Traders Brief - Crucial Support Near 200D SMA at 1509 to Prevent Further Rout

HLInvest

Publish date: Wed, 02 Sep 2020, 04:56 PM

MARKET REVIEW

Global. Lifted by strong reading on China’s manufacturing sector, Asian markets ended mixed following a sluggish close on Wall St overnight and escalating geopolitical tensions in the South China Sea coupled with worries about a Covid-19 resurgence in the fall and winter.

Wall St staged a strong debut in September as upbeat Aug ISM manufacturing data and dovish tones from the Fed helped feed the buying momentum, despite expectations for a seasonally challenging month for equities, following the best August returns (+7.6%) in more than 30 years. The Dow soared 216 pts to 28646 whilst both the S&P 500 index (+26 pts to 3526) and Nasdaq Composite (+165 pts at 11939) close at record highs, with tech shares in the lead as investors snapped up work-from-home winners.

Bursa Malaysia made a cautious start in a seasonally sluggish September outing (KLCI tumbled ~1.7% from 2000-2019) as investors digested the subdued 2Q20 results season and await the possibility of another OPR on 10 Sep BNM meeting. Trading volume decreased to 10.4bn shares worth RM5.6bn against last Thursday’s 11.15bn shares valued at RM8.26bn. Market breadth stayed negative for the 3rd day running, as 612 losers beat 542 gainers.

Yesterday, foreigners were the main sellers (-RM380m, the highest in three months) whilst the local retailers (RM200m) and institutional investors (RM180m) were the main buying forces on Bursa Malaysia. YTD, foreigners net sold RM20.7bn shares compared with net purchases by local institutional funds (RM10.2bn) and retailers (RM10.5bn).

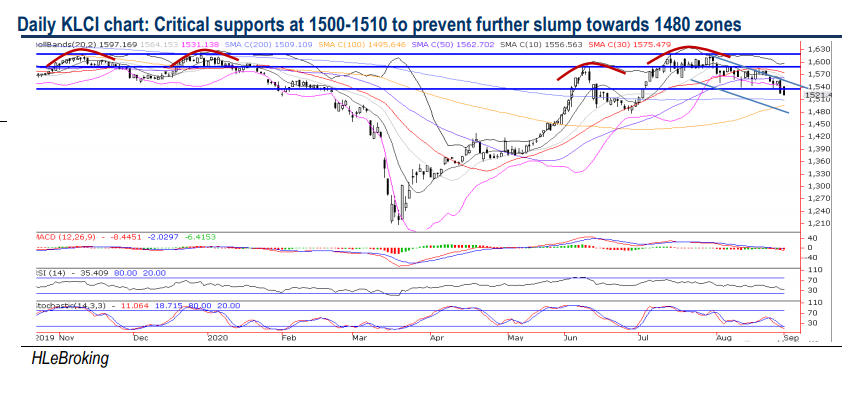

TECHNICAL OUTLOOK: KLCI

KLCI is currently trapped in a downtrend channel after sliding 97 pts from the YTD peak of 1618 (28 July) to 1521. With the violation of multiple key SMA supports and the formation of two negative long black candles, the benchmark is likely to retest lower supports near 1509 (200D SMA) and 1495 (100D SMA) levels before staging an oversold rebound. In light of a dearth of fresh catalysts, any rebound is likely to be capped near 1538 (26 Aug low), 1562 (50D SMA) and 1575(30D SMA) zones in a seasonally weak September outing (KLCI tumbled ~1.7% from 2000-2019).

MARKET OUTLOOK

The current two-tier market on Bursa Malaysia with strong retail interest in the small caps and ACE companies should continue to dominate the trading scene whilst big caps remain in consolidation mode. Unless staging a strong technical rebound this week to reclaim above 1538-1562 levels, we expect KLCI to experience more volatility in a seasonally sluggish September outing, compounded by domestic political uncertainty (ahead of the 26 Sep Sabah state election), the resurgence of Covid-19 cases in global hotspots coupled with escalating US-China geopolitical tension. Key supports are situated at 1509-1495- 1480 whilst resistances are pegged at 1538-1562-1575 levels.

On stock selection, after tumbling 29% from a 52-week high of RM2.52 (6 Jan) to RM1.79 yesterday, SERBADK (RM1.79, Not-rated) will be attractive to bargain on any price weakness towards the RM1.71 (20D SMA) and RM1.67 (100D SMA) supports levels. To recap, SERBADK is an international energy services group providing integrated engineering solutions to the Oil & Gas, petrochemical, power generation industries, water & wastewater, and utilities industries. Its main business is in operations and maintenance (O&M), and engineering, procurement, construction and commissioning (EPCC), IT Solutions, and Education & Training. The stock is currently trading at 9.9x FY21E P/E, backed by a strong earnings CAGR of 11% and a sturdy RM18.5bn order book (anchoring the next 3-year growth). Based on the Bloomberg consensus rating, there are 9 BUYs and 2 HOLDs, with an average 12M target price at RM2.29 (implying 27.9% upside).

After correcting 59.5% from RM2.52 to a low of RM1.02 (19 Mar), SERBADK has been consolidating range bound within RM1.44-1.94 levels in the last 5 months. We believe the stock is at the tail end of consolidation and is ripe for an ascending triangle breakout as share prices have been trending above multiple key SMAs since 21 Aug. A decisive breakout above RM1.87 neckline resistance (also 200D SMA) will spur prices higher towards RM2.00 before reaching our long term target at RM2.17 (76.4% FR). Cut loss at RM1.64.

Source: Hong Leong Investment Bank Research - 2 Sept 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024