Traders Brief - Cautious Mood to Prevail Amid External Headwinds and Upcoming Aug Reporting Season

HLInvest

Publish date: Mon, 27 Jul 2020, 02:07 PM

MARKET REVIEW

Global: Led by routs on China SHCOMP (-3.9% to 3196) and Hang Seng (-2% to 24705), Asian markets were in a sea of red following overnight selloff on Wall St and intensified USChina geopolitical tensions. Thus far, the US-China animosities had been ignored in favor of a focus on the public-health crisis and fiscal stimulus but the recent events could morph into further military escalation (the US had sent a series of big aircraft carrier operations in early July to the South China Sea), given that the disputed South China Sea territory looks set to become the new flashpoint for increasingly hostile US-China tensions.

Despite better-than-expected July PMI manufacturing and June new home sales reports, Wall St tumbled last Friday as investors fretted about rising Sino-American tensions and a lack of progress on another fiscal stimulus bill in Washington, as well as awaiting more clarity as the Fed will meet on 29-30 July and the release of 2Q20 GDP (30 July). The Dow fell 182 to close at 26470 (-0.8% WoW) whilst the Nasdaq skidded 98 pts to 10363 (-1.3% WoW).

Malaysia. In tandem with sluggish regional markets, KLCI slipped 16.8 pts to 1589.6 (-6.7 pts WoW) on Friday after trading within a range of 20.1 pts between an intra -day high of 1605.2 and a low of 1585.1. Trading volume decreased to 9.88bn shares worth RM5.19bn as compared to Thursday’s 12.12bn shares worth RM6.64bn. Market breadth was negative with 383 gainers as compared to 719 losers.

For the week ended 24 July, foreign and local institutional funds were the net sellers with RM910m (selling narrowed RM29m WoW) and RM216m (selling expanded RM588 WoW), respectively while retailers bought RM1126m shares (buying soared RM559m WoW). YTD, foreigners sold RM18.6bn compared with purchases by local institutional funds (RM10.6bn) and retailers (RM8bn).

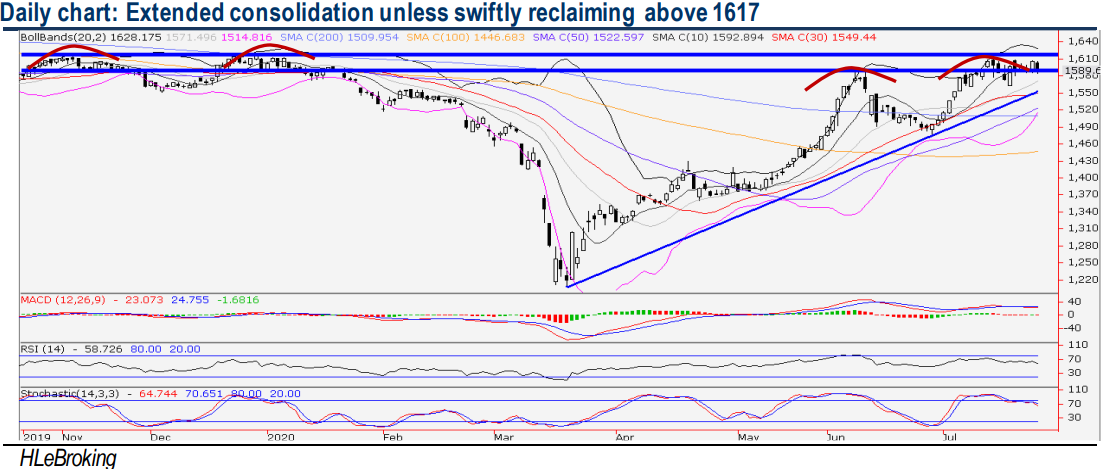

TECHNICAL OUTLOOK: KLCI

After hitting a 6M high at 1617 (14 July), KLCI was locked in a 46- pt range bound consolidation mode within 1563 (17 July low) and 1609 (20 July) levels before ending at 1589 last Friday. Unless a decisive breakout above immediate 1617 neckline resistance, current consolidation pattern would prevail to neutralize overbought technical momentum for a more sustained uptrend going forward. A strong breakout above 1617 would open the door for higher targets at 1634 (weekly upper BB) and 1679 (200W SMA) zones. On the flip side, a breakdown below 1563 would trigger further selling towards 1549 (30D SMA) and 1522 (50d SMA) territory.

MARKET OUTLOOK

KLCI has erased all its losses YTD on strong buying interest from the retailers and local funds amounted to RM10.6bn and RM8bn, respectively vs massive foreign selloff of R18.6bn. With that the million-dollar question now is whether it can hold on to that and advance further amid rising Covid-19 count globally, souring US-China relations, domestic political uncertainty, a bleak Aug reporting season, stretched valuation and growing speculation about GE15 by end 2020.

Hence, the possibility of further overbought consolidation in Aug remains high. Still, the pullback shouldn’t be as severe (unlike 1Q20) as liquidity factors (rejuvenated retail participation and Fed’s “unlimited QE” arsenal) would help cushion it. Technically, a strong breakout above 1617 would open the door for higher targets at 1634 (weekly upper BB) and 1679 (200W SMA) zones. On the flip side, a breakdown below 1563 would trigger further selling towards 1549 (30D SMA) and 1522 (50d SMA) territory.

On stock selection, HLIB Research has upgraded Westport to Buy with a higher TP at RM3.96, in anticipation of the global trade recovery amid gradual re-opening of economies. Technically, the stock is poised for a triangle breakout soon. A decisive break above immediate neckline resistance near RM3.78 will lift prices higher towards RM3.88-4.00 zones. Key supports are pegged at RM3.50-3.60. Cut loss at RM3.56.

CLOSED POSITION

Last Friday, we had squared off our position on PECCA (8.1% gain, hit R2 upside target).

Source: Hong Leong Investment Bank Research - 27 Jul 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024