Traders Brief - Market to Remain Choppy Amid The CMCO and Fluid Politics

HLInvest

Publish date: Wed, 14 Oct 2020, 10:03 AM

MARKET REVIEW

Global. Asian markets rose in the early sessions, boosted by positive Sep auto sales and trade data from China. However, early gains were pared amid fear of a 2nd wave Covid-19 resurgence and news that J&J paused its vaccine trials due to safety concerns. As 3Q20 earnings season got underway (Wells Fargo, Bank of America and Goldman Sachs and Morgan Stanley earnings are due this week), the Dow snapped its 4-day winning streak (- 157 pts to 28680) on profit taking as sentiment was dampened by news of halted Covid-19 vaccine trials (J&J and Eli Lilly) due to safety concerns, and an elusive stimulus aids (after Pelosi rejected the USD$1.8 trillion relief proposal from the White House).

Malaysia. KLCI slipped as much as 6 pts in the early trade before ending 6.8 pts higher at 1525.2 as investors digested the economic and political repercussions on the government’s CMCOs announcement and news that Anwar finally had an audience with Agong by revealing the numbers of MPs supporting him (but not the identities). Yesterday, local institutional investors were the major sellers (-RM91m) whilst foreign investors (4th straight days of net buying) and the local retailers (resumed buying after two days of net selling) were the main buyers with net buys of RM10m and RM82m equities, respectively.

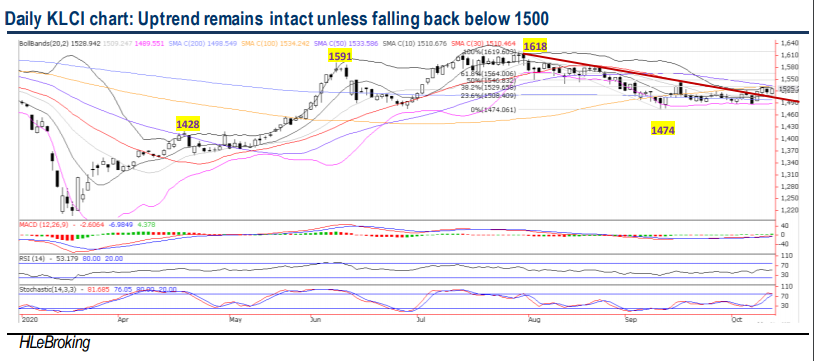

TECHNICAL OUTLOOK: KLCI

We reiterate our near term positive view on KLCI following a successful downtrend line breakout from the YTD high of 1618 (29 July) last week. Barring any sharp fall below the downtrend line again (now at 1500), KLCI is still on course for a further march in the weeks ahead towards 1533 (50D SMA), 1546 (50% FR) and 1563 (61.8% FR) zones. However, failure to defend 1500 levels will favour the bears again, with an extended downward consolidation towards 1489 (lower BB) and 1474 (10 Sep low) levels.

MARKET OUTLOOK

Following the successful downtrend line breakout from the YTD high of 1618 (29 July) last week and barring any pullback below 1500-1510 supports, KLCI’s near term technical outlook has turned increasingly positive, with short term targets situated at 1533-1563 levels. Nevertheless, the tug of wall between bears and bulls may prevail to cap further rally in the wake of the headwinds ahead such as lingering political uncertainty, surging Covid-19 cases and clusters in Malaysia, the vaccines’ progress and the US presidential election on 3 Nov.

On stock pick, we like FPI (RM1.52, Not-rated) due to its fruitful diversification from conventional speakers into richer margins audio system and component/ musical instrument segments coupled with the synergistic partnership with an established global EMS, Wistron (parent company with a 28% stake). Save for the unprecedented FY20 results due to Covid19, FPI’s LT prospects remain bright, driven by (i) positive speaker market outlook with consumers’ rising needs and expectations around personalisation, lifestyle and customisation, (ii) capacity expansion, (iii) strategic tie-up with Wistron, (iv) beneficiary of the US-China trade war due to trade diversions and (v) travel curtailment to boost consumer electronics spending. Valuation is undemanding at 13.6x P/E (23% lower than peers), supported by solid balance sheet with RM0.59 net cash and 5.8% dividend yield (132% higher than peers).

In anticipation of a seasonally stronger 3Q results (vs 2Q), the stock is poised for a LT downtrend line breakout (from RM1.80 on 18 Feb 2019). A successful breakout above RM1.56 barrier will spur prices higher towards RM1.62-1.80 territory. Key supports are pegged at RM1.43-1.48. Cut loss at RM1.42.

Source: Hong Leong Investment Bank Research - 14 Oct 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024