Traders Brief - Continue to Err on the Side of Caution

HLInvest

Publish date: Tue, 13 Oct 2020, 09:39 AM

MARKET REVIEW

Global. Asian markets ended mostly higher last Friday, led by a 2.6% rally on SHCOMP as investors cheered recent upbeat economic data and Beijing’s latest policy support for equity markets to attract more mid and long-term funds. Overnight, Dow rose 250 pts at 28837, led by a rally in tech shares (Nasdaq Composite surged 2.6% to 11876) as investors are bracing another huge rescue package post US 3 Nov presidential election despite near term hiccups in finalising more fiscal stimulus. Sentiment was also boosted by improving expectations of the upcoming 3Q20 results (-21% YoY), smaller than a 31% slump in the preceding quarter.

Malaysia. After rallying 30 pts WoW, KLCI slipped 11.9 pts at 1518.4, after the government announced CMCOs in Selangor, KL, Putrajaya and Sabah to curb the spiking Covid-19 cases and clusters. Sentiment was also dampened by elevated political uncertainty as Anwar is set to meet Agong today in a challenge for the premiership. Yesterday, local retailers were major sellers (-RM68m) whilst foreign investors bought RM39m (3rd consecutive days of net buying) and the local institutional purchased RM29m) of equities.

TECHNICAL OUTLOOK: KLCI

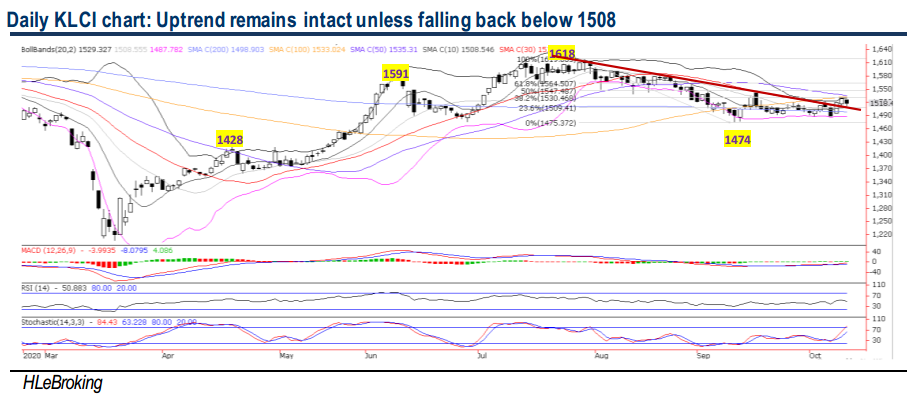

We believe near term KLCI uptrend remains intact after a successful downtrend line breakout from the YTD high of 1618 (29 July) last week, despite surrendering 11.9 pts at 1518.4 yesterday after government announced CMCOs in Selangor, KL, Putrajaya and Sabah. Barring any sharp fall below the downtrend line again (now at 1508), KLCI is still on course for a further march in the weeks ahead towards 1535 (50D SMA), 1546 (50% FR) and 1563 (61.8% FR) zones. However, failure to defend 1508 and 1499 (200D SMA) levels will favour the bears again, with an extended downward consolidation to 1487 (lower BB) and 1474 (10 Sep low) levels.

MARKET OUTLOOK

The focus today will be on domestic politics as Anwar Ibrahim, was granted an audience with the King to prove his claim of having a formidable majority to form the next government. On top of the lingering political uncertainty, surging Covid-19 cases and clusters could pose downside economic risks, considering the soaring cases in Klang Valley (which makes up ~41% of national GDP). Sectors wise, major beneficiaries from the soaring Covid-19 cases in Malaysia are gloves, technology, telco and courier while sectors most vulnerable appeared to be aviation, retail, F&B, gaming, malls and hotels. Key supports fall on 1499-1508 while resistances are situated at 1535-1563 levels.

Source: Hong Leong Investment Bank Research - 13 Oct 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024