HLBank Research Highlights

Trading idea: SUNWAY: Values resurface after recent pullback; Grossly oversold

HLInvest

Publish date: Thu, 19 Oct 2017, 10:42 AM

- Values resurface after recent pullback. Sunway’s share prices tumbled 16.3% from all time high of RM1.96 (15 Sep) to end at RM1.64 on 17 Oct as investors took profit following the ex-date of bonus shares and warrants (27 Sep) as well as the 3 sen dividend (13 Oct).

- Our institutional research maintains a BUY rating on Sunway with a SOP TP of RM2.25 as we believe the stock should be rerated and trade closer to its peers such as IJM (18.5x FY18 P/E) and Gamuda (15.6x FY18 P/E) given its diversified income stream and declassification from property sector (now Trading and services).

- At a FY18 P/E of 12.8x (24% lower than its peers 17x), we opine that Sunway is a deep value stock with mature investment properties and the underappreciated trading and healthcare segments, and supported by attractive DY18 of 4% (vs 2.2% for IJM and Gamuda).

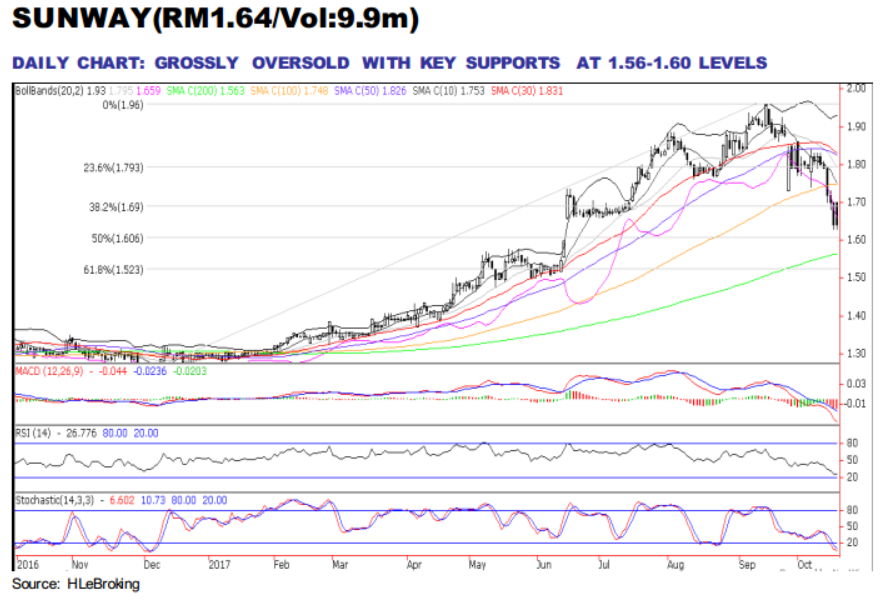

- Grossly oversold with key supports at RM1.56-1.60. We believe Sunway’s undemanding valuation and attractive DY have provided a sufficient margin of safety and cushion further sharp share price decline, supported by steeply grossly oversold indicators. We expect the stock to find a floor near RM1.60 (50% FR) and RM1.56 (200-d SMA) territory and trending sideways briefly before staging a technical rebound.

- A decisive close above immediate resistance at RM1.69 (38.2% FR) will spur prices higher to RM1.79 (23.6%) before reaching to our LT objective at RM1.87 (the RM1.89-1.73 gap down on 27 Sep). Cut loss at RM1.54.

Source: Hong Leong Investment Bank Research - 19 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-30

SUNWAY2024-07-30

SUNWAY2024-07-30

SUNWAY2024-07-29

SUNWAY2024-07-29

SUNWAY2024-07-26

SUNWAY2024-07-26

SUNWAY2024-07-26

SUNWAY2024-07-26

SUNWAY2024-07-25

SUNWAY2024-07-25

SUNWAY2024-07-25

SUNWAY2024-07-25

SUNWAY2024-07-24

SUNWAY2024-07-24

SUNWAY2024-07-22

SUNWAY2024-07-22

SUNWAY2024-07-22

SUNWAYMore articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments