HSS Engineers - Riding on the revival of water sector and infrastructure potential in ASEAN

HLInvest

Publish date: Wed, 05 Sep 2018, 09:07 AM

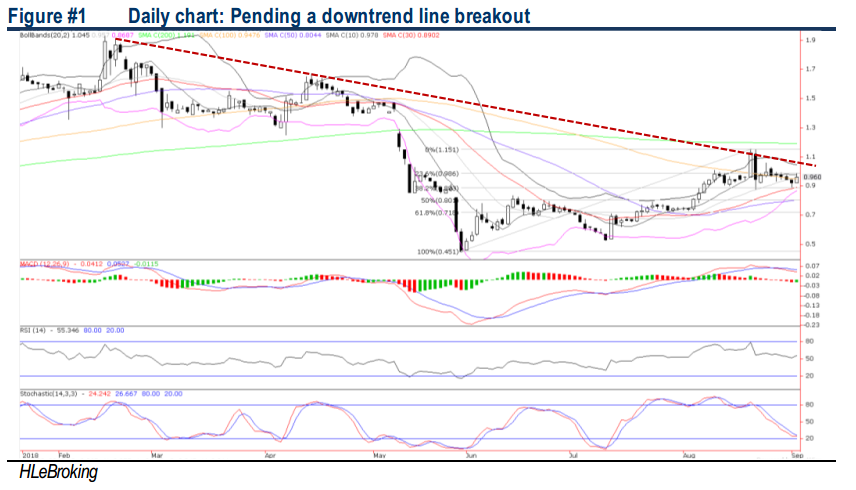

We believe HSSEB’s exposure to a wide array of domestic sectors and penetration to the infrastructure boom in ASEAN augur well for earnings enhancement, which is expected to grow strongly at 16% EPS CAGR from FY18- 20. Valuation is undemanding at 18.7x FY19 P/E and 1.47x P/B (21% below its average P/E of 23.8x since listing), supported by RM630 orderbook sustainable for 3-5 years. A successful breakout above downtrend near RM1.08 will spur prices higher to retest 200D SMA at RM1.19.

Malaysia’s engineering DNA. HSSEB is the 1st engineering consultancy services listed on Bursa Malaysia and the largest local engineering firm that provides engineering and project management services to a wide array of sectors including urban infrastructure, roads and highways, railways and metro systems, building and structures, transportation planning, power generation, and water resources management and supply. Its clientele is spanning from the domestic and international arenas (India, the Middle East and ASEAN). To date, the total workforce is more than 1,000 staff, of which more than half are engineers.

Beneficiary of mandatory use of BIM. According to the Construction Industry Development Board (CIDB), property developers working on government projects worth more than RM100m will be required to use BIM by 2020, in line with the five year Construction Industry Transformation Plan (CITP) launched in 2016. BIM is the process of designing a building or facility using an intelligent system of 3D modelling and computer simulation, which can identify design issues and construction errors before construction works start and this ultimately leads to 20-25% cost savings and reduced time on project delivery. HSSEB is one of the few consultants in Malaysia that can offer an integrated BIM system and is set to benefit from CIDB’s imposition of BIM requirement for government projects by 2020.

Eyeing opportunities from asset consolidation in water sector. To capitalise on water infrastructure boom, HSSEB had on 28 March 2018 completed the RM270m acquisition of SMHB Engineering Sdn Bhd (SMHB), which is the largest local engineering consulting firm in the water sector. SMHB has been involved in many vital projects in the water sector including the Raw Water Supply to Rapid Pengerang, the Development of Sungai Selangor Phase 1, 2 and 3, the Pahang-Selangor Raw Water Transfer Project, Melaka River Rehabilitation and Beautification, the design of various dams and 2800km of water supply pipeline in Malaysia among others.

Overall, HSSEB is well positioned to capture the water infrastructure works as the long-awaited conclusion of the restructuring of Selangor water treatment and distribution, to reduce non-revenue water from an average of 35.2% currently to the internationally accepted level of 20.0-25.0% and to also ensure uninterrupted supply to cope with increasing water demand and addressing the low reserve margin in the country in line with the population and industry growth.

Strong orderbook to sustain 3-5 years growth. HSSEB’s current order book of RM630m will accord earnings visibility over the next 3-5 years, positioning it to weather the expected slowdown in new contract awards given the EPS enhancement and better profit margin from the SMHB acquisition.

Moreover, it is aggressively making inroads into the huge infrastructure potential in South East Asia. According to the Oxford Economics, the six countries in ASEAN’s (i.e. Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam) total spending on transport infrastructure (road, rail, sea and airports) is expected to grow at 6% CAGR from USD47bn in 2015 to USD84bn in 2025, driven by increased population and urbanization, accelerated mobility and demand for transportation coupled with increased trade competitiveness.

Pending a downtrend line breakout. Since hitting 52-week low at RM1.93 (15 Feb), HSSEB nosedived RM1.48 or 77% to a low of RM0.445 (31 May) amid a broad-based selloff in construction stocks post GE14. However, the stock has recouped 35% or RM0.51 of the RM1.48 slump to RM0.96 yesterday. Following the small hammer candlestick pattern on 3 Sep, we see HSSEB to retest the key RM1.00 psychological barrier soon, before heading towards the downtrend line resistance (near RM1.10), supported by bottoming up indicators. A decisive breakout RM1.08 will spur prices further towards our long term price target of RM1.19 (200d SMA). Key supports are RM0.90 and RM0.88 (38.2%FR). Cut loss at RM0.87.

Source: Hong Leong Investment Bank Research - 5 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024