Traders Brief - O&G and Export-driven to be Focused

HLInvest

Publish date: Wed, 12 Sep 2018, 04:30 PM

MARKET REVIEW

Asia’s stocks traded mixed amid the prolong trade worries between the US and its trading partners (China and Canada). Also, the White House announced that it was in the process of coordinating a second meeting between President Trump and North Korean leader Kim Jong Un. Shanghai Composite Index and Hang Seng Index (within bear market territory) declined 0.18% and 0.71%, respectively, but the Nikkei 225 increased 1.3%.

Market tone was sluggish prior to the long weekend holiday and the FBM KLCI ended marginally higher by 0.03% to 1,799.17 pts, but was hovering below the 1,800 psychological level. The market breadth was negative with 475 decliners vs. 334 gainers, accompanied by 1.73bn market traded volumes worth RM1.64bn.

Wall Street closed higher led by tech stocks despite the on-going US-China trade tensions and the unsettled US-Canada trade discussions. To recap, last Friday President Trump commented to impose an additional USD267bn worth of tariffs on Chinese goods. The Dow and S&P500 rose 0.44% and 0.37%, respectively while Nasdaq gained 0.61%.

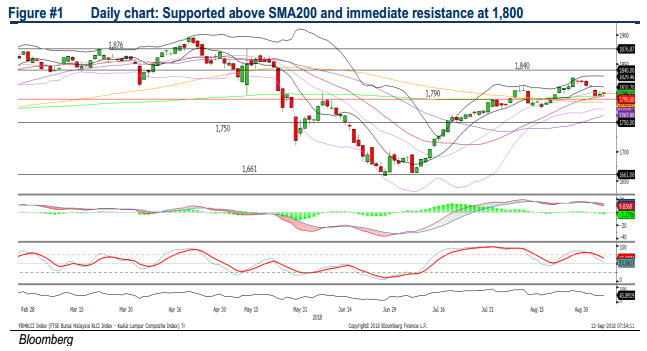

TECHNICAL OUTLOOK: KLCI

The FBM KLCI is currently supported around the SMA200. However, the MACD indicator is weakening and the Stochastic has crossed below 50; indicating that we may anticipate further retracement over the near term. The immediate resistance will be pegged around 1,800, followed by 1,810. Support will be located around 1,795 and 1,784 (SMA100).

Tracking the overnight positive Wall Street performance, buying interest may spillover towards stocks on the local bourse. The firmer crude oil prices and the weaker ringgit position should also lift the trading activities amongst the O&G and export-oriented stocks.

TECHNICAL OUTLOOK: DOW JONES

The Dow has been consolidating sideways over the past 7 days within a narrow range between 25,750-26,075 levels. The MACD Line is still below the Signal Line, but both the momentum oscillators are recovering above 50. We may expect a short term rebound with the upside limited around 26,200. Support will be located around 25,750, followed by 25,500.

We believe the trade discussions and worries between the US and its trading partners will be an on-going concern which may dampen the trading tone of the stock markets. Hence, we anticipate that Wall Street may trend sideways over the near term.

Source: Hong Leong Investment Bank Research - 12 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024