DRB-HICOM - Riding on the Proton’s Revival

HLInvest

Publish date: Fri, 31 May 2019, 09:56 AM

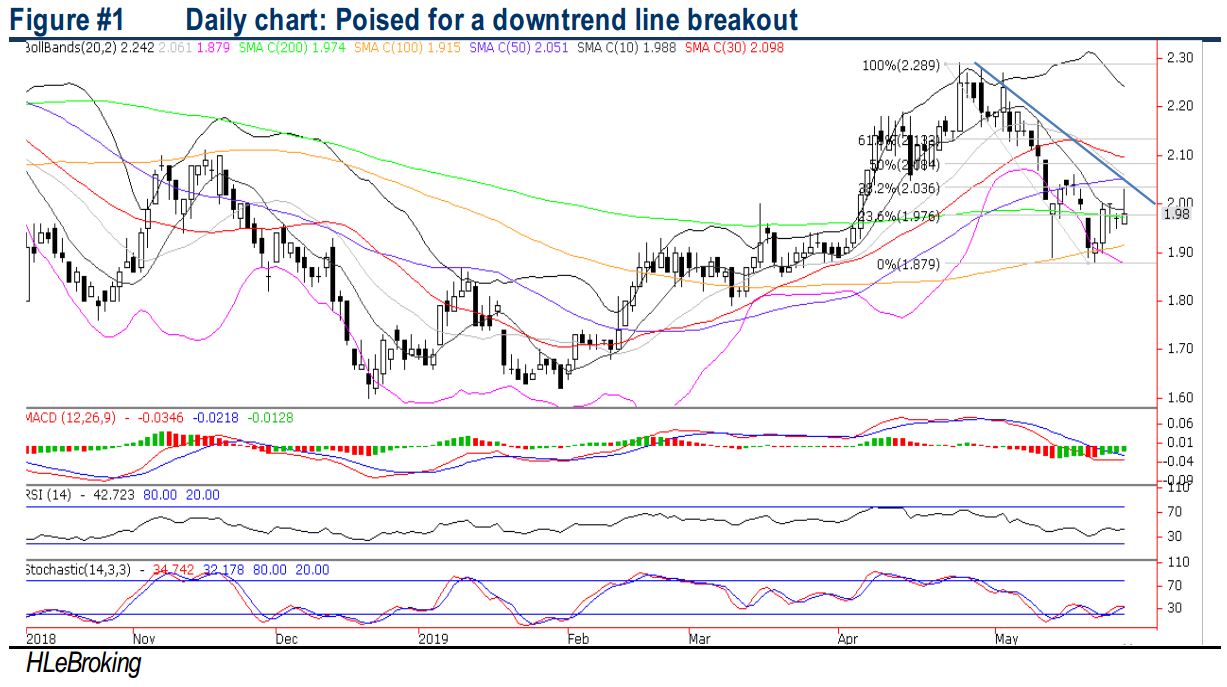

We expect DRB to continue report earnings improvement, where recovering trend was observed in its 2HFY19 results, leveraging on Proton’s turnaround momentum following the participation of Geely as Proton’s Foreign Strategic Partner. Following X70 launch, Proton has been reporting strong sales growth and the positive momentum is likely to continue ahead of the exciting models lined up in 2019-2020. Moreover, Proton’s new plant commencement by Sep 2019 will allow it to manufacture “next Generation” Proton models and further improving its cost structure. Technically, the stock is poised for a downtrend resistance breakout soon, to lift prices towards RM2.09-2.29 in the short to mid term.

Poised for a downtrend channel breakout. After hitting a low of RM1.88 (24 May), DRB is likely to experience a downtrend resistance breakout (near RM2.02) soon, supported by bottoming up indicators. A decisive breakout above RM2.02 will lift prices higher towards RM2.09 (50% FR) and RM2.19 (76.4% FR) before reaching our LT objective at YTD high of RM2.29 (24 Apr). On the flip side, failure to hold at RM1.92 (100D SMA) may indicate weakness in the share price towards RM1.88. Cut loss at RM1.84.

Source: Hong Leong Investment Bank Research - 31 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|