HLBank Research Highlights

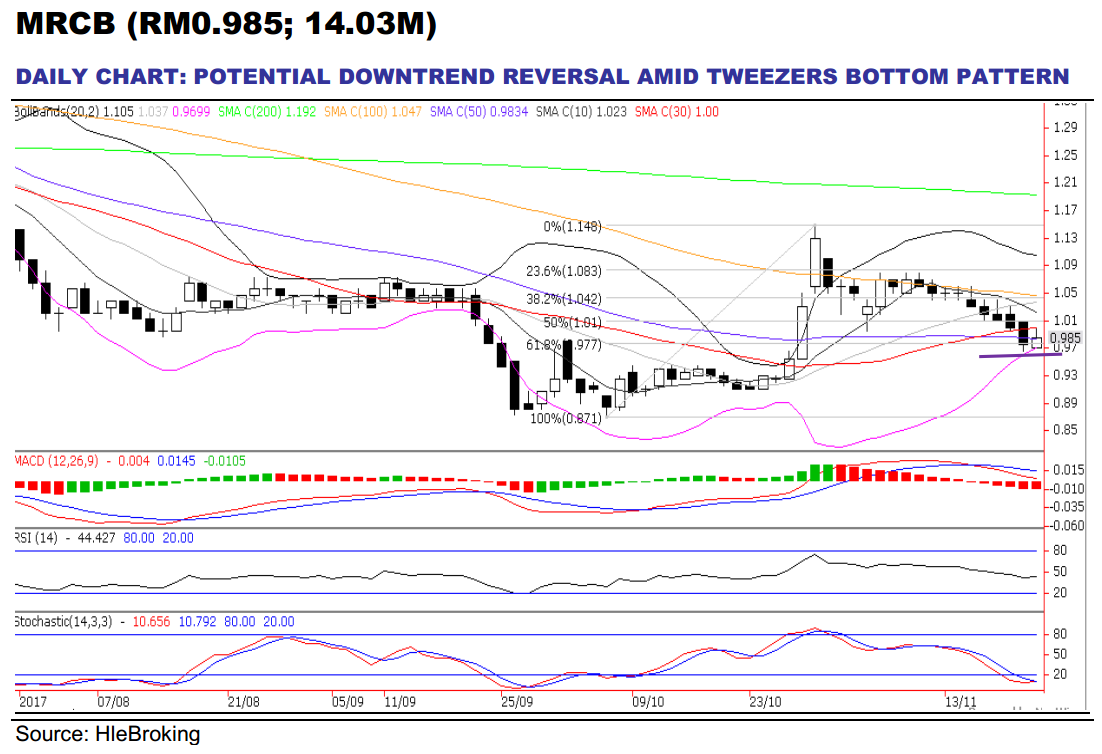

Trading Idea: MRCB – A new lease of life; Potential downtrend reversal amid Tweezers bottom pattern

HLInvest

Publish date: Thu, 23 Nov 2017, 05:09 PM

- Profile: MRCB is engaged in construction (niche strength in environmental projects), property development and investment and toll road operations. It is known for its transit-oriented developments (TOD) for example KL Sentral, Bukit Jalil City, Kwasa Damansara and Penang Sentral.

- HLIB upgraded MRCB rating to BUY with higher SOP TP at RM1.18. In tandem with the stronger-than-expected 3Q17 results from property revenue and construction margin, HLIB has upgraded the rating to BUY (from HOLD previously) with a revised TP of RM1.18, imputing 20% upside. Meanwhile, balance sheet will be in a better financial footing following the completed de gearing exercise, which involved 1-for-1 rights issue @ RM0.79 together with 1 free warrant (strike price RM1.25) for every 5 rights subscribed. The exercise will slash MRCB’s proforma net gearing to 36% from 114% in 3Q17.

- A healthy RM5.3bn outstanding order book. MRCB currently sits on an orderbook of RM5.3bn and management highlighted that with the current value of jobs in tender of RM2.9bn with focus on securing more civil engineering and long term fee-based contracts. Coupled with ~RM1.2b unbilled property sales, these numbers will provide the group at least four years of earnings visibility.

- Monetisation of EDL is a potential catalyst. Recall that during the Budget 2018 announcement, the government announced that toll collections for the Eastern Dispersal Link would be abolished from 1 Jan 18. Hence, we expect the government to buy out the expressway or compensate MRCB based on traffic flows on the highway. Management estimates that the disposal of EDL, Menara Celcom and Ascott could potentially transform its balance sheet into a net cash position, thereby in a much better position to execute its various catalytic projects such as embarking on the maiden launches of its key TOD projects – Kwasa Sentral and Bukit Jalil Sentral, both with a combined GDV of RM22.6bn.

- Potential downtrend reversal. After tumbling 14% to RM0.985 from 1M high of RM1.15 on 30 Oct, MRCB is ripe for imminent technical rebound following the formation of Tweezers bottoms and uptick in RSI. A decisive breakout above RM1.03 (mid Bollinger band) will spur prices higher towards RM1.10 (50% FR) before reaching our LT objective at RM1.19 (200-d SMA). Key supports are situated near RM0.94 (76.4% FR) and RM0.91 (1M low). A breakdown below RM0.91 will trigger further retracement towards RM0.87 (5 Oct low). Cut loss at RM0.90.

Source: Hong Leong Investment Bank Research - 23 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments