HLBank Research Highlights

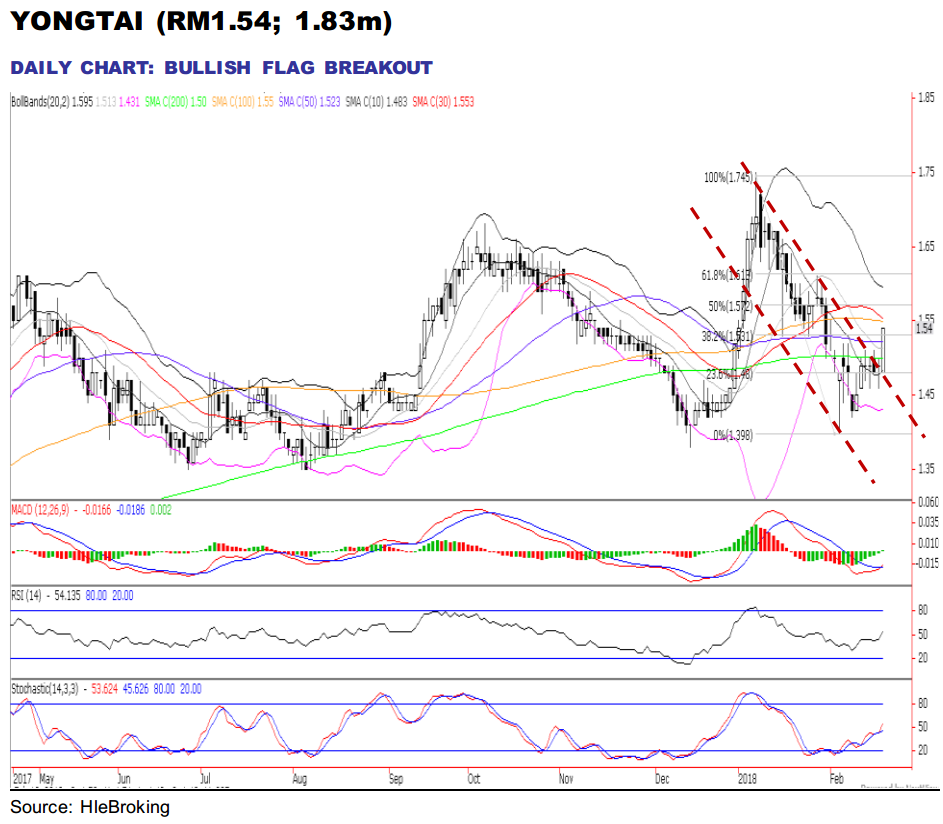

YONGTAI – A good proxy to booming Chinese tourism; Bullish flag breakout

HLInvest

Publish date: Thu, 22 Feb 2018, 09:20 AM

- From garment manufacturer to a tourism-related property developer. Following the disposal of its garment manufacturing business, Yong Tai has successfully transformed into a Melaka-centric township property developer (dubbed as the Impression City) and operator of the “ Impression Melaka ” or Encore Melaka performance via a 30-year licensing agreement.

- Encore Melaka is the game-changer. Encore Melaka theatre will occupy 15 acres in Impression City and “ Impression Melaka ” would be the 10th series of its Impression Series and the first outside of China. Encore Melaka is viewed as one of the “entry point project” within the National Key Economic Area (NKEA) initiative for the tourism sector and is poised to be a resounding success by tapping into the booming Chinese tourism in Malaysia which has seen an impressive 11% tourist arrivals CAGR over 2000-2016 (vs 1% for Malaysia’s overall tourist arrivals), making it the 3rd largest tourist source market.

- Impression City to benefit from spillover effects from Encore Melaka . Impression City, which will be located on a 138-acre 99-year leasehold site facing the Straits of Malacca, will be completed over 8 years and will have an estimated RM7bn GDV. Also, the city will consists of the Encore Melaka theatre, hotels, service apartments, commercial complexes, office towers, educational and wellness facilities, retail and shopping centres, and a yacht club. We believe the success of this development is imminent, particularly riding on the 1.1m tourists expected to pour into the area for the Encore Melaka performance, and the official opening of Encore Melaka before end June 2018 will be a major catalyst. To date, Yong Tai has secured RM1.3bn in property development sales to date, of which RM1bn are for properties in Impression City

- Poised to scale to greater heights following a bullish flag breakout. Given Yong Tai’s unrivalled competitive advantages arising from its unique tourism appeal and synergistic property product offerings, current valuation of 9.4x FY19 PE (Bloomberg consensus) is grossly unjustified, supported by FY18-20 EPS CAGR of 97% amid its value-adding

Source: Hong Leong Investment Bank Research - 22 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-30

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-25

YONGTAI2024-07-23

YONGTAI2024-07-23

YONGTAI2024-07-23

YONGTAI2024-07-23

YONGTAI2024-07-23

YONGTAIMore articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024