Traders Brief - KLCI could be due for technical rebound

HLInvest

Publish date: Fri, 26 Oct 2018, 04:18 PM

MARKET REVIEW

Asia’s stock markets went through another rocky session, tracking the sell offs on overnight Wall Street led by technology heavyweights amid rich valuations and disappointment in corporate earnings. The Nikkei 225 and Hang Seng Index dived 3.72% and 1.01%, while the Shanghai Composite Index ended flattish, rising marginally higher by 0.02%. In tandem with the regional performances, stock on the local front faced another round of selling pressure and the FBM KLCI ended lower at 1,686.59 pts (-0.20%). Market breadth remained negative (there were more than 4 decliners to 1 gainers in the broader market). Market traded volumes stood at 2.24bn worth RM2.34bn. Equities on Wall Street managed to recoup part of earlier losses led by technology shares on the back of better-than-expected earnings from selected tech giants like Microsoft and Twitter. Also, bargain hunting activities has emerged after the sharp fall on Wednesday; the Dow rose 1.63%, while S&P500 and Nasdaq gained 1.86% and 2.95%, respectively.

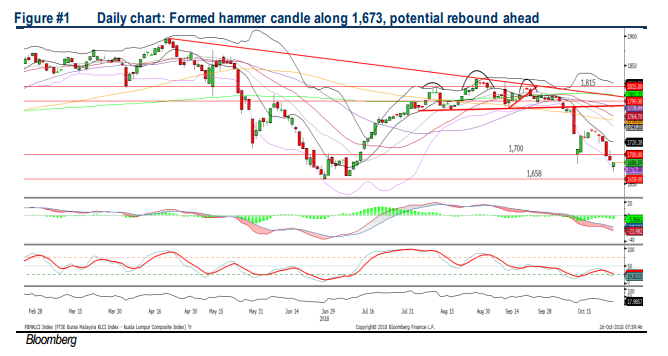

TECHNICAL OUTLOOK: KLCI

Again, the FBM KLCI closed in the negative region for the past 6 trading days and stayed below 1,700. The MACD indicator remained below zero, while the RSI and Stochastic oscillators are suggesting oversold status on the KLCI. With the hammer candle formed yesterday above the support of 1,673, the key index could be due for a rebound. Resistance will be pegged around 1,700, followed by 1,743. Support will be pegged along 1,660-1,673.

On the local bourse, sentiment may stay tepid following the recent selling pressure and investors may still wait for further clarity in Budget 2019 next week before expanding their exposure in stock markets. Hence, we think rebound would be short lived over the near term and upside should be capped near the 1,700.

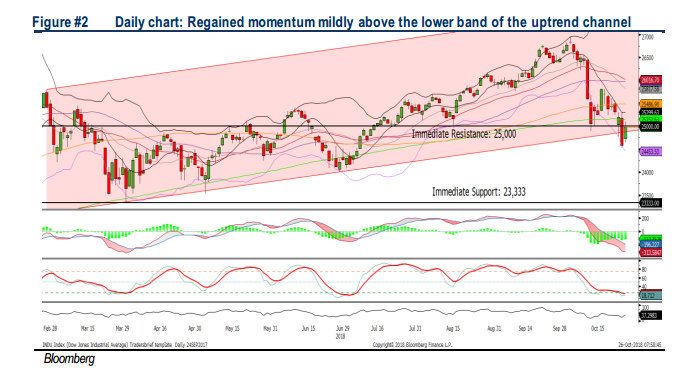

TECHNICAL OUTLOOK: DOW JONES

After plummeting more than 600 points on Wednesday, the Dow has regained strength, rising back into the uptrend channel. The MACD Indicator however is still suggesting that the negative momentum is intact. Meanwhile, both RSI and Stochastic oscillators are on a recovering process. Hence, should there be any breakout above the 25,000 level, next resistance will be located around 25,486 (100D SMA). Support will be pegged around 24,500.

Although market participants have returned to stock markets yesterday, we believe it could be short lived as the worries on trade war (dampening the global economic activities) as well as the interest rate up-cycle environment could resurface in the upcoming months. Meanwhile, over the near term, Wall Street is likely to trend sideways ahead of the US midterm election.

Source: Hong Leong Investment Bank Research - 26 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024