FCPO - More Range Bound Consolidation Amid Nagging Worries of Rising Stockpiles in 2H and Slow Exports

HLInvest

Publish date: Fri, 24 Aug 2018, 08:53 AM

In the near term, FCPO outlook remains negative in anticipation of higher stockpiles in 2H and slow exports. However, severe downside is limited following a 11.2% slide from 3M high of RM2498 (24 May), cushioned by RM weakness (vs USD) and a zero percent CPO export tax in Sep 2018, Indian government’s recent move to raise import duties on other soft oils and potential re-emergence of El Nino. Stiff resistances are set at RM2265-2300 levels.

Tug-of-war as rangebound consolidation prevails. Tracking weaker related edible oils and worries of rising output in the coming months saw FCPO falling for a 2nd day (-RM23 to RM2217). In the short term, positive expectations from stronger USD and potential rising exports to China after its pledge to import more palm oils from Malaysia coupled with the possibility of a re-emergence of El Nino are the catalysts for price rerating. However, these will be offset by downside risks such as nagging concerns of rising inventory amid production surplus in a seasonally strong 2H and the weakness in rival oil related prices.

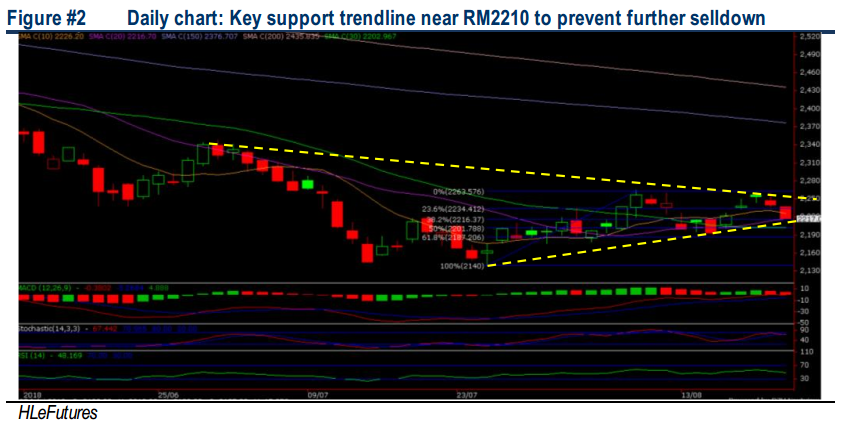

FCPO needs to stay above RM2250 to arrest current downtrend. Following a 14.3% or RM358 slump from RM2498 (3M high on 24 May) to a low of RM2140 (25 July), FCPO staged a 5.8% rebound to a high of RM2265 (8 Aug) before retreating again to RM2217 yesterday. We expect FCPO to engage in rangebound consolidation unless staging a decisive breakout above RM2250 (downtrend line), which will lift prices higher towards RM2265 (8 Aug high) and RM2300 psychological barrier. On the flip side, a breakdown below RM2210 (support trendline) could see more retracements towards RM2188/2170/2140 territory.

Source: Hong Leong Investment Bank Research - 24 Aug 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024