Traders Brief - KLCI could be due for technical rebound

HLInvest

Publish date: Tue, 03 Dec 2019, 05:10 PM

Tracking the positive gains on Wall Street, coupled with further developments on the US and China trade front, where leading negotiators from Washington and Beijing held another phone call to discuss "core issues", Asia's stock markets ended on a higher note. The Nikkei 225 and Shanghai Composite added 0.35% and 0.03%, respectively, but Hang Seng Index declined 0.29%.

Meanwhile, the FBM KLCI closed lower by 0.47% to 1,583.87 pts as further profit taking activities were seen among banking heavyweights such as Public Bank, Maybank and CIMB. Market breadth was negative with 529 decliners as compared to 352 gainers. Market traded volumes stood at 3.41bn on Tuesday (worth RM4.21bn) vs. 2.52bn (worth RM1.54bn) on Monday. Newly listed IPO Solarvest gained 115% to RM0.755 (IPO price: RM0.35).

US stock markets ended on a higher note led by retail shares ahead of Black Friday (which unofficially marks the start of holiday shopping season). Also, retailers were traded positively after Best Buy posted stronger-than-expected results and raised its 2020 forecast. The Dow and S&P500 rose 0.20% and 0.22%, respectively, while Nasdaq gained 0.18%.

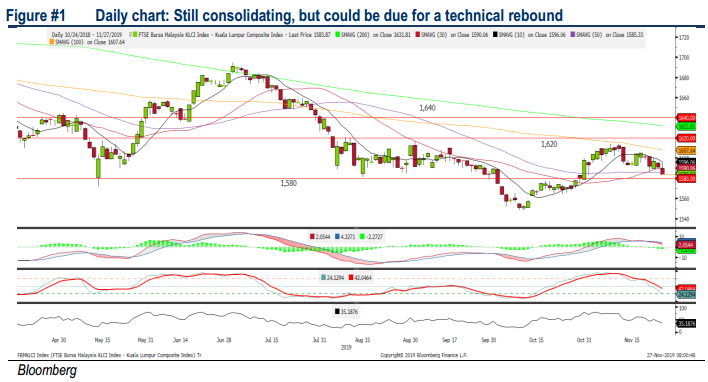

TECHNICAL OUTLOOK: KLCI

The FBM KLCI trended lower following the MSCI rebalancing activities and the MACD indicator is still declining (albeit above zero level). Meanwhile, both the RSI and Stochastic oscillators are below 50. Technical readings are negative at this juncture. However, the key index is hovering near the support of 1,580 and may warrant a technical rebound. The KLCI’s resistance is envisaged around 1,600-1,620.

We believe after the MSCI rebalancing activities, coupled with the positive trade progress between the US and China, stocks on the local front may regain traction moving forward. Despite traders may look for profit taking activities during the ongoing November reporting season period, traders are likely to deploy strategy on index heavyweights to tackle window dressing opportunities.

TECHNICAL OUTLOOK: DOW JONES

Following the recent breakout and follow through buying support on the Dow, the MACD indicator has stabilised and turned higher. Meanwhile, both the RSI and Stochastic oscillators are hooking higher over the past two sessions. With the technicals turning more positive we may anticipate the uptrend to sustain towards 28,500. Support is set around 27,400.

With the fresh positive progress on the US and China trade front after both officials extended the discussions on “core issues” for the phase one mini deal, we expect sentiment will remain positive and translating to potential upside on the Dow. However, traders will still be monitoring on the tariffs that may potentially take off In Dec. Hence, the Dow could trend higher with the upside resistance located around 28,500.

Source: Hong Leong Investment Bank Research - 3 Dec 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024