Traders Brief - Risk off mode returns; Facing stiff resistances at 1738-1754 zones

HLInvest

Publish date: Tue, 16 Oct 2018, 09:43 AM

MARKET REVIEW

Asian markets retreated following IMF and World Bank’s warnings in Bali over the weekend that the global recovery is increasingly uneven and risks are being skewed to the downside coupled with higher risks of financial stresses. Sentiment was also dampened by Trump’s threat to impose another round of tariff on China in an interview with CBS’s “60 Minutes” that China’s meddling in U.S. politics is a “bigger problem” than Russian involvement in the 2016 election.

Tracking sluggish regional markets, KLCI lost 2 pts at 1728.4 after traded within a range of 13.1 pts between an intra-day high of 1739.3 and a low of 1726.3. Trading volume and value decreased 8.4% and 18.5% to 2.03bn shares worth RM2.03bn, respectively. Market breadth was negative with 342 gainers as compared to 532 losers.

The Dow alternated between gains (+142 pts) and losses (-96 pts) before ending 89 pts lower at 25251, adding to the steep losses from last week. Sentiment was dampened by a crosscurrent of factors i.e. escalating US-China trade spats after Trump accused China meddling in US politics and threat to impose another round of tariffs; potential earnings miss due to high expectations in 3Q18 earnings growth of 19%; high borrowing costs on rising bond yields coupled with upcoming US mid-term elections.

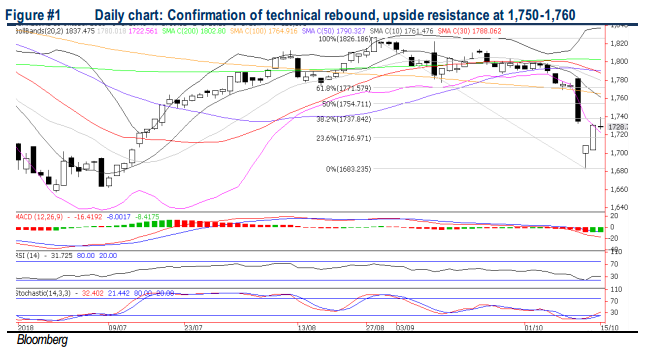

TECHNICAL OUTLOOK: KLCI

While the technical rebound that we witnessed last Friday is expected to prevail this week following the successful refill of 1700-1730 gap (12 Oct) and a hammer candle formation last Friday, the momentum is expected to taper off due to the lack of rerating local catalysts and prolonged external headwinds. Key reistances are 1738 (38.2% FR) and 1755 (50% FR) levels while supports fall on 1700 and 1683 (11 Oct low).

After a massive foreign outflows amounting to RM1.26bn over the last six sessions, selling pressures tapered off to –RM78 yesterday, the smallest in Oct. Despite potential relief rally in the near term, risk off mode prevails and any rebound would be capped at 1755 zones due to external headwinds (i.e. stormier global growth outlook, heightened trade tensions and ongoing geopolitical concerns, tighter financial conditions, wobbly stock markets, vulnerable EM currencies etc) and lack of local rerating catalysts (i.e. slowing economy and corporate earnings growth, expectations of a “belt-tightening budget 2019” on 2 Nov).

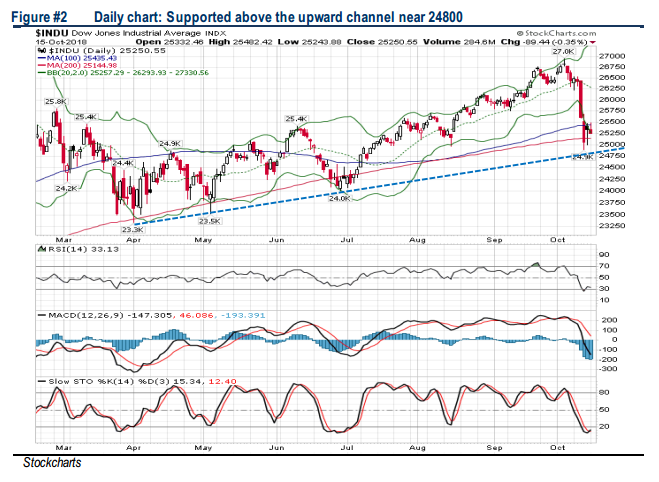

TECHNICAL OUTLOOK: DOW JONES

The Dow is building base along the 200D SMA (25143) amid grossly oversold Stochastic and RSI readings while the MACD continued to hover below zero. Should there be any decisive breakdown below the SMA200, the Dow could resume downtrend towards 24800 (support trendline) and 24200. Meanwhile, the resistance will be envisaged around 26000-26300.

The Dow is likely to extend its consolidation mode on the back of upcoming US mid-term election and ongoing 3Q18 earnings season. Nevertheless, 4Q18 and 2019 earnings could be affected by rising input costs, stronger USD, higher borrowing costs and escalating trade wars. Overall, the Dow’s 4.6% slide in October, traditionally a volatile period for stocks, highlights an abrupt turnaround for the Dow that hit all-time high of 26953 (3 Oct) and the ascent of 10Y yields that touched a 7Y high of 3.26% (5 Oct) have compelled a broad-based unwind of investors' portfolios.

Source: Hong Leong Investment Bank Research - 16 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024