Traders Brief - Wait-and-see Sentiment Ahead of Budget 2019

HLInvest

Publish date: Mon, 22 Oct 2018, 10:04 AM

MARKET REVIEW

Asia’s stock markets ended in the positive territories, recouping strongly from earlier losses following a series of rules and measures by China’s regulators to support the already struggling stock market. Also, despite China’s GDP grew at a softer pace of 6.5% YoY (analyst consensus of 6.6%) for 3Q18, the Shanghai Composite Index rallied 2.58%, while Hang Seng Index rose 0.42%.

Meanwhile, on the local front, the FBM KLCI bucked the regional by trading lower to 1,732.14 pts (-0.34%). Market breadth was bearish with 579 decliners vs. 252 gainers, accompanied by market volumes of 2.41bn, worth RM2.30bn. Nevertheless, selected export-related stocks such as Top Glove, MPI and Globetronics managed to trade actively higher.

Under the cautious market tone, the Dow ended on a positive note, snapping the 3-week losing streak led by Procter & Gamble amid better-than-expected earnings. However, the S&P500 and Nasdaq slipped 0.04% and 0.48%, respectively.

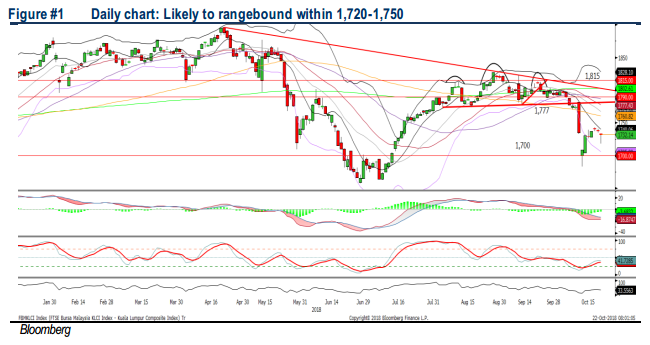

TECHNICAL OUTLOOK: KLCI

After the strong rebound from the 1,683 level two weeks ago, the KLCI has turned sideways, ranging between 1,720-1,743. The MACD Line stayed flattish below the zero level, but both the RSI and Stochastic oscillators are trending below 50. With most of the technical indicators pointing on the negative path, we may anticipate the KLCI to have resistance near the 1,750, followed by the 1,777 level, while support will be located around 1,700-1,720.

We believe Malaysia’s stock market will be traded on a sideways trend over the near term following the 11MP midterm review and prior to the “belt-tightening mode” Budget 2019 as investors will need to wait for more clarity before further investing in Malaysia’s equities. Hence, we opine that the KLCI will be trading within the range of 1,720-1,750.

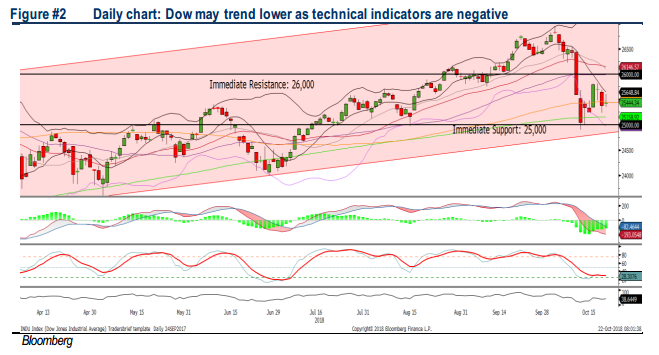

ECHNICAL OUTLOOK: DOW JONES

The Dow is trading below the 10D SMA, but maintaining its long term trend above 200D SMA. However, indicators such as MACD, RSI and Stochastic are suggesting that the momentum is weak at this juncture. Hence, the Dow’s upside is likely to be limited around 25,600-25,818, while the support will be set along 24,900-25,222.

In the US, the stronger-than-expected corporate earnings season would be able to cushion the volatile markets recently. To recap, sentiment was dragged by the unsettled trade war, 10-year Treasury yield and interest rate up-cycle outlook. The Dow’s upside could be capped along 26,000.

TECHNICAL TRACKER: BIOALPHA HOLDINGS

Steady growth ahead; Poised for a bullish flag breakout. BIOHLDG has grown to become an integrated biotechnology company with businesses comprising all segments of the supply chain (e.g. in-house cultivation of raw materials, R&D, ODM, distribution and pharmacy chains). Valuations are undemanding at 9.6x FY19 P/E and 1.5x P/B (34% and 20% lower than its bigger cap peers), supported by a strong 63% EPS CAGR for FY17-19 and net cash of RM7.7m or 1sen/share. More synergies are coming from the recent proposed NWE’s acquisition to distribute its products to hotels all across the country as well as the MOU with Jinrui Fortune Group, China to jointly develop “Thousand Medicinal Hall” platform and herbal farms in China.

Source: Hong Leong Investment Bank Research - 22 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024