HLBank Research Highlights

ORNA – Anticipation of better results on the back of robust e-commerce sales

HLInvest

Publish date: Wed, 24 Jan 2018, 10:17 AM

- Company profile. Ornapaper Berhad (ORNA) is involved in the paper packaging industry and is a leader in the corrugated boards and carton manufacturing industry. With the current capacity, the company is able to produce 84,000 M/T of corrugated boards and cartons per annum.

- E-commerce sales could boost packaging industry. With the recent trending e-commerce marketing events such as 11.11 Singles Day, 12.12 and Black Friday, we noticed the online sales have been picking up in terms of volumes and transaction values. With that, the packaging industry should be a proxy towards e-commerce sales, suggesting higher demand in paper packaging, eventually. Also, the surge in demand during 4Q17 globally would potentially translate to earnings on packaging industry.

- Favourable environment to boost 4Q17 earnings. Currently, 9M17 revenue and PAT stood at RM239.9m and 10.9m, which is 20% and 68% higher on the yearly basis compared to the corresponding period. Also, we think Orna is trading at decent single digit PE of 8.3x, based on the trailing 12M EPS of 16.6sen.

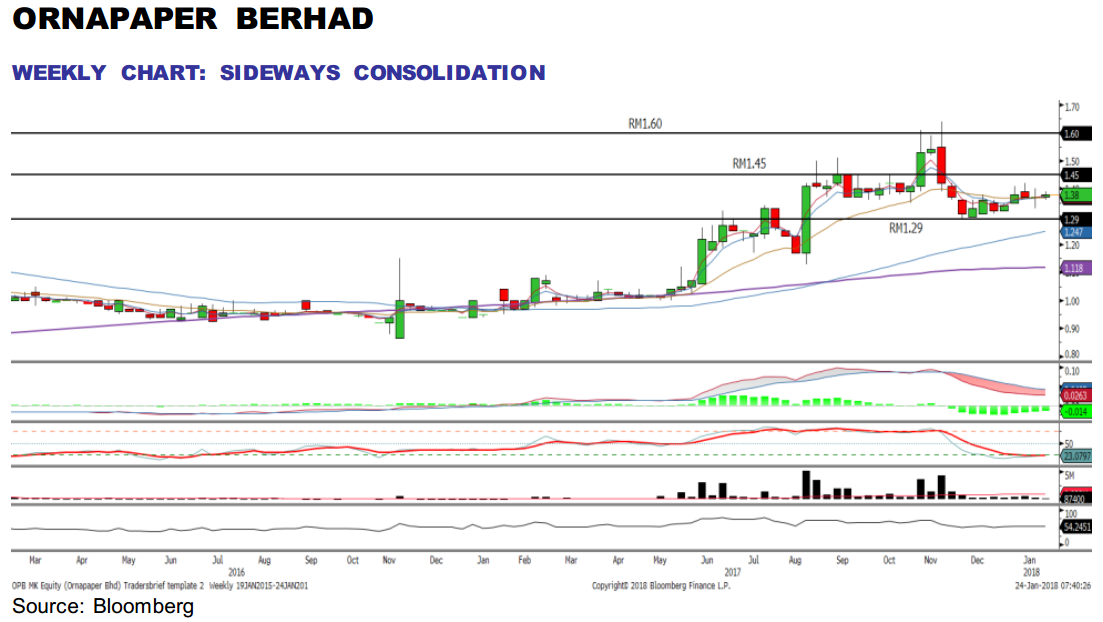

- Potential flag formation breakout after a sideways mode. ORNA has trended sideways over the past two month between the RM1.31-1.42 levels. As the MACD Indicator is trending higher, coupled with the recovering momentum oscillators, we may anticipate a potential flag breakout above RM1.38, targeting RM1.45-1.52, followed by a LT target of RM1.60. Support will be located around RM1.31-1.33. Cut loss will be set around RM1.29.

Source: Hong Leong Investment Bank Research - 24 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 4 of 4 comments

probability

Company profile. Ornapaper Berhad (ORNA) is involved in the paper packaging industry and is a leader in the corrugated boards and carton manufacturing industry. With the current capacity, the company is able to produce 84,000 M/T of corrugated boards and cartons per annum.

E-commerce sales could boost packaging industry. With the recent trending e-commerce marketing events such as 11.11 Singles Day, 12.12 and Black Friday, we noticed the online sales have been picking up in terms of volumes and transaction values. With that, the packaging industry should be a proxy towards e-commerce sales, suggesting higher demand in paper packaging, eventually. Also, the surge in demand during 4Q17 globally would potentially translate to earnings on packaging industry.

Favourable environment to boost 4Q17 earnings. Currently, 9M17 revenue and PAT stood at RM239.9m and 10.9m, which is 20% and 68% higher on the yearly basis compared to the corresponding period. Also, we think Orna is trading at decent single digit PE of 8.3x, based on the trailing 12M EPS of 16.6sen.

Potential flag formation breakout after a sideways mode. ORNA has trended sideways over the past two month between the RM1.31-1.42 levels. As the MACD Indicator is trending higher, coupled with the recovering momentum oscillators, we may anticipate a potential flag breakout above RM1.38, targeting RM1.45-1.52, followed by a LT target of RM1.60. Support will be located around RM1.31-1.33. Cut loss will be set around RM1.29.

2018-05-23 00:22