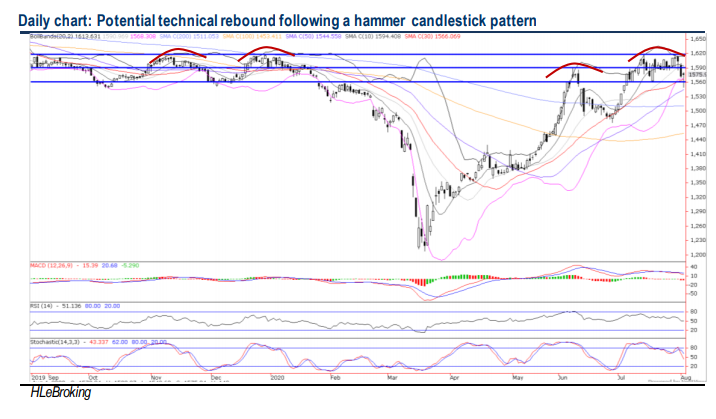

Traders Brief 5 Aug 2020 - Technical Rebound Is Likely To Be Capped Near 1591-1600 Zones

HLInvest

Publish date: Wed, 05 Aug 2020, 11:07 AM

MARKET REVIEW

Global: China and Japan bourses led regional markets higher, underpinned by strong gains in banks as investors cheered Beijing’s latest move to ease pressure on the country’s financial institutions as China will extend the grace period for implementation of sweeping asset management rules to the end of 2021. Sentiment was also boosted by a rebound in Wall St amid a strong U.S. manufacturing data and efforts to hammer out a coronavirus relief bill reporting progress over the weekend, overshadowed the rising Covid -19 infections and lingering US-China tensions over TikTok.

The Dow rose 164 pts to 26828, recording its 3rd straight increase as US. reported fewer than 50,000 new coronavirus cases for the second day in a row while investors awaited more government stimulus to blunt the economic impact of the coronavirus pandemic.

Malaysia. KLCI tumbled as much as 26.3 pts intraday to 1549.6 (within our envisaged 1541-1563 supports) before paring its losses to end 3.3 pts higher at 1575.9, in line with stronger regional markets and a strong recovery in gloves and banking stocks. Trading volume and value surged to another record high of 15.6bn shares valued at RM10.4bn against Monday’s 13.1bn shares worth RM8.2bn, helped by heavy churning of lower liners and ACE companies (+5.3%), followed by the healthcare (+4.8%) and technology (+3.3%) shares. Market breadth turned positive with 608 gainers vs 514 losers after registering negative market breadth for the third consecutive day. Yesterday, foreigners remained the net sellers (-RM251m) whilst local institutional funds and retailers were the net buyers with RM182m and RM69m, respectively. YTD, foreigners sold RM19bn shares compared with purchases by local institutional funds (RM10.4bn) and retailers (RM8.6bn).

TECHNICAL OUTLOOK: KLCI

Following a 77-pt pullback from 7M high of 1618 (29 July high) to a low of 1541 (4 Aug low) yesterday, KLCI’s overbought technical momentum has been grossly neutralise as slow stochastic indicator has retreated below 50%. We may see further technical rebound today on the back of the positive hammer candlestick pattern. Nevertheless, an extended rangebound consolidation may prevail until the index can successfully reclaim above formidable tops at 1591 (9 June) and 1618 (29 July), respectively in wake of ongoing domestic political uncertainty and August reporting season, a resurgence of Covid-19 cases and intensified US-China geopolitical tensions. Key supports are situated at 1563 (17 July low), 1541 (4 Aug low) and 1511 (200D SMA).

MARKET OUTLOOK

In wake of fading impact of past stimulus measures and evidence that the global V-shaped recovery has stalled amid lingering fears of a 2nd wave Covid-19 infections coupled with heightened US-China geopolitical conflicts, it remains to be seen what will help to keep global stock markets elevated in the coming weeks. On the domestic scene, nagging political uncertaitny and expectations of worsening reported numbers for 2Q20 (both GDP and corporate results) are the risks that could trigger further consolidation in August.

Today, we may witness KLCI to enjoy further technical rebound after rebounding from 1541 low yesterday, supported by a positive hammer candlestick and a grossly neutralise ovebought slow stochastic indicator. Nevertheless, we still expect an extended range bound consolidation in August until the index can successfully reclaim above formidable tops at 1591 (9 June) and 1618 (29 July), respectively. Key supports are situated at 1563 (17 July low), 1541 (4 Aug low) and 1511 (200D SMA).

On stock selection, HLIB Research maintains a BUY rating on Harta and upgrades its TP to RM24.10 (from RM20.12), on optimism that Hartalega will continue to focus on their capacity expansion plans from current 39bn to 44bn pieces by FY22 and expect to enjoy more upward “catch up” of ASPs in the coming quarters. Technically, the stock is likely to rewrite all-time high of RM21.16 (3 Aug) following a bullish hammer candlestick pattern yesterday. Higher targets are RM21.16-22.00-22.60 whilst supports fall on RM19.00-18.00- 17.40.

Source: Hong Leong Investment Bank Research - 5 Aug 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024