseen circumstances and subject to the approvals of the relevant authorities and parties being obtained, the Proposed Joint Development is expected to be implemented by the 3 rd quarter of 2019.

17. DOCUMENTS AVAILABLE FOR INSPECTION

Copies of the following documents are available for inspection at the registered office of Protasco at 802, 8th Floor, Block C, Kelana Square, 17, Jalan SS7/26, 47301 Petaling Jaya, Selangor Darul Ehsan during normal office hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this Announcement:

(i) JDA and Power of Attorney; and

(ii) Market Feasibility Report.

This Announcement is dated 1 March 2019

MARKET SHOCKED - ANOTHER (MONEY STRIPPING) COVER UP?

What is the (real) reasons the Protasco Bhd's board which is controlled by Dato Sri' Chong Ket Pen, in-a-rush push the limit of Protasco which is already loss making and Rm633 million debt-ridden. Protasco Bhd which just suffer a -RM44 million quarterly loss has to load up another RM48.6 million cash payment to Dato Sri' Chong Ket Pen likely from yet another bank loan. The ruthless move is jaw dropping.

The land in Kuala Lumpur or Selangor are facing market gluts, and Penmaland Sdn Bhd (aka Dato Sri' Chong Ket Pen) invested in land outside Klang Valley (Tampin, Negeri Sembilan) which apparently has outstanding loan from UOB Bank with interest, as stated in Section 13 above. The exercise is obviously a technical bailout or cover up by Protasco Bhd for it's director Dato Sri' Chong Ket Pen own interest.

Save on the (Dato Sri' Chong Ket Pen controlled) Protosco Bhd board of directors, especially the 3 Audit Committee members, maybe the relevant authorities can give public investors a better reason while the cash stripping exercise is on-going, as per Section 15 above quoted their "approval" would be in 2 months, rather than standard copy-and-paste excuses to facilitate the questionable related party transaction to cover up the interest party's true intention.

The Protasco "rush" to pay cash to Dato Sri' Chong Ket Pen is coincidentally trying to move ahead on another pressing matter - the RM368 million lawsuit by Global Capital Limited* on (the same) Dato Sri' Chong Ket Pen. That breach of contract is Dato Sri' Chong Ket Pen's personal liability and Court Trial could take place anytime mid of this year. Unfortunately Dato Sri' Chong Ket Pen net worth sunk into his own modus operandi to "recycle his money obtained from Protasco to buy more Protasco shares" during year 2012-2018, and share has since plunged from RM2.10 before split to RM0.245 as of today, written off most of his investments. Perhaps this explains the "urgent cash payout?

As for the "relevant authorities", the matter and the authorities themselves would not be relevant anymore if Dato Sri' Chong Ket Pen ran away with another RM48.6 million cash from Protasco Bhd.

" Corporate Governance At Risk - Corporate Misconduct Exposure Report ". 1st March 2019.

*note: Global Capital Limited was the broker which got Dato Sri' Chong Ket Pen the power and control of Protasco Bhd on 3 November 2012. Chong signed the personal guaranteed engagement to place the "order" to buy his re-entry into Protasco Bhd.

REFERS TO:

Bursa Malaysia announcement: http://www.bursamalaysia.com/market/listed-companies/company-announcements/6084945

TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS) : RELATED PARTY TRANSACTIONS PROTASCO BERHAD ("PROTASCO" OR THE "COMPANY") PROPOSED JOINT DEVELOPMENT BETWEEN DE CENTRUM RETAIL SDN BHD ("DCRSB"), A WHOLLY-OWNED SUBSIDIARY OF PROTASCO DEVELOPMENT SDN BHD, WHICH IN TURN IS A WHOLLY-OWNED SUBSIDIARY OF PROTASCO, AND PENMALAND SDN BHD ("PENMALAND") TO JOINTLY DEVELOP THREE (3) CONTIGUOUS PARCELS OF FREEHOLD DEVELOPMENT LAND IN MUKIM OF TAMPIN TENGAH, DISTRICT OF TAMPIN, NEGERI SEMBILAN DARUL KHUSUS ("TAMPIN LAND") ("PROPOSED JOINT DEVELOPMENT")

| PROTASCO BERHAD |

| Type | Announcement |

| Subject |

TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS) RELATED PARTY TRANSACTIONS |

| Description |

PROTASCO BERHAD ("PROTASCO" OR THE "COMPANY")

PROPOSED JOINT DEVELOPMENT BETWEEN DE CENTRUM RETAIL SDN BHD ("DCRSB"), A WHOLLY-OWNED SUBSIDIARY OF PROTASCO DEVELOPMENT SDN BHD, WHICH IN TURN IS A WHOLLY-OWNED SUBSIDIARY OF PROTASCO, AND PENMALAND SDN BHD ("PENMALAND") TO JOINTLY DEVELOP THREE (3) CONTIGUOUS PARCELS OF FREEHOLD DEVELOPMENT LAND IN MUKIM OF TAMPIN TENGAH, DISTRICT OF TAMPIN, NEGERI SEMBILAN DARUL KHUSUS ("TAMPIN LAND") ("PROPOSED JOINT DEVELOPMENT")

|

|

On behalf of the Board of Directors of Protasco, RHB Investment Bank Berhad wishes to announce that DCRSB had on 1 March 2019 entered into a conditional joint development agreement with Penmaland to jointly develop the Tampin Land into a mixed residential development.

Further details of the Proposed Joint Development are set out in the attachment.

This Announcement is dated 1 March 2019. |

|

Please refer attachment below.

Announcement Info

| Company Name | PROTASCO BERHAD |

| Stock Name | PRTASCO |

| Date Announced | 01 Mar 2019 |

| Category | General Announcement for PLC |

| Reference Number | GA1-01032019-00114 |

Daim4u

Means more siphoning money buying more protasco shares using nominees. Really criminal disregard the law. Matter of time behind bar.

2019-03-02 21:03