Traders Brief - Under Siege Amid a Dearth of Fresh Catalysts

HLInvest

Publish date: Thu, 27 Aug 2020, 12:34 PM

MARKET REVIEW

Global. Ahead of Fed’s Powell speech on long-awaited monetary policy framework review tonight, Asian bourses ended lower yesterday on profit-taking as investors are getting “a mixed bag” of signals, such as relatively positive US home sales but disappointing consumer confidence coupled with fears of more waves of Covid-19 infections persist in global hotspots.

Wall St extended a streak of record gains in anticipation of easing monetary policy to prevail ahead of Powell's speech on long-awaited monetary policy framework review tonight as the US economy shows mixed signs of recovery. Powered by technology and e commerce shares and encouraging news of progress on coronavirus vaccine trials, the Dow gained 83 pts to 28332 while the S&P 500 (+35 pts to 3478) and Nasdaq Composite (+198 to 11665) registered further new highs.

Malaysia. Despite technical rebounds on TOPGLOV and HARTA, KLCI slipped 5.4 pts to record its 3rd straight losses, mainly weighed down by banking, telco and O&G stocks. Trading volume soared to 12.1bn shares worth RM6.2bn against Tuesday’s 10.2bn shares valued at RM7.6bn as rising appetite on ACE (+6.23% to 10367) and smallcaps (+1.23% to 13628) companies returned after recent pullback. Market breadth was positive with 706 gainers as compared to 424 losers.

Yesterday, foreign (-RM116m) and local institutional investors (-RM33m) were the net sellers whilst local retailers (+RM149m) were the main pillars of buying force on Bursa Malaysia. YTD, foreigners net sold RM20bn shares compared with net purchases by local institutional funds (RM9.7bn) and retailers (RM10.3bn).

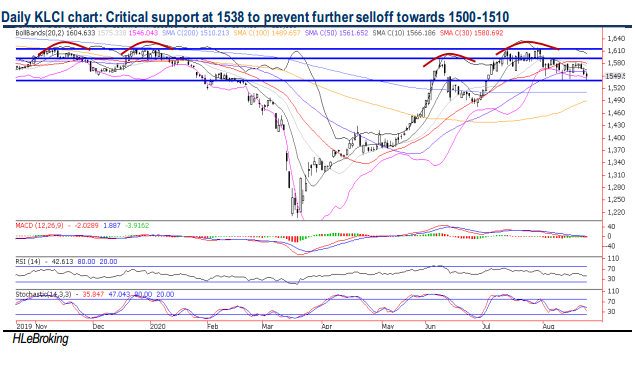

TECHNICAL OUTLOOK: KLCI

From a YTD peak of 1618 (28 July), KLCI plunged as much as 80 pts to 1538 (26 Aug low) before staging a mild rebound to finish at 1550, falling below the multiple key 20D/30D/50D SMAs supports. Follwoing the 50D SMA breakdown at 1561, KLCI is likely to remain under siege pending further fresh catalysts, with lower supports pegged at 1538 and 1510 (200D SMA) levels. Conversely, a strong reclaim above 1561 will boost the chances to retest 1575 (mid BB), 1580 (30D SMA) and 1591 (9 June high) upside zones.

MARKET OUTLOOK

The recent fall below 20D/30D/50 SMA supports would likely signal that the KLCI will extend its consolidation mode during this peak August reporting season. This is further compounded by lingering domestic political uncertainty, the resurgence of Covid-19 cases in global hotspots coupled with simmering US-China geopolitical tension. Key supports are situated at 1538-1510-1500 whilst resistances are pegged at 1561-1580-1591 levels.

On stock selection, HLIB Research maintains a Buy rating on SUNWAY (TP: RM1.95) based on a 10% holding discount to SOP-derived value of RM2.17. SUNWAY remains our top pick in the property sector given its well -integrated property and construction developments. The value of the healthcare business (with new hospitals and the SMC expansion coming on stream over the next three years) has yet to be appreciated as it is embedded within the parentco.

At RM1.37, SUNWAY is trading at an undemanding valuation of 10.5x FY21E P/E (13% lower than IJM’s 12.1x and 28% discount vs GAMUDA’s 14.7x), supported by an attractive 6.7% FY21E DY. Technically, the stock is poised for further rally after a bullish downtrend line breakout and a long white candle yesterday. MACD has confirmed its golden cross while the RSI is still on the rise, pointing to a more positive near term outlook. A successful breakout above RM1.44 (100D SMA) will spur prices higher towards RM1.55 (50% FR) before reaching our LT objective at RM1.63 (61.8% FR). Key supports are pegged at RM1.32 (10D SAM) and RM1.27 (lower BB). Cut loss at RM1.26

Source: Hong Leong Investment Bank Research - 27 Aug 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024