Traders Brief - A Cautious Start as Profit Taking May Cap Upside Near 1546 (downtrend Line Resistance)

HLInvest

Publish date: Thu, 17 Sep 2020, 10:52 AM

MARKET REVIEW

Global. Asian markets rose in early trades following better-than-expected China’s Aug retail sales and industrial production reports amid supportive policies paving the way for a continuing and convincing growth rebound. However, profit taking reduced gains as investors were cautious ahead of the FOMC statement (at 2am on 17 Sep) for signs on how it will execute a policy shift allowing for greater tolerance towards inflation.

Overnight, the Dow surged as much as 368 pts after talk of coronavirus vaccine distribution plans by the White House by end Oct and the Fed said it would likely hold interest rates near zero until at least 2023. However, strong profit taking on major technology stocks pared the gains to only 36 pts at 28032 whilst the Nasdaq Composite tumbled 140 pts or 1.3% to 11050 after Powell warned of risks to the economy amid ongoing unemployment stress as well as an uptick in evictions and foreclosures without additional fiscal stimulus.

Malaysia. KLCI jumped 19 pts to 1531.3 to register its 3rd consecutive winning streak, led by active interests on selected glove (HARTA), banking (PBBANk, CIMB and MAYBANK) and plantation (SIMEPLT and KLK) stocks. Trading volume decreased by 0.8 bn shares to 8.9 bn shares worth RM5.4bn ahead of the Malaysia Day holiday on 16 Sep. After a strong relief rally of 57 pts from 1474 (10 Sep low), profit taking activities emerged as the gainers/losers ratio reduced to 1.35x from 2.45 (14 Sep) and 2.09 (11 Sep), respectively.

Yesterday, local institutional (RM70m) and retailers (RM153m) investors were the net buyers whilst foreign investors net sold (RM223m) equities. YTD, local institutional and retail investors net bought RM9.44bn and RM11.17bn equities, respectively compared with a total of RM20.61bn sold by foreign investors.

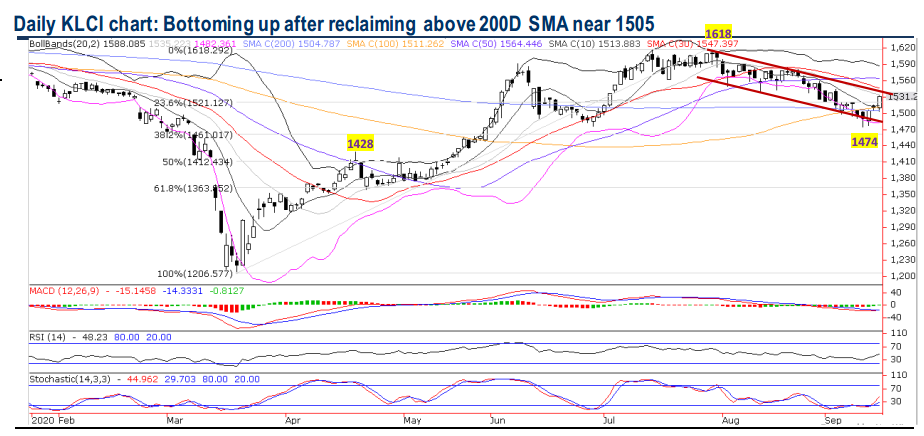

TECHNICAL OUTLOOK: KLCI

The recent rebound off the lower downtrend channel near 1487 coupled with a decisive close above the key 200D SMA (1505)/10D SMA (1513) and 1521 (23.6% FR) on 15 Sep to 1531 could spur further rally toward the critical 1546 (upper downtrend channel), supported by bottoming up indicators. A successful breakout above 1546 could indicate a resumption of further rally from 1474 with higher upside targets near 1564 (50D SMA) and 1588 (upper BB). On the contrary, a breakdown below 1521 will witness further profit taking pullback towards 1500-1505 zones.

MARKET OUTLOOK

KLCI should extend gains today, led by further buying interests on glove stocks in anticipation of TOPGLOV’s robust 4Q results today (at 12.30 noon followed by a concall at 3.30pm) as well as expectations of a buoyant outlook ahead, discounting the nagging concerns of a potential windfall tax and discovery of a Covid-19 vaccines. Moreover, glove demand is unlikely to taper off amid worries of a Covid-19 resurgence towards the wintering period in 4Q20 and potential surge in demand when masses rush to be vaccinated.

Nevertheless, further rally could be capped near 1546-1564 zones amid elevated domestic risks due to: 1) domestic political uncertainty ahead of the Sabah polls on 26 Sep, 2) the expiry of 6M grace period for loan repayments by end Sep), 3) review on Malaysia’s position in the World Government Bond Index (WGBI) by end Sep and 4) concern over government’s major source of income following Petronas sluggish 1HFY20 results. Key supports are pegged at 1521-1505-1487.

On stock selection, after correcting 29% YTD to RM0.535 on 15 Sep, ECONBHD (Not rated) will be attractive to bargain on any price weakness towards the 0.50 and RM0.49 (38.2% FR) supports levels. On 15 Sep, ECONBHD has proposed a private placement of up to 133.7m new shares (10% of issued shares) to raise RM76.7m (indicative price of RM0.574). The exercise would provide flexibility in allocating financial resources for its operations and would position the company's balance sheet towards longer-term sustainability for the construction industry's eventual recovery.

Illustrating this, ECONBHD remained competitive in the industry, having won RM315m in FY6/20. As at end June, the group's orderbook stood at RM670.0 million, providing earnings visibility over the next 15 months. Among its prominent projects are works for Pavilion Damansara Heights, LRT3 – Package GS04, TNB mixed development and Terra Putrajaya Project.

In wake of a grossly oversold levels, downside risk is limited and we may see a technical rebound soon to test immediate resistance at RM0.57 (10D SMA). A decisive breakout above this hurdle will lift prices higher towards RM0. 62 (200D SMA or downtrend line) before testing our LT objective at RM0.69 (76.4% FR). Cut loss at RM0.475.

Source: Hong Leong Investment Bank Research - 17 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024