Technical Tracker - Serba Dinamik Holdings - A Dynamic O&M and EPCC Services Provider With Strong and International Footprint; Poised for a Triangle Breakout

HLInvest

Publish date: Mon, 04 Jun 2018, 10:36 AM

SERBADK is a solid O&M and EPCC services provider with several assets ownership, providing several recurring income stream. Valuation remains undemanding at 10.8x FY19 P/E vs its closest peer, Deleum (significantly lower market cap and ROE coupled with domestic-centric customers profile), supported by a strong FY18-20 earnings CAGR of 14%. We expect an imminent triangle breakout with medium to LT targets at RMN3.68-4.00 levels.

Solid track record. Serba Dinamik (Serbadk) is involved in providing engineering services to the O&G and power generation industries. It provides: (i) maintenance, repair and overhaul (MRO) works for rotating equipment; (ii) inspection, repairs and maintenance (IRM) services for static equipment. Overall, the MRO and IRM series are resilient and with high barriers of entry. It has moved up the value chain to provide engineering, procurement, construction and commissioning (EPCC) services. Order book remains robust at RM6.2bn including RM4.2b in O&M and RM2b in EPCC projects, which provide 2-year earnings visibility.

Local and international profile. Serbadk has an extended geographical presence, as its revenue comes from Malaysia, Indonesia, Turkmenistan, India, Middle East and the UK. Internationally, it has completed a range of projects as well as several on going projects, for its O&M and EPCC segments. Its recent acquisition of 24.8% stake in SGX-listed CSE last month will expand Serbadk’s geographical footprint given that

CSE has global presence in more than 20 countries, including the USA, Mexico, Australia andNew Zealand.

Asset ownership to provide recurring income. Serbadk currently has three assets – the CNG plant in Muaro Jambi, the Kota Marudu hydro power plant and the Ambon Mall small gas power plant which will provide it with a source of recurring income. This, in turn, would support its O&M and EPCC business.

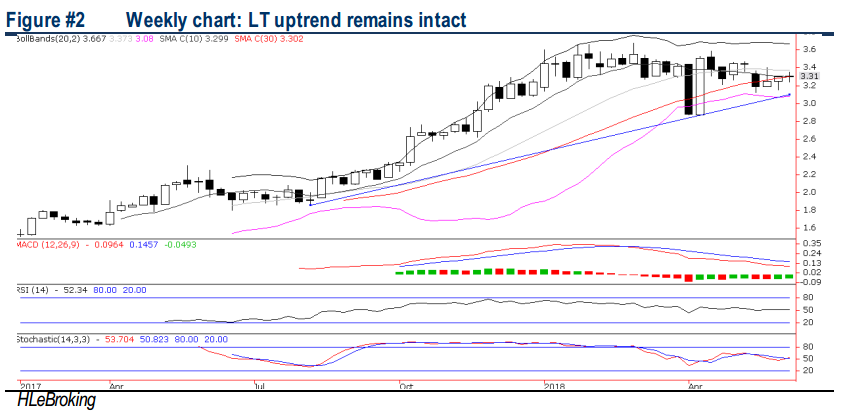

Poised for a triangle breakout. After falling from all-time high of RM3.68 (28 Feb) to a low of RM2.87 (9 Apr), Serbadk has been building a gradual uptrend to end at RM3.31 last Friday. We expect a triangle breakout formation soon, with share prices closed above key 10d/20d/3d/50d SMAs and supported by a golden cross in MACD. Serbadk valuation is also undemanding at 10.8x FY19 P/E (in line with its closest peer, Deleum, a much smaller domestic-centric player with less diversified customer base, significant lower market cap and ROE).

Hence, a successful breakout above RM3.32 (downtrend line) will push share prices towards RM3.47 (7 May high) and RM3.68 barrier before reaching our LT objective at RM4.00 (breakout objective). Key supports are RM3.22 (daily uptrend line) and RM3.11 (weekly uptrend line). Cut loss at RM3.05.

Source: Hong Leong Investment Bank Research - 4 Jun 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024