HLBank Research Highlights

ROHAS – Anticipate strong FY17-19 earnings CAGR of ~35%; Potential downtrend reversal

HLInvest

Publish date: Tue, 13 Feb 2018, 04:57 PM

- Riding on the tower boom and infrastructure heat in the ASEAN regional. Rohas Tecnic Berhad (Rohas) was formed after Rohas-Euco Industries Sdn Bhd (REI) underwent a reverse takeover of Tecnic Group Berhad in March 2017. The group is involved in the fabrication of steel towers used for power transmission and telecommunications industries. It also provides galvanising services, fabrication of electrical substation structures and EPCC works.

- We like Rohas for its exposure to ASEAN which is one of the fastest growing economic regions in the world. Infrastructure investment needs are expected to be robust in the foreseeable future and this will generate steady demand for the products of the company. Moreover, the acquisition of HG Power Transmission S/B (HGPT is a turnkey solutions for high voltage transmission lines and substations in Malaysia and overseas) will open up more EPCC contract opportunities for Rohas in new markets such as Bangladesh, Papua New Guinea and Indonesia. Meanwhile, HGPT would also benefit from Rohas EPCC exposures in Vietnam and Laos.

- Likely to see stronger 4Q17. Overall, HLIB expects stronger 4Q mainly due to contributions from Laos EPCC contract and newly acquired HGPT. The acquisition of HGPT was completed back in mid-Oct 2017 and we expect Rohas book in 1-2 months of HGPT earnings in 4Q results. Besides, the RM300m Laos EPCC project to supply and construct transmission lines, substations and distribution lines will start to contribute from 4Q onwards.

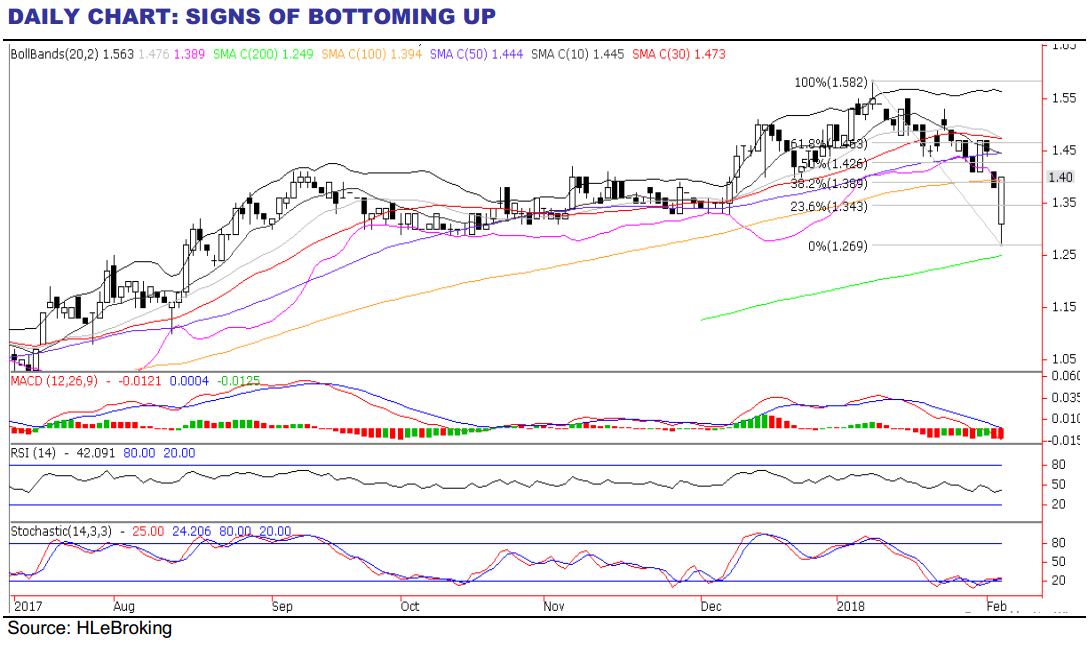

- Potential downtrend reversal? Rohas share prices tumbled 19.6% from historical high of RM1.58 (9 Jan) to a low of RM1.27 (6 Feb) before closing at RM1.40 yesterday. We see limited downside risks amid its strong ~35% FY17-19 EPS CAGR and early signs of bottoming up signals, following the formation of a long white candlestick in daily chart and the hammer pattern in weekly chart. A successful breakout above RM1.43 (50% FR) will spur prices higher towards RM1.50 (76.4% FR) and RM1.58 before reaching our LT target at RM1.65 (123.6% FR).

- Key supports are situated near RM1.34 (23.6% FR) and RM1.30. However, failure to hold near RM1.30 levels may weaken share prices lower towards RM1.21 zones. Cut loss at RM1.28.

Source: Hong Leong Investment Bank Research - 13 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments