Traders Brief - Choppiness Ahead Amid Internal And External Headwinds

HLInvest

Publish date: Mon, 14 Sep 2020, 10:38 AM

MARKET REVIEW

Global. Most Asian markets were lower in the morning sessions before recouping early losses following a sell-off of US technology shares overnight, concerns about the coronavirus pandemic, potential hiccups in vaccines roll out by the end 2020, and a US virus aid impasse.

Last Friday, the Dow soared as much as 294 pts on a technical rebound on vaccines progress but the gains were reduced to only 131 pts at 27666 amid persistent tech-selloff, looming 3 Nov Presidential election, deadlock in pandemic stimulus, and lingering Brexit challenges. WoW, the Dow shed 1.7%, while the S&P 500 fell 2.5% and the Nasdaq dropped 4.1%.

Malaysia. KLCI jumped 14.7 pts to 1504.9 in a volatile session after hovering within 1505.9 and a low of 1477.5. KLCI-linked glove stocks such as TOPGLOV and HARTA (both account about 10% of top 30 market cap) were on the limelight after the recent meltdown in anticipation of an outstanding TOPGLOV’s 4QFY20 results on 17 Sep. Trading volume decreased to 7.66bn shares worth RM6.49bn as compared to Thursday’s 8.4bn shares valued at RM5.49bn. Market breadth was bullish with 729 gainers vs 348 losers.

Last Friday, local institutional (+RM41m) and foreign (+RM1m) investors remained the net buyers whilst local retailers (-RM42m) were the net sellers in equities after eight straight days of net buying. WoW, local institutional, and retail investors net sold RM620m and RM154m equities, respectively whilst foreign investors (RM775m) were the main buyers.

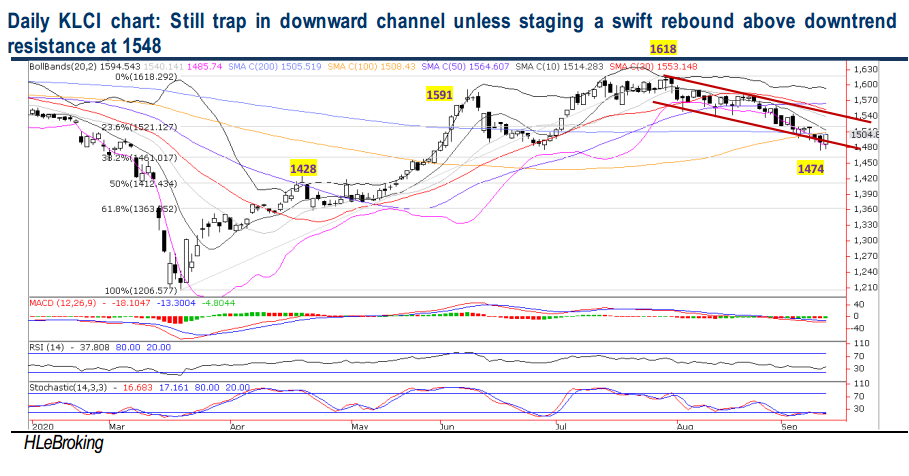

TECHNICAL OUTLOOK: KLCI

Despite a strong 14.7-pt technical rebound last Friday, KLCI was still ended 11 pts lower WoW at 1504.9 (below the multiple key SMAs), suggesting that the short to medium trend is turning mildly negative. Only a successful close above 1506 (200D SMA), 1521 (23.6% FR) and 1548 (upper downtrend channel) levels will lift KLCI out of the ongoing downward consolidation. A decisive breakdown below 1487 (lower downtrend channel) support will trigger further selldown to 1474 (10 Sep low), 1461 (38.2% FR) and 1428 (20 April high) territory.

MARKET OUTLOOK

Led by a further rebound on glove stocks in anticipation of a robust TOPGLOV’s results this Thursday, KLCI may inch higher in a holiday-shortened week (in conjunction with Malaysia Day holiday on 16 Sep). Nevertheless, in the light of internal and external headwinds, any rebound could be capped during this seasonally sluggish September outing (KLCI tumbled average 1.7% from 2000-2019).

Overall, volatility remains elevated amid the domestic political uncertainty (ahead of the 26 Sep Sabah state election), the expiry of 6M grace period for loan repayments by the end Sep, a review on Malaysia’s position in the World Government Bond Index (WGBI) by end Sep, concern over government’s major source of income following Petronas sluggish 1HFY20 results, worries of a Covid-19 resurgence in the fall and winter, escalating US China tension, potential delay in the vaccine development timelines, the potential deadlock over additional pandemic aid in US Congress coupled with the looming uncertainty ahead of the US presidential election on 3 Nov. Key supports are pegged at 1474-1461-1428 whilst resistances are situated near 1506-1521-1548.

On stock selection, HLIB Research reiterates a BUY on POS with a TP RM1.20, based on a P/B multiple of 0.65x on FY20 BVPS of RM1.84 (at -1SD below its 3-year P/B mean of 1.17x) in anticipation of recovery ahead, contributed by higher courier volume, increase in tariff hike, a higher business contribution from its logistics segment as well as stringent cost control and increasing operating efficiency.

POS is in the 2nd year of its 5Y transformation plan and optimistic that the new norms (accelerated digitalization, social distancing, the proliferation of online shopping, etc.) in the aftermath of the Covid-19 pandemic bode well for the group to break-even in 3QFY12/20 and profitable by 4QFY12/20 before returning to the black in the full FY12/21.

After tumbling 44% YTD, POS is steeply oversold and we see good entry levels near RM0.825-0.785-0.75 as values re-emerge after recent rout. A decisive breakout above RM0.87 (downtrend line) is likely to spur share prices higher towards RM0.92 (upper BB) before heading towards our LT objective at RM1.00. Cut loss at RM0.74.

Source: Hong Leong Investment Bank Research - 14 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|