Traders Brief - Downside Bias Towards 1740-1750; All Eyes on the Oct 9 Investment Conference

HLInvest

Publish date: Mon, 08 Oct 2018, 09:41 AM

MARKET REVIEW

Asian markets stumbled amid overnight slide in Dow amid surging US 10-year Treasury yields towards 7-year high near 3.23% after Powell commented that the US central bank has “a long way” from neutral on interest rate on strong underlying economic data. Sentiment was also dampened by heightened US-China tensions after US Vice President Mike Pence accusation of China’s "malign influence and interference" to sway the elections against the Republicans in retaliation for Trump’s trade policies.

Tracking sluggish regional markets, KLCI fell 13 pts last Friday to record its 3rd consecutive decline, slipping 16 pts WoW to 1777.2. Trading value reduced 23% to RM1.89bn with bearish market breadth of 265 gainers as compared to 639 losers.

Wall Street closed sharply lower Friday as US 10Y Treasury yields rose 0.04% to 3.23% and a tight labour market and strong wages growth as the US unemployment rate fell to its lowest level since 1969 economy. The Dow plunged 180 pts (reduced from -325 pts) to 26447 and ended 11 pts higher WoW.

TECHNICAL OUTLOOK: KLCI

The sharp fall last Friday saw the KLCI breaking the neckline support near 1793 (50d SMA), forming a mini H&S pattern. This could spur further troubles for KLCI towards 1741 levels in the short term if immediate support near 1771 near 100d SMA is violated. Only a strong reclaim above 1793 will arrest the downtrend, targeting 1800-1810 territory.

Given the recent Dow’s consolidation and expectations of renewed selling spree in the China markets today after the Golden Week holidays, KLCI will continue to indulge in near term consolidation amid nagging external headwinds, a meagre KLCI earnings growth and an upcoming “belt-tightening budget 2019” (on 2 Nov). All eyes are focus on the upcoming “Malaysia: A New Dawn” conference (a precursor to the Budget 2019) on 9 Oct to gauge how the new PH government is going to instil confidence in the management of the economy, the monetary sector and capital markets despite facing the severe fiscal issues brought about by the RM1 trillion Federal Government debts.

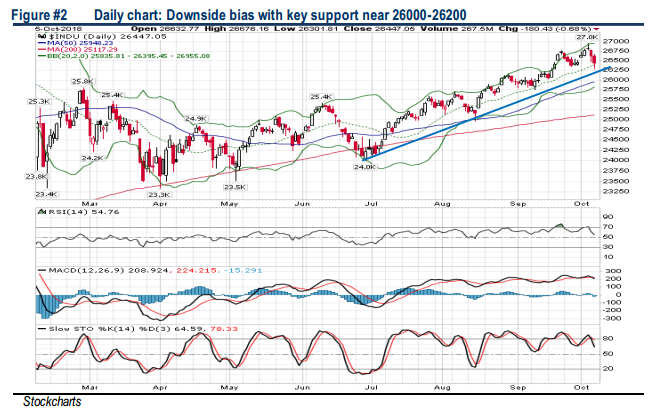

TECHNICAL OUTLOOK: DOW JONES

The Dow fell for the 2nd sessions after hitting the all-time high of 26951. We see downside bias foe the benchmark index amid weakening technical indicators, with key support at 26250 (uptrend line). A decisive violation below 26250 will witness further slide towards 26750-26000 zones. Meanwhile, the resistance will be pegged around 26951-27200 zones.

In wake of escalating US-China trade tensions, spiking US 10-year yield and the start of the US 3Q18 reporting season this week (to gauge the latest earnings outlook after recent rounds of tariffs), and investors are likely to stay alert. Hence, we opine the Dow’s upside will be capped along 27000 psychological level, in view of the overbought situation noticed on the momentum oscillators.

Source: Hong Leong Investment Bank Research - 8 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024