Traders Brief - Market Is Moving Away From Budget 2019 to US Midterm Election and FOMC Meeting This Week

HLInvest

Publish date: Mon, 05 Nov 2018, 10:16 AM

MARKET REVIEW

Despite setback by APPLE’s tepid forecasts, Asian markets gained last Friday, helped by positive tone in HSI (4.2%), KOSPI (3.5%) and SHCOMP (2.7%). Overall, sentiment was boosted amid fresh trade talks hopes following a phone call between Trump and Xi and Bloomberg news that Trump had asked officials in his administration to start drafting a potential trade deal with China.

Tracking bullish regional markets and in the absence of more punitive proposals from Budget 2019, KLCI jumped as much as 13.2 pts before paring the gains to 7 pts at 1713.9 (+30.8 pts WoW). Trading volume soared 45% and 52% to 3.16bn shares valued at RM2.53bn respectively, amid the resumption of foreign inflows of RM172m (+4.2% WoW). Market breadth was positive with 744 gainers as compared to 204 losers.

After a 3-day 938 pts rally, the Dow slid as much as 303 pts intraday due to Apple’s poor forecast, surging bond yields (+0.08% to 3.21%) following a strong Oct job data and a flurry of contradictory US-China trade deal headlines from Trump and his top economic adviser, Larry Kudlow. Nevertheless, Dow pared losses in late trade to 110 pts at 25271 (+2.4% WoW) after Trump says 'we'll make a deal with China', countering Kudlow remarks ahead of the planned ‘Trump-Xi’ meeting at the G20 summit end Nov.

TECHNICAL OUTLOOK: KLCI

Tracking relief rallies in Dow and KLCI resilience in building a strong floor above the 1657 (post GE14 low) -1670 (Oct low) uptrend line, KLCI hit a high of 1720 last Friday before closing lower at 1713. We remain cautiously optimistic of further KLCI’s appreciation towards 1720/1730 (38.2% FR) /1748 (50% FR) in the short to medium term, supported by the bottom-up indicators and a decisive breakout above 10d SMA (1698). On the flipside, current rebound from 1670 will fizzle off should the index fall below 10d SMA again.

As the Budget 2019 uncertainty is grossly priced in, investors are now refocus on the US midterm election (6 Nov) and FOMC meeting (7-8 Nov) coupled with the upcoming 3Q18 corporate earnings. Given the concerns over widened fiscal deficit in 2018 and a heavier reliance on commodity-based revenues (due to more structural revenue-raising measures) and lingering external headwinds (eg. slowing global growth, trade tensions, geopolitics, tighter financial conditions etc), the relief rally from 1670 is likely to be capped near 1730-1748 zones.

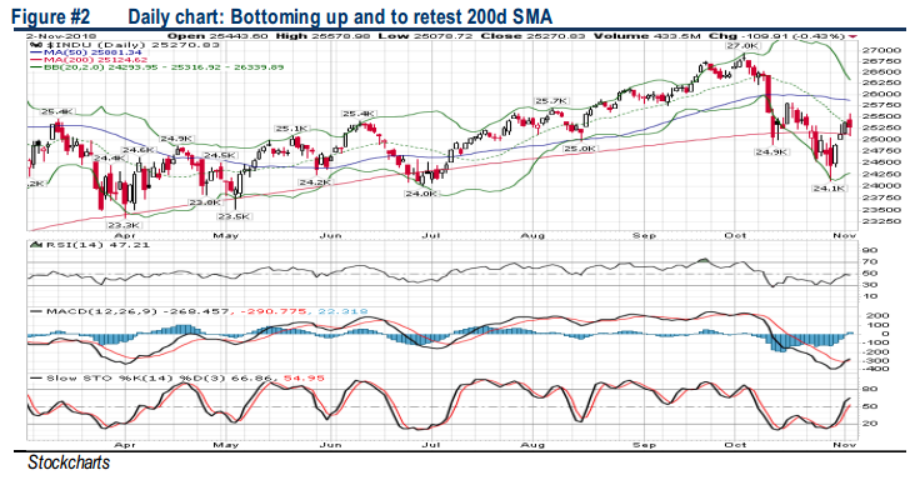

TECHNICAL OUTLOOK: DOW JONES

The Dow is likely to find a temporary bottom after hitting a 3M low of 24122, supported by the hammer-liked on 29 Oct and bottoming up indicators coupled with a close above 200d SMA near 25124. Nevertheless, the spinning top formation last Friday ahead of the US mid-term election on 6 Nov demonstrated a sign of indecision in the market. Should the index retreat below 200d SMA, Dow could retest the 24000-24100 territory. Stiff resistances are 25881- 26000.

Despite fresh developments on the trade talks last week, we believe Wall Street could stay choppy ahead of the crucial US midterm election as investors are watching closely to gauge about the durability of the Trump administration’s populist brand of politics and protectionism policies. In addition, sentiment would remain edgy, stemming from spiking 10Y bond yields (ahead of the FOMC meeting on 7-8 Nov), worries about economic growth and corporate earnings peaking.

TECHNICAL TRACKER: ASIA KNIGHT

Turnaround story and potential upliftment of PN17. A-Knight is involved in manufacturing of plastic injection moulding company, and has acquired 60% into Rapid Growth Technology (RGT) in order to facilitate with the upliftment of PN17 status. The acquisition comes with a profit guarantee of RM20m for FY17 and FY18. It has sustained two quarters of profit recently and is a net cash company at this juncture. Should there be a strong breakout above RM0.185, next resistance will be at RM0.22-0.24, with a LT target of RM0.26. Support will be at RM0.15- 0.16, with the cut loss set around RM0.145.

Source: Hong Leong Investment Bank Research - 5 Nov 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024