Traders Brief - Downside Risk Is Cushioned by Expectations of End 3Q Window Dressing

HLInvest

Publish date: Thu, 27 Sep 2018, 09:21 AM

MARKET REVIEW

Ahead of the FOMC meeting outcome, Asian markets dropped in the early sessions following overnight Dow’s decline after a tough trade talk from Trump at the United Nations General Assembly and news that the US is prepared to move ahead on a trade deal with Mexico that excluded Canada. However, rebounds in SHCOMP (+0.9%) and HSI (+1.1%) led a recovery in Asian markets after MSCI said it could quadruple China’s weighting in global benchmarks, which is a fresh impetus to a market already buoyed by expectations of state stimulus to offset the impact of U.S. tariffs.

In line with higher regional markets, KLCI jumped 4.3 pts at 1798.7 after fluctuated within a range of 13.1 pts between an intra-day high of 1800.7 and a low of 1787.6. Sentiment was also buoyed by expectations of end 3Q18 window dressing and positive development from foreign participations (net buy of RM115m in Sep to date vs –RM97m in Aug). Trading volume rose 20% to RM2.3bn with positive market breadth of 469 gainers as compared to 387 losers.

The Dow jumped as much as 114 pts in early session but surrendered the entire gains to end 107 pts lower at 26385 after the Fed raised 25bps interest rates as expected, and flagged the end of its “accommodative” monetary policy in wake of a strong economic growth and jobs market and well-contained inflation. Overall, the Fed indicated that it still foresees another rate rise in December, three more in 2019 and one in 2020. Powell added that although tense trade relations were on the central bank’s radar it hadn’t yet risen to the level of a significant concern for policy makers.

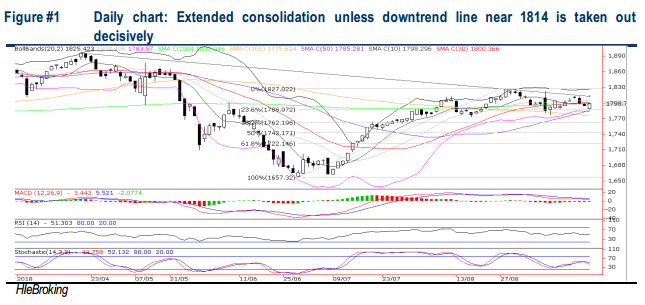

TECHNICAL OUTLOOK: KLCI

After slipping as much as 6.8 pts yesterday to 1787.6 (23.6% FR), KLCI managed to stage a rebound to end 4.3pts higher at 1798.7, a tad below 1800 or 200d SMA. We expect KLCI to lock in range bound consolidation mode in the short term unless it is able to decisively close above the 1800-1814 congested resistances. A break above 1814 will spur greater upside towards 1827 (30 Aug high) and 1846 (pre GE14 close). Conversely, a breakdown below 1787 will see further retracements towards 1776 (100d SMA) and 1762 (50% FR) levels.

In the near term, KLCI is likely to remain choppy due to the lack of domestic rerating catalysts, given the prospects of protracted US-China trade war, EM contagion risks, tightening financial conditions and expectations of further “belt-tightening budget 2019” to be tabled on 2 Nov. Nevertheless, downside risk is well-cushioned by expectations of end 3Q18 window dressing and positive development from foreign participations.

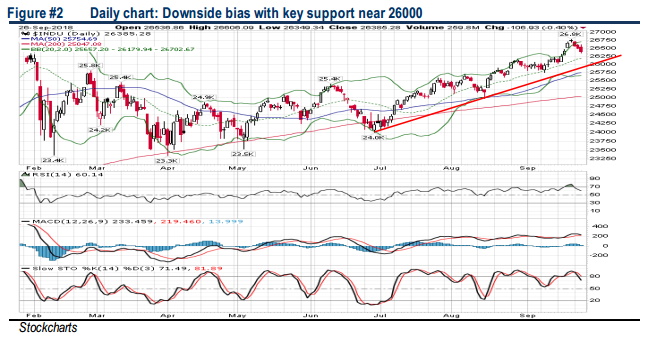

TECHNICAL OUTLOOK: DOW JONES

The Dow fell for the 3rd sessions after hitting the recent all-time high of 26769. The MACD is poised to record a dead cross whilst the RSI and Stochastic are hooking downwards from the overbought zone. We believe the Dow is undergoing a mild retracement phase and the next support will be located around 26000 (support trendline). Meanwhile, the resistance will be pegged around 26800-27000 zones.

Although investors remain sanguine that the heightened anxiety over an escalating US-China trade conflict would compromise to eventually quell fears of a growth-hindering trade war in the long term, recent harsh stance by Trump at the United Nations General Assembly could spiral into a full-blown trade war that may soften the corporate earnings. Hence, Dow is likely to lock in brief consolidation mode ahead of the start of the UAS 3Q18 reporting season in early Oct, to gauge the latest earnings outlook after recent rounds of tariffs.

Source: Hong Leong Investment Bank Research - 27 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024