HLBank Research Highlights

Trading Idea: ROHAS – Firmer 3QFY17 results, with potentially higher EPCC orderbook in FY18

HLInvest

Publish date: Mon, 11 Dec 2017, 10:14 AM

- Company profile. Rohas Tecnic Berhad is involved in the fabrication of steel towers used for power transmission and telecommunications industries. It also provides galvanising services, fabrication of electrical substation structures and EPCC works.

- HGPT’s earnings and Laos EPCC to start contributing in 4Q. With the acquisition of HGPT completed two months ago, we think Rohas may book in 1-2 months HGPT earnings in 4Q. Also, the RM300m Laos EPCC project to supply and construct transmission lines, substations and distribution lines will start to contribute from 4Q onwards.

- Potential boost in earnings on the back of high EPCC order book. Rohas current EPCC orderbook is estimated at RM650m. This is expected to provide a strong boost to Rohas earnings moving forwards as the current contribution is minimal. Also, the company is targeting to double its job replenishment next year to c.RM800m.

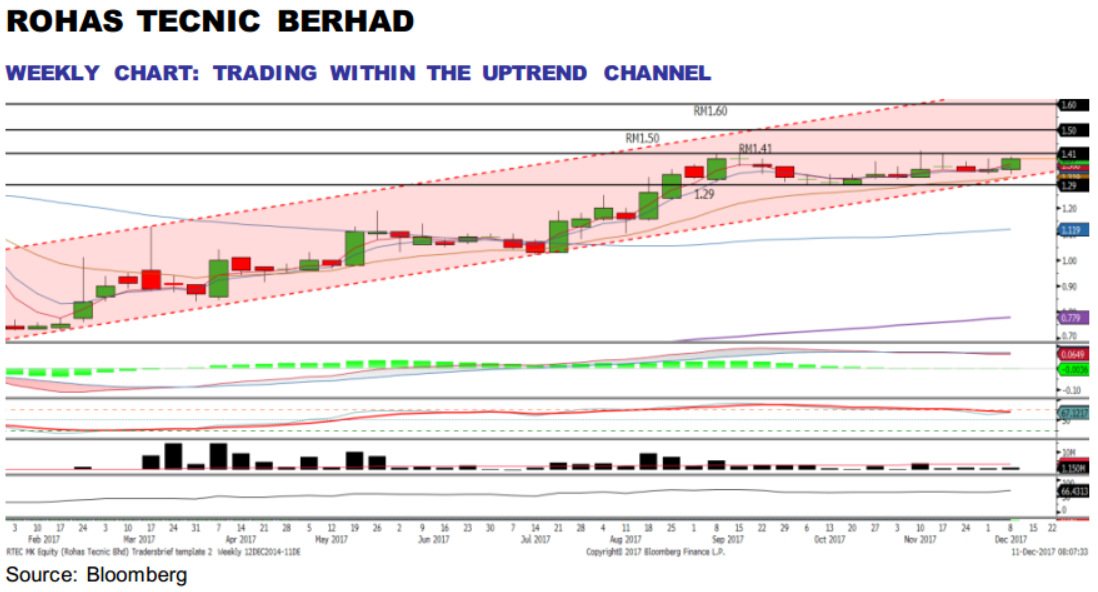

- Technical outlook. Rohas has experienced a short term consolidation breakout above the RM1.38 level accompanied by increased volumes after a sideways move over the past one month. The MACD Line has crossed above the Signal Line. Meanwhile, both the RSI and Stochastics oscillators are trending positively. We think Rohas could trend higher towards RM1.50-RM1.60, followed by a LT target at RM1.70. Support will be located around RM1.31-1.33. The cut loss level will be set at RM1.29.

Source: Hong Leong Investment Bank Research - 11 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments