Technical Tracker - Dayang Enterprise Holdings - Earnings Upcycle Star in FY18; Potential Bottoming Up

HLInvest

Publish date: Wed, 06 Jun 2018, 08:55 AM

We remain positive on Dayang amid undemanding valuation at 11x FY19 P/E (26% lower than 5Y average of 14.8x), as earnings upcycle (after a sluggish FY17) is expected to resume with a strong 28% EPS CAGR from FY18-20. Downside risk is limited, as sentiment is boosted by recent oil price strength (vs RM) and early signs of bottoming up share price coupled with recent share buy-back by major shareholders.

Earnings upcycle to start in FY18 after a sluggish FY17. From the offshore activity levels that are currently taking place, we believe that the earnings upcycle for Dayang could start as early as 2HFY18, premised on: (i) higher topside maintenance services (TMS), Hook-up and Commissioning (HUC) contracts, Engineering Procurement Construction and Commissioning (EPCC) services amid improving operating climate and renewed activities by Petronas; and (ii) better utilisation of its 25 offshore support vessels and vessel charter rates. Meanwhile, the fleet utilisation at Perdana (60% subsidiary) should also improve going into 2018 as more than 9 vessels out of a fleet of 16 are earmarked for Dayang’s offshore maintenance, HUC and EPCC contracts.

Strong orderbook of ~RM2bn in hand. The company guided that activity levels for the MCM and TMS works under the Pan Hook-up and Commissioning Contract (Pan HUC) improved in 1QFY18 despite the typical cyclical monsoon months. The company's current orderbook stands at approximately RM2bn lasting through to 2022.

RM8bn tenderbook. The company has participated in approximately RM8b worth of projects, in particular the Pan MCM tenders. The company remains fairly confident of winning a portion given its track record and successful campaigns in similar projects.

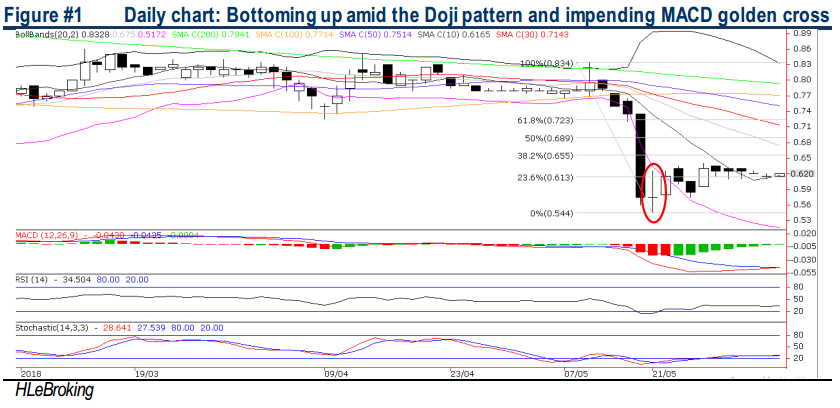

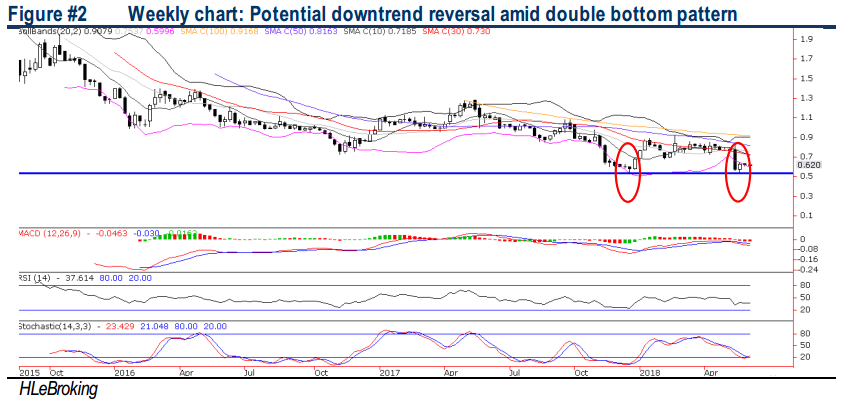

Early signs of bottoming up. DAYANG’s share prices dived 30% from RM0.78 (pre GE14 on 8 May) to a low of RM0.545 (21 May) before creeping up to RM0.62 yesterday. We witness signs of early bottoming up in share prices following the Doji formation (21 May) and the double bottom (weekly chart), supported by the potential golden cross in MACD and gradual hook-up in RSI and slow stochastic indicators. A decisive breakout above the immediate resistance of RM0.655 (38.2% FR) will likely to lift share prices higher towards RM0.675 (20d SMA) and our LT objective at RM0.75 (50d SMA). On the flip side, key supports are RM0.60 and RM0.575 (24 May low). Cut loss at RM0.57.

Source: Hong Leong Investment Bank Research - 6 Jun 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024