Taliworks Corporation - Beneficiary of the resolution of Selangor water saga

HLInvest

Publish date: Tue, 28 Aug 2018, 09:24 AM

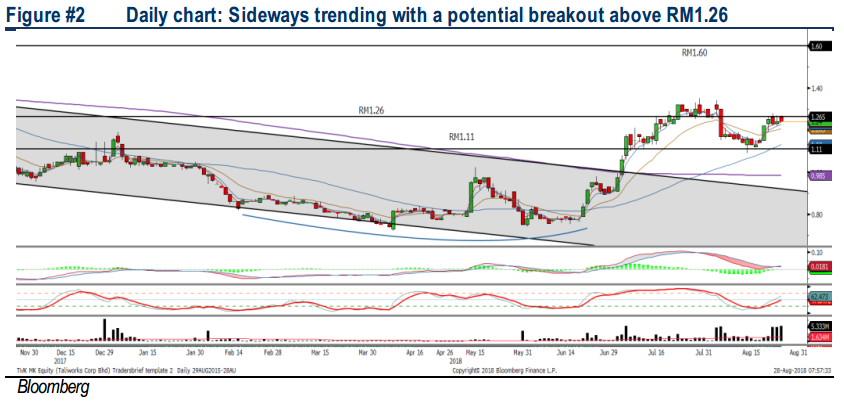

Following the resolution of Selangor water issue, we anticipate TALIWORK to be a beneficiary of this good progress within the water segment in Malaysia. Also, TALIWORK is expected to recover its outstanding receivables amounted to c.RM650m (54 sen per share). Following this settlement, we expect more upside for the dividend in the future, which may translate to c.10% dividend yield based on current share price. Technicals are positive as volumes picked up on a sideways formation. Should there be a breakout above RM1.26, the next target will be at RM1.37-1.40, followed by RM1.60. Support will be at RM1.18- 1.19, with a cut loss at RM1.11.

Positive beneficiary from the resolution of Selangor water saga. As the earlier dead-lock water asset situation in Selangor has been resolved, we see this as a good progress within the water segment in Malaysia. Also, Taliworks is expected to recover its outstanding receivables amounted to c.RM650m (54 sen per share).

Healthy dividend paymaster. Over the years, TALIWORK being in stable recurring businesses and has been paying a decent amount of dividends. Following this settlement, we expect more upside for the dividend in the future, which may translate to c.10% dividend yield based on current share price. Moreover, we also do not discount the possibility of lump-sum upfront special dividend amounted to 50 sen per share, assuming 100% payout.

Volumes picked up amid sideways trend. TALIWORK has been trending sideways over the past 4 trading days within a narrow range, accompanied by healthy volumes. The MACD Indicator has issued a “buy” signal, while the Stochastic oscillator is trending positively above 50. We anticipate this as a positive signal for a breakout above the RM1.26 level, targeting the RM1.37-RM1.40, followed by a LT target of RM1.60. Support will be located around RM1.18-1.19, with a cut loss below RM1.11.

Source: Hong Leong Investment Bank Research - 28 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRKMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024