HLBank Research Highlights

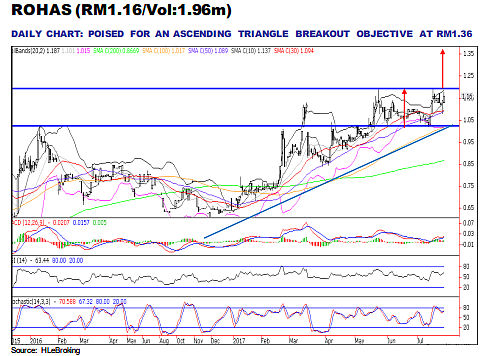

Trading idea: ROHAS – Riding on the tower boom in regional markets; Poised for an ascending triangle breakout

HLInvest

Publish date: Mon, 31 Jul 2017, 12:55 PM

-

HLIB institutional research has a BUY rating with TP of RM1.39 (+19.8% upside), based on 16x P/E multiple pegged to FY18 EPS. Rohas’s core business is fabrication of steel towers which are used for power transmission and telecommunications industries. The group is ranked as one of the top operators in the industry in terms of revenue. We like Rohas for its exposure to ASEAN which is one of the fastest growing economic regions in the world. Infrastructure investment needs are expected to be robust in the foreseeable future and this will generate steady demand for its products.

-

Strong earnings accretive deal. The recently concluded acquisition of a 75% equity interest in HG Power Transmission S/B (HGPT is a turnkey solutions for high voltage transmission lines and substations in Malaysia and overseas) will open up more EPCC contract opportunities for Rohas in new markets such as Bangladesh, Papua New Guinea and Indonesia. Meanwhile, HGPT would also benefit from Rohas EPCC exposures in Vietnam and Laos. Note that HGPT’s orderbook currently exceeds RM400m and this will more than double Rohas current EPCC orderbook of c.RM300m post acquisition, hence providing strong earnings visibility for the company (with 15% FY16-19 earnings CAGR).

- Besides, 75% of the purchase consideration will be satisfied by issuance of new shares which would avoid any significant impact on the cash flow and gearing of Rohas (estimated net gearing only at c.6% post acquisition).

- Strong reputable LT investor. Post-acquisition, Navis Capital (Navis) will hold 15.4% stake in the enlarged entity for Rohas shares. We are encouraged by this move as we see Navis as a long-term capital and management partner. Navis Capital Partners was founded in 1998 to make private equity investments in buyouts, recapitalisations and financial restructurings in Asia, particularly in enterprises with a strong or developing presence in Southeast Asia, Australia and Hong Kong. The firm manages several private and public equity funds totaling US$5bn, and whose investors include a number of well -known US, European, Middle Eastern and Asian commercial and investment banks, pension funds, insurance companies etc.

- Poised for an ascending triangle breakout. Rohas has been holding up well above the support trendline since Dec 2016. Overall, the uptrend is still intact given the higher highs and higher lows sequence, thereby increases the likelihood of the resumption of further advance. The buying momentum will further accelerate pending an ascending triangle breakout, supported by positive indicators after recent declines.

- A decisive breakout above historical high of RM1.19 (24 May & 19 July) is poised to spur ROHAS further towards RM1.23 (123.6% FP from peak RM1.19 and low RM1.02) and RM1.28 (150% FP) before reaching our breakout target at RM1.36. Meanwhile, key supports are RM1.13 (38.2% FR) psychological levels and RM1.08 (61.8% FR). Cut loss at RM1.07.

Source: Hong Leong Investment Bank Research - 31 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments