Destini - Downside Is Cushioned by Its Undemanding Valuations and Strong EPS CAGR of 18% for FY18-20

HLInvest

Publish date: Tue, 18 Sep 2018, 09:36 AM

We believe the 49% YTD slump in share price is overdone and already discounted the fears of the new PH government would review the on-going and upcoming projects. Severe downside risks are likely to be cushioned by persistent acquisition from the largest shareholder i.e. Group CEO Dato Rozabil (increased stakes to 26.5% from 24.7% pre-GE14). Moreover, valuations are attractive at 7x FY19 P/E (65% below its average 10-year P/E of 20x) and 0.59x P/B (55% lower than 10-year average of 1.3x), given its high barrier to entry to the industry, ~RM900m orderbook and strong EPS CAGR of 18% from FY18-20.

An established MRO service provider with global presence. The Group started off as an aviation tool and spare parts trading company supplying for the defence industry. Two decades later, Destini has evolved to provide a diversified range of products and services for the aviation, marine and land system industries for both defence and commercial sectors. With a wider portfolio and coupled with Destini’s foray into oil and gas, it has expanded the Group’s geographical footprint over the Asian, Australian, Middle East and European regions. In FY17, the marine divisions contributed 52% to revenue while the rest were from aviation (40%), O&G (4%) and land systems and others (4%).

Strong execution skills; long term prospects remain favourable. At RM0.265, Destini is trading at attractive 7x FY19 P/E (65% below its average 10-year P/E of 20x) and 0.59x P/B (55% lower than 10-year average of 1.3x), supported by its high barrier to entry to the industry, RM900m orderbook and strong EPS CAGR of 18% from FY18-20. Also, Destini is actively tendering for more contracts locally and overseas. Potential contracts include offering safety survival maintenance, repair and overhaul (MRO) services to more government agencies, full ground handling services for civilian airlines, MRO and supply of more helicopters, more offshore petrol vessels (OPVs) and New Generation Patrol Craft (NGPCs), offering rail MRO services and expanding decommissioning services and fabrication for the O&G downstream sector in the wake of the recovery in oil prices. Clinching these contracts could provide a sizeable boost to its existing orderbook and provide a significant earnings rerating to the stock. Destini may seem dependent on the niche focus government-related defence and aviation job opportunities, which contributed ~90% to revenue. Nevertheless, we

remain positive on the stock as due to its proven capability and timely delivery of services at competitive pricing compared to foreign companies or contractors, which are important to a new government facing budgetary constraints and emphasizes efficiency and transparency.

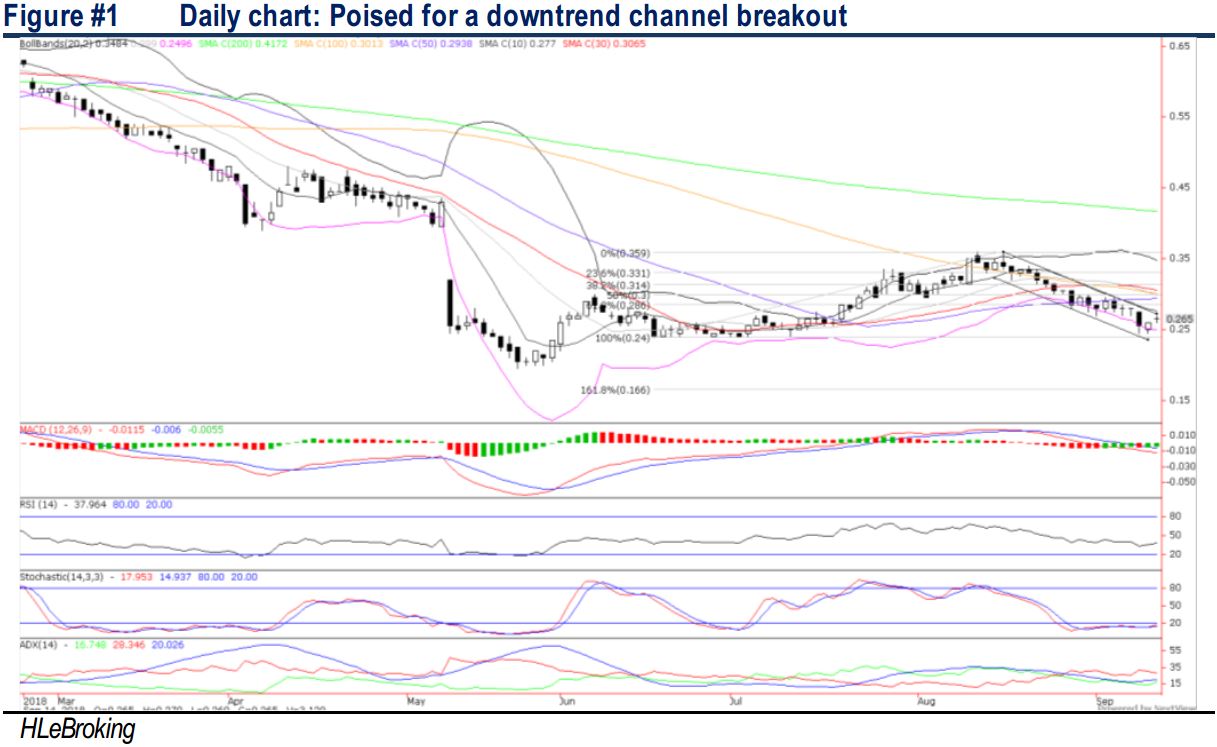

Potential downtrend channel breakout. After correcting 32% from 1M high of RM0.36 (15 Aug) to a low of RM0.245 (12 % 13 Sep), DESTINI is likely at the tail end of its downward consolidation after rebounding 8.2% to RM0.265 on 14 Sep from RM0.245, reflected by the Tweezers bottoms pattern (12 & 13 Sep). A decisive cross above RM0.285 (downward channel) hurdle will spur prices higher towards RM0.30 (50% FR) before reaching our LT objective at RM0.36. Supports are RM0.25 (lower Bollinger band) and RM0.245. Cut loss at RM0.225.

Source: Hong Leong Investment Bank Research - 18 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024