Traders Brief 15 Oct 2020 - Cautious Mood To Stay Amid Lingering Worries Of CMCO And Political Noises

HLInvest

Publish date: Thu, 15 Oct 2020, 09:55 AM

MARKET REVIEW

Global. Asian markets ended mixed on profit taking, as halted Covid-19 vaccine trials and diminishing hopes for the passage of a U.S. coronavirus relief bill dented risk appetite. The Dow slipped 165 pts at 28514 after Treasury Secretary Steven Mnuchin down played the chances of striking a stimulus deal before the election. Sentiment was also dampened by mixed 3Q20 results from the banks and surging number of new Covid-19 infections that led investors to shift away from risky assets to traditional safe havens.

Malaysia. Tracking cautious undertone in regional markets, KLCI shed 2 pts at 1523.3 after fluctuated within intra-day high of 1524.23 and a low of 1516.1, as sentiment was dampened by worries over the CMCOs and domestic fluid politics. Trading volume increased to 7.03bn shares worth RM6.26bn as compared to Tuesday’s 5.97bn shares valued at RM3.89bn, supported by improving gainers/losers ratio of 1.15x (Wednesday 1.04x) with glove makers, PPE and vaccine-related stocks leading gains. Yesterday, foreign investors were the major sellers (-RM87m) after four days of consecutive net buys whilst the local retailers (+RM6m) and local institutional investors (+RM81m) were the main buyers.

TECHNICAL OUTLOOK: KLCI

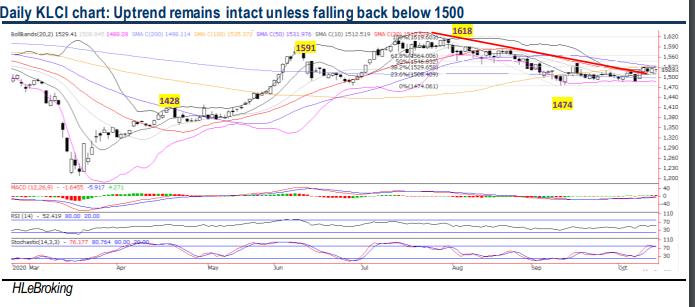

We reiterate our near term positive view on KLCI following a successful downtrend line breakout from the YTD high of 1618 (29 July) last week. Barring any sharp fall below the downtrend line again (now at 1500), KLCI is still on course for a further march in the weeks ahead towards 1532 (50D SMA), 1546 (50% FR) and 1563 (61.8% FR) zones. However, failure to defend 1500 levels will favour the bears again, with an extended downward consolidation towards 1488 (lower BB) and 1474 (10 Sep low) levels.

MARKET OUTLOOK

Barring any sharp pullback below 1500 support, KLCI’s near term technical outlook has turned mildly positive (short term targets at 1532-1564 levels) following the successful downtrend line breakout from the YTD high of 1618 (29 July). However, the tug of war between bears and bulls may stay for a while to cap further rally in the wake of the nagging headwinds such as domestic political uncertainty, surging Covid-19 cases and clusters in Malaysia, the vaccines’ progress and the US presidential election on 3 Nov.

On stock pick, we like DNONCE(RM0.66, Not-rated), riding on twin engines of growth i.e. healthcare and E&E sectors. To recap, DNONCE is a diversified engineering solutions provider with key customers’ base from: 1) Healthcare division (contributed 41% of 1QFY4/21 operating profit) mainly serving major glove producers based in Thailand such as Top Glove and Sri Trang Gloves, as well as other glove players i.e European glove maker Mercator Medical and US glove maker Halyard (manufacture packaging boxes for major glove manufacturers and produce plastic products for medical use); 2) E&E division (56% of 1QFY4/21 operating profit) mainly serving the semiconductors and memory drive manufacturers (provide cleanroom services, box-Build assembly and plastic components parts such as PCB trays/precision component tape and reels), and 3) Manufacturing division (3% of 1QFY4/21 total operating profit) mainly producing industrial and carton boxes primarily for furniture, automotive and F&B industries.

The bullish uptrend remains intact as share price is currently trading above all key SMAs and we expect it to break above immediate neckline resistance at RM0.68 soon, supported by improving technicals. A successful breakout will lift share prices higher towards RM0.715 - 0.755 zones. Key supports are pegged at RM0.62-0.63 levels. Cut loss at RM0.615.

Source: Hong Leong Investment Bank Research - 15 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024