Traders Brief - Anticipate More Volatility in a Seasonally Weak September

HLInvest

Publish date: Tue, 01 Sep 2020, 06:44 PM

MARKET REVIEW

Global. Asian markets eased on profit-taking on 31 Aug after a strong rally in Aug following a mixed pair of economic data from China (Aug factory activity was below expectation whilst the services sector topped estimates) and escalating geopolitical tensions in t he South China sea coupled with a fear of another Covid-19 resurgence ahead of the winter and the discovery of a more infectious mutation of the coronavirus in populous India and Indonesia.

Overnight, the Dow lost 224 pts at 28430 on profit taking but still surged 7.6% in Aug whilst the Nasdaq Composite rose 80 pts to end at a record 11775 (+9.6% in Aug). Sentiment was cautious ahead of a seasonally weak September, which could be amplified by worries about a Covid-19 resurgence in the fall and winter, the deadlock in Congress over additional pandemic aid coupled with heightened political uncertainty ahead of the US presidential election on 3 Nov.

Malaysia. Ahead of the extended long Hari Merdeka holiday on 31 Aug and the portfolio rebalancing actions in the wake of the inclusion of KOSSAN and SUPERMX as component stocks of the MSCI Global Standard index (effective 1 Sep), KLCI slumped 29.6 pts in the final minutes selldown. Trading volume decreased to 11.15bn shares worth RM8.26bn as compared to Thursday’s 13.71bn shares valued at RM5.56bn. Market breadth was negative with 552 gainers as compared to 588 losers.

On 28 Aug, foreigners (-RM114m) and local retailers (-RM49m) remained as the main sellers whilst local institutional investors (+RM163m) were the main buying forces on Bursa Malaysia. YTD, foreigners net sold RM20.3bn shares compared with net purchases by local institutional funds (RM10bn) and retailers (RM10.2bn).

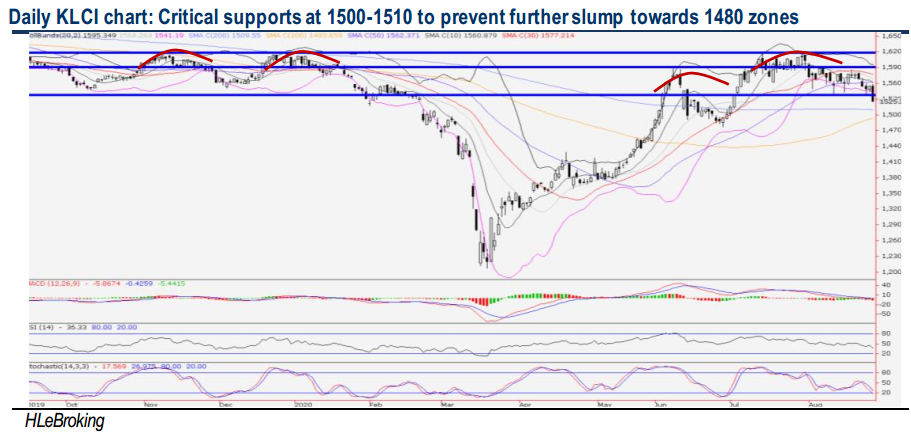

TECHNICAL OUTLOOK: KLCI

After sliding 29.6 pts on 28 Aug to 1525, KLCI ended 52 pts lower WoW and 78pts lower MoM, breaking multiple key SMA supports but still remain above the crucial 1509 (200D SMA) and 1500 psychological levels. Unless staging a strong technical rebound this week above 1541 (lower BB) and 1562 (50D SMA) resistances, investors will have to brace for further wild swings ahead of the seasonally weaker September (KLCI tumbled ~1.7% from 2000-2019). A breakdown below 1500 is likely to send the index lower towards 1481 (30W SMA) zones.

MARKET OUTLOOK

Unless staging a strong technical rebound this week to reclaim above 1541 (lower BB) and 1562 (50D SMA) levels, we expect KLCI to experience further wild swings in a seasonally sluggish September (KLCI tumbled ~1.7% from 2000-2019), compounded by domestic political uncertainty (ahead of the 26 Sep Sabah state election), the resurgence of Covid-19 cases in global hotspots coupled with simmering US-China geopolitical tension. Key supports are situated at 1509-1500-1481 whilst resistances are pegged at 1541-1562-1577 levels.

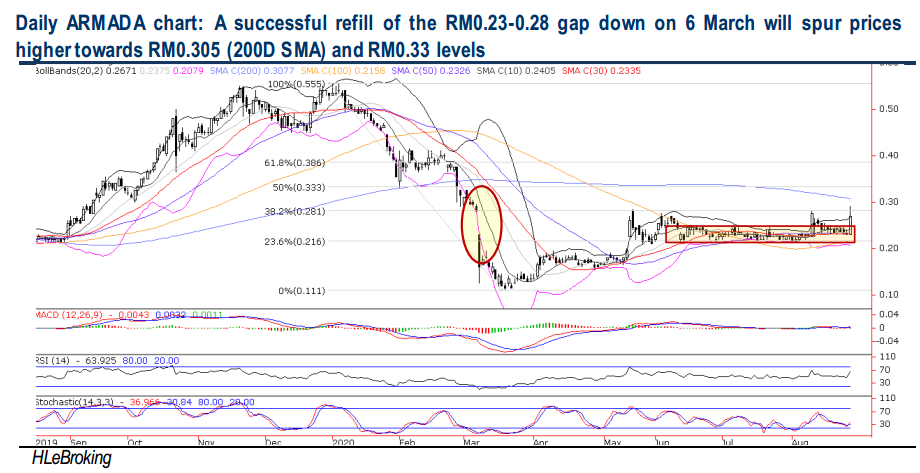

On stock selection, HLIB Research maintains a BUY rating on ARMADA with a higher TP of RM0.60 (from RM0.41) based on 10.3x FY21F EPS of 5.9sen (vs average YINSON’s FY21-22F P/E of 17.5x). We believe that the valuation gap between both stocks should narrow as ARMADA continues to exhibit a steady FY19-21 earnings CAGR of 11% as its FPSO contract values are not linked to the fluctuations in oil prices, overshadowing the subdued OMS segment.

Following a robust 2Q20 results last Friday, ARMADA’s share prices staged a strong range bound consolidation breakout to end 17.4% higher at RM0.27 last Friday, supported by an active 411m shares traded (4.3x higher than 3M average 94m). A successful refill of the RM0.23-0.28 gap down on 6 March will spur prices higher towards RM0.305 (200D SMA) and RM0.33 (50% FR) levels before reaching our LT objective at RM0.38 (61.8% FR). Key supports are pegged at RM0.23 (30D SMA) and RM0.215 (23.6% FR). Cut loss at RM0.21.

Source: Hong Leong Investment Bank Research - 1 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024