Traders Brief - KLCI Could be Due for Mild Pullback

HLInvest

Publish date: Fri, 09 Nov 2018, 09:31 AM

MARKET REVIEW

Asia’s equities trended mixed despite the positive rally on Wall Street following the conclusion of the US midterm election. Meanwhile, the weaker sentiment on China was dragged by the softer-than-expected China’s October export and import data. The Nikkei 225 rallied 1.82% and Hang Seng Index gained 0.31%, while Shanghai Composite Index ended lower by 0.22%.

Meanwhile, tracking the positive performance on Wall Street, the FBM KLCI trended higher by 0.38% to close at 1,721.42 pts. Market breadth was positive with 475 advancers vs. 357 decliners. Market traded volumes stood at 2.27bn shares, worth RM2.29bn. Traders were focusing on selected technology (FRONTKEN, REVENUE) and O&G (EATECH, DAYANG, REACH) related stocks as they were traded actively higher.

Moving on after the US midterm election, Wall Street ended broadly lower after the conclusion of the FOMC meeting, where the Federal Reserve kept the rates unchanged and central bank commented that they expect “further gradual increases” in the overnight rate. The Dow was flattish, but S&P500 and Nasdaq fell 0.25% and 0.53%, respectively.

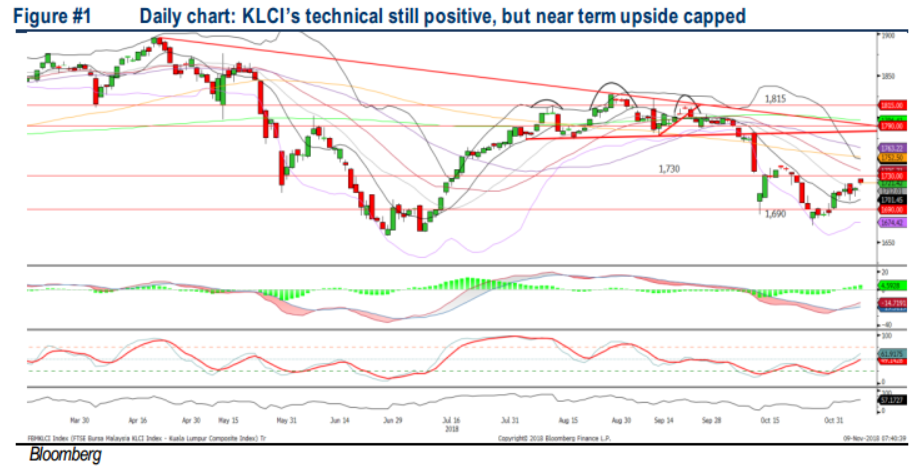

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has gapped up and closed above 1,720, still trending higher over the past three trading weeks. The MACD Indicator continues to recover below the zero level, while both the RSI and Stochastic are hovering above 50, suggesting that the KLCI is likely to trend higher with the potential upside targeted around 1,746, followed by 1,777. Support will be set around 1,700, followed by 1,670

While we think there could be further upside on KLCI as technicals are turning positive, profit taking activities could emerge over the near term to digest the recent rebound, coupled with the weaker oil prices and Moody’s downgrade on Petronas’ outlook (from stable to negative) as well as the ongoing reporting season could provide negative surprises amid the sluggish business environment after few of the mega construction projects was being cancelled/ postponed under the PH-led government.

TECHNICAL OUTLOOK: DOW JONES

After the strong surge in the Dow, the key index formed an indecisive candle, suggesting further profit taking activities could emerge over the near term. The MACD Indicator is approaching zero, but both the RSI and Stochastic oscillators are near the overbought region. Hence, with the mixed technical readings, we may expect that the Dow’s upside could be capped along 26,552-27,000. Meanwhile, support will be set around 25,433, followed by 25,117.

After the strong surge in Wall Street, we opine that profit taking activities may emerge over the near term as the Federal Reserve reaffirmed expectations for a December rate hike. Also, traders could avoid further exposure in energy and technology shares amid declining in crude oil prices and rich valuations in technology stocks.

Source: Hong Leong Investment Bank Research - 9 Nov 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024