WTI - Building base near $64-65 ahead of the Iran’s sanction

HLInvest

Publish date: Tue, 30 Oct 2018, 04:34 PM

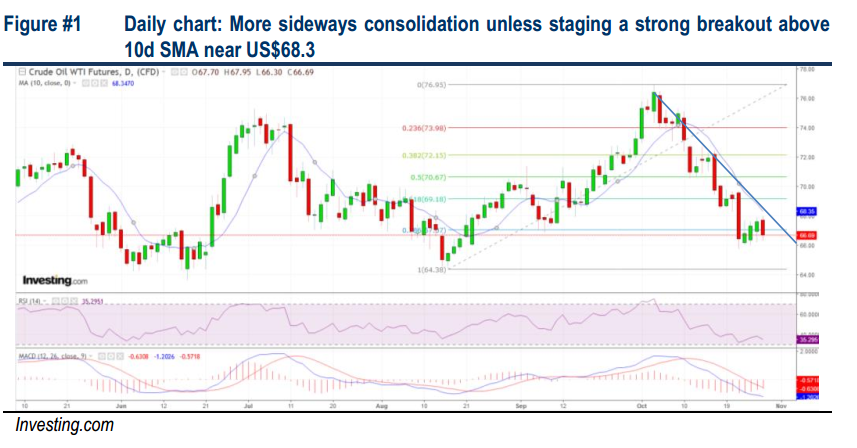

After hitting nearly 4Y high of US$76.9 (3 Oct), WTI corrected 14.6% to a low of US$65.7 (23 Oct) amid concerns of oversupply from US shale production, uneven demand due to global economic growth, ongoing US-China trade war and the European political woes as well as a stronger dollar. Although there is a potential price recovery ahead of the US sanction on Iran’s exports effective 4 Nov, any rebound would be short-lived unless staging a strong breakout above US$68.3 territory.

WTI corrected 13.4% from 4Y high of US$76.9. WTI tumbled US$1 or 1.5% to US$66.6 (-13.4% from Oct’s high of US$76.9) as traders continued to fret over worries of oversupply as Baker Hughes showed on last Friday that US drilling activity continued to climb by two in the latest week to 875 (highest since Mar 2015). Meanwhile, U.S. crude oil production has also increased by almost a third since mid- 2016 to around 11m barrels per day. Overall, WTI could recover ahead of the US sanction on Iran’s exports effective 4 Nov but markets remain wary about the recovery owing to global economic growth is tapering off following heightened US-China trade war tensions and the European political woes as well as a stronger dollar. Sentiment was also dampened after Saudi Arabia pledged to play a "responsible role" in energy markets despite its increasing isolation over the killing of Washington Post’s journalist Jamal Khashoggi.

A strong breakout above US$68.3 will spur greater upside. After hitting nearly 4Y high of US$76.9 (3 Oct), WTI corrected 13.4% to end at US$66.6 amid concerns of oversupply. Current downtrend could prevail unless prices can swiftly reclaim above the US$68.3 (10d SMA or downtrend line) successfully. A strong breakout above US$68.3 will spur greater upside to US$69.2-70.7 levels before moving further to our LT target at US$72.2. Conversely, failure to defend US$65.7 will witness further retracements towards US$63.6-64.4 levels.

Source: Hong Leong Investment Bank Research - 30 Oct 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024