HLBank Research Highlights

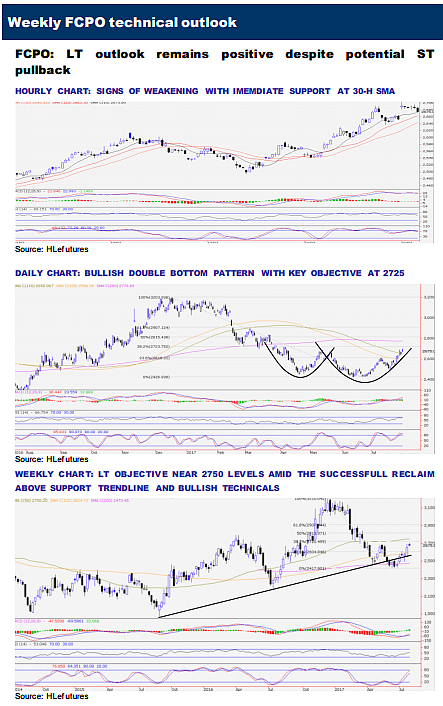

Trading Idea - FCPO: LT outlook remains positive despite potential ST pullback

HLInvest

Publish date: Tue, 01 Aug 2017, 12:43 PM

- In July, FCPO surged RM220 or 9% to RM2655 on the back of strength in other edible oils and tracking stronger export data from cargo surveyors. Sentiment was also boosted by forecast of potential slower-than-expected rise in July production.

- Technically, the bullish double-bottom pattern (daily chart) and the successful recapture of LT support trendline (weekly chart) augur well for FCPO’s strength. We remain optimistic that after a brief pullback to neutralize overbought daily stochastic, FCPO may retest RM2700 (psychological barrier), RM2724 (38.2% FR) and RM2750 (50-w SMA) targets in the mid to long term. Conversely, failure to hold at immediate support of RM2543 (30-h SMA) will witness prices to retreat back towards RM2610 (23.6% FR) and RM2588 (14-d SMA) levels.

Source: Hong Leong Investment Bank Research - 1 Aug 2017

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments