Telekom Malaysia - Attractive DY to cushion selloff; Potential relief rebound

HLInvest

Publish date: Tue, 03 Jul 2018, 04:52 PM

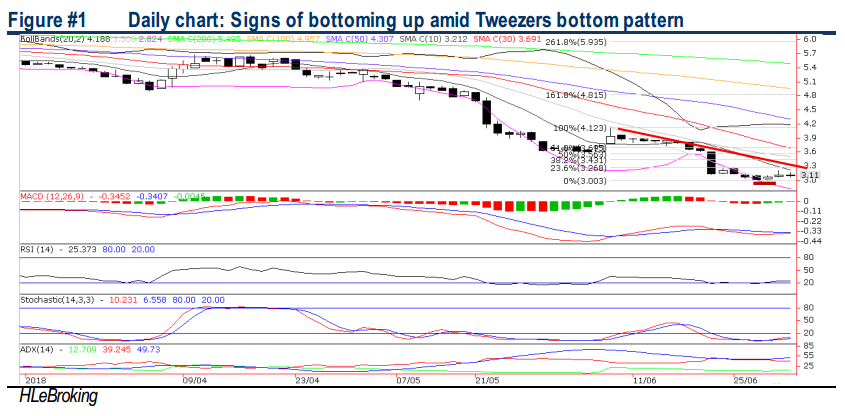

We see TM’s rout (-50% YTD and 38% since the eve of GE14) as overdone, pricing in substantially the uncertainty ahead of the implementation of the MSAP by the MCMC. Values emerge amid undemanding 14.6x FY19 P/E (28% lower than industry) and attractive 6% FY19E DY (45% higher than peers), supported by a strong 14% EPS FY18-20 CAGR. Potential downtrend reversal amid Tweezers bottom pattern.

Cheapest domestic telco stock after recent selloff. TM nosedived 50% YTD and 38% post GE14 as HLIB research is pricing in a 16% fall in FY18 earnings following a weak 1Q18 results and concerns over the uncertainty of possible changes in the telco sector’s overall policy direction under the new PH. Values re-emerge amid undemanding 14.6x FY19 P/E (28% lower than industry) and attractive 6% FY19E DY (45% higher than peers), supported by a strong 14% EPS FY18-20 CAGR.

Broadband prices to fall by 25% by end of the year. As part of Pakatan Harapan’s election manifesto, the new government is partially fulfilling its promise with the announcement of a 25% reduction in broadband prices by end-2018 (vs. a 50% cut stipulated in its election manifesto). This follows the implementation of the Mandatory Standard on Access Pricing (MSAP) by the Malaysian Communications and Multimedia Commission (MCMC). The Communications and Multimedia Minister said relevant parties are currently in discussion to finalise the wholesale prices and this is expected to conclude by July/August, after which new lower-priced broadband packages are expected to be rolled out to consumers. Although earnings headwinds increased as TM should post lower ARPU as a result of the government’s move, we also expect subscriber base to rise as prices become more affordable. In addition, we believe this could prompt TM to be more aggressive in implementing cost-cutting measures in order to defend its bottomline.

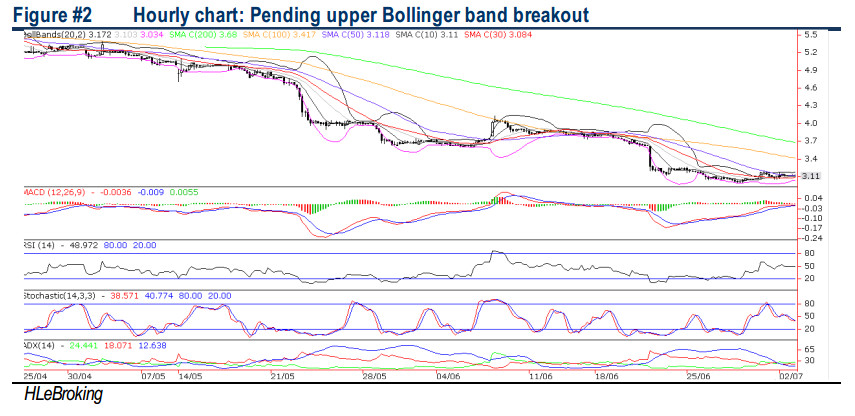

Potential downtrend reversal. Following the formation of Tweezers bottoms pattern and bottoming up indicators in the daily chart, the stock is poised for a potential downtrend resistance breakout (near RM3.30) soon. A decisive breach will spur prices higher towards RM3.56 (50% FR) before reaching our LT objective at RM3.69 (61.8% FR). Key supports are situated near RM3.00 (27 & 28 June low) and RM2.95 (weekly lower Bollinger band). Cut loss at RM2.90.

Source: Hong Leong Investment Bank Research - 3 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-29

TM2024-07-29

TM2024-07-29

TM2024-07-29

TM2024-07-29

TM2024-07-29

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-26

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-25

TM2024-07-24

TM2024-07-24

TM2024-07-24

TM2024-07-23

TM2024-07-23

TM2024-07-23

TM2024-07-22

TM2024-07-22

TM2024-07-22

TM2024-07-19

TM2024-07-19

TM2024-07-19

TM2024-07-19

TMMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024