HLBank Research Highlights

PECCA – Steady growth with solid balance sheet; Signs of bottoming up

HLInvest

Publish date: Fri, 13 Apr 2018, 09:25 AM

- The largest local player in automotive leather upholstery, with over 65% market share. PECCA is involved in the leather upholstery of passenger car seats covers (contribute ~70% to 1HFY18 revenue) for OEM, pre-delivery inspection (PDI) and replacement equipment manufacturing (REM) market segments, as well as the supply of leather cut pieces and others (contribute ~30% to revenue) to the automotive leather upholstery industry. Its main customer includes automotive seat manufacturers (Fuji Seats, Toyota Boshoku, Lear Automotive, Auto Part Manufacturers, etc.), which in turn supply car seats to automotive OEMs (Perodua, Toyota, Proton, Nissan, Honda etc.) and automotive distributors (Perodua Sales).

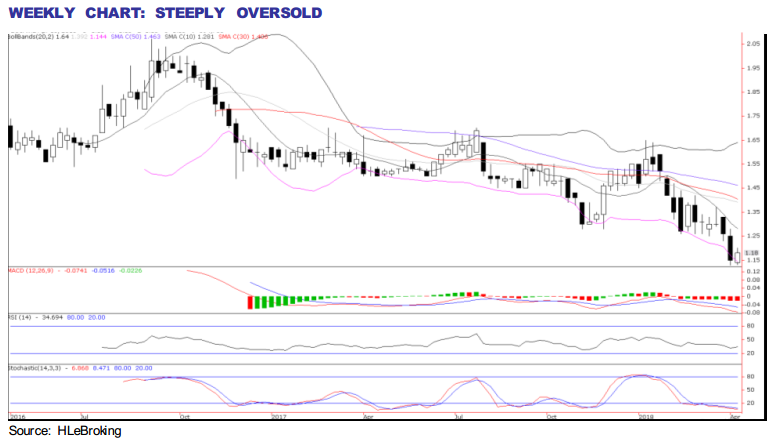

- HLIB maintains a BUY rating with RM1.72 TP (45.7% upside). We remain positive on PECCA amid its undemanding valuations at 11.6x FY19 P/E and 1.37x P/B (30% and 19% lower than average 16.6x P/E and 1.7x P/B since listed), supported by a commendable 12% EPS CAGR from FY17-20, net cash of RM92m or 49sen (ex-cash P/E of 6.8x), and potentially higher dividend payout (expecting 5.1%-6.8% for FY18-19 DY).

Source: Hong Leong Investment Bank Research - 13 Apr 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments