Traders Brief - Mild rebound in store, tracking Wall Street

HLInvest

Publish date: Fri, 28 Sep 2018, 04:24 PM

MARKET REVIEW

Key regional benchmark indices were pressured yesterday following the interest rate decision by the Federal Reserve, hiking by another 25 basis points (3rd hike for 2018). The Nikkei 225 declined nearly 1%, while Hang Seng Index and Shanghai Composite Index fell 0.36% and 0.54%, respectively.

Similarly, the FBM KLCI reversed earlier gains after hitting an intra-day high of 1,803.71 pts and ended marginally lower at 1,798.64 pts. Market breadth also turned negative as ringgit stood near the RM4.14/USD level, there were 4 gainers for every 5 losers on the local bourse market. Market volume declined below 2.0bn at 1.99bn, worth RM2.05bn.

Despite the interest rate hike by the Fed, Wall Street ended on a higher note led by Apple as JP Morgan initiated coverage, indicating that the tech giant is having a transformation from a hardware company to a services company. The Dow and S&P500 gained 0.21% and 0.28%, respectively, while Nasdaq up 0.65%.

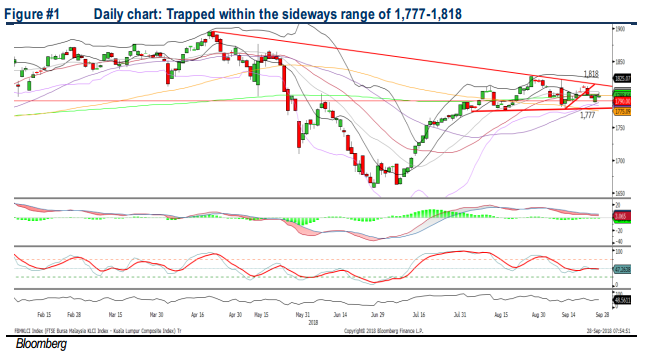

TECHNICAL OUTLOOK: KLCI

The FBM KLCI continued to stay within the range between 1,777-1,818 and the MACD Indicator has turned flattish approaching the zero level. The RSI and Stochastic oscillators are suggesting that the momentum is flattening. Hence, the near term resistance will be pegged around 1,818, while the support will be envisaged around 1,777. Should there be any downward violation below 1,777, next support will be at 1,755.

Although market sentiment remains weak at this moment on the back of the uncertain trade progress, we think the 3Q18 window dressing should be able to cushion the downside risk over the near term. Also, we still see opportunities amongst oil and gas stocks with the firmer recovery of crude oil prices.

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trend within the retracement phase, despite the mild positive overnight performance. The MACD Indicator is flattening, while both the RSI and Stochastic oscillators are showing mixed signals. Hence, we believe the retracement phase may persist over the near term. Resistance will be envisaged around 27,000, while support will be anchored around 26,000.

In the US, the upward rally remains strong supported by healthy corporate earnings boosted by lower corporate tax and decent economic growth. However, should there be any extended trade war between the US and its trading partners; it may crimp the corporate earnings moving forward.

Source: Hong Leong Investment Bank Research - 28 Sep 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024