Technical Tracker - JOHOTIN - 20180618-hlib - Strong Earnings Visibility and Undemanding Valuations; Positive Downtrend Line Breakout

HLInvest

Publish date: Mon, 18 Jun 2018, 09:05 AM

Negatives largely priced after a 30% slump in share prices from YTD high of RM1.42 to end at RM1.00 last Friday. Further downside risks are cushioned by an undemanding 10.3x FY19 P/E (53% below its peers and supported by an 8% EPS CAGR from FY17-20) coupled with a generous DY of 4% (peers: 2.1%).

Company profile. JOHOTIN is mainly involved in two segments namely (i) tin manufacturing (contributed about 31% to FY17 PBT), which produces various tins, cans and other containers and printing of tinplates and it is ranked among the top three largest manufacturers of general tin cans in Malaysia, behind Kian Joo and Can One and (ii) F&B businesses (contributed about 69% to FY17 PBT), which engaged in manufacturing of milk, packing and processing of milk powder and other related dairy products. In this segment, about 70% of its customers are from overseas, mainly in West Africa, ASEAN and American Continent.

Stable earnings growth. JOHOTIN’s FY11-16 earnings jumped 26% CAGR, mainly attributed to strong growth in the higher margin F&B segment. Bloomberg consensus is predicting a stable 8% growth from FY17-20, propelled by capacity expansion in its F&B segment e.g. improved utilisation from milk powder plant and additional capacity from upgrading machineries in sweetened condensed milk and evaporated milk plant. On the contrary, demand for the tin manufacturing segment, is expected to grow marginally in the matured and stable industry.

Undemanding valuations. Trading at 10.3x FY19 P/E, the stock is indeed an undemanding consumer stock vis-à-vis its peers (22x). We like JOHOTIN for its favourable industry outlook, sound balance sheet (net cash of 7sen/share) and generous dividend yield of 4% (peers average: 2.1%)

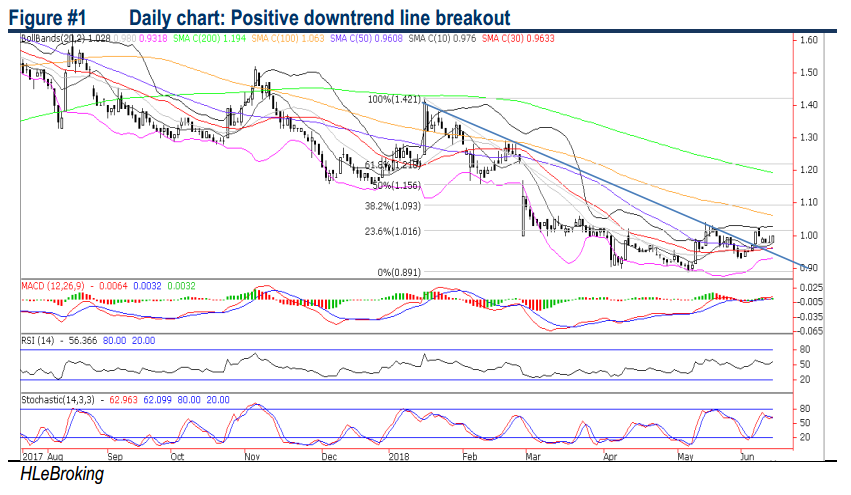

Positive downtrend line breakout. The recent breakout above the downtrend line on 7 June bodes well for the stock. Last Friday’s close above its 10d/20d/30d/50d SMAs likely adds to the near term bullish momentum. The positive daily and weekly charts indicators are pointing further advance in share prices towards RM1.06 (100d SMA). A decisive breakout above RM1.06 will spur prices higher to RM1.09 (38.2% FR) and before advancing to LT target at RM1.16 (50% FR). Supports are situated around RM0.96 (30d SMA) and RM0.93 (200w SMA) . Cut loss is set at RM0.92.

Source: Hong Leong Investment Bank Research - 18 Jun 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024