Traders Brief 20 Oct 2020 - Tug-A-War Risk To Prevail

HLInvest

Publish date: Tue, 20 Oct 2020, 09:49 AM

MARKET REVIEW

Global. Asian markets ended mixed amid fading hopes of a fresh US stimulus deal before 3 Nov presidential election and surging global Covid-19 cases. Sentiment was also dampened by rising US-China geopolitical tension after the US Destroyer sailed through Taiwan Strait last week and a weaker than-expected China’s 3Q20 GDP of 4.9%. Overnight, the Dow tumbled 411 pts to 28195 as the prospects of a stimulus package being completed prior to the 3 Nov is dimming after Pelosi imposed a deadline on Wednesday (Malaysia time) to strike an agreement. Market’s volatility was also driven by the resurgence of Covid19 2nd wave across the US and Europe and the ongoing 3Q20 earnings season.

Malaysia. After slipping 26.5 pts WoW, KLCI staged a 14.3-pt relief rebound amid active buying interests on TOPGLOV and HARTA as well as bargain hunting on selected bashed down blue chips. Trading volume increased to 9.5bn shares worth RM5.43bn as compared to Friday’s 8.71bn shares valued at RM4.77bn due to a revival of buying interests on lower liners and ACE shares. Market breadth was positive with 723 gainers vs 387 losers. Yesterday, local institutional investors and retailers net sold RM101m and RM0.2m equities, respectively against a net purchase of RM101m by foreign investors (after net sold RM287m shares from 14-16 Oct).

TECHNICAL OUTLOOK: KLCI

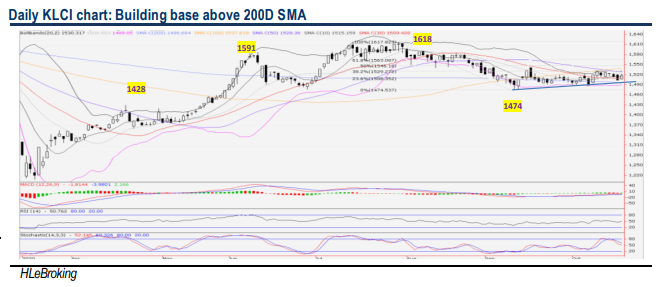

Despite a strong close above the critical 200D SMA support (now at 1497) and the major support trendline (from 1474 low) yesterday, KLCI is still locked in a short term sideways consolidation mode unless staging a successful reclaim above 1528 (50D SMA) overhead resistance. Crossing this hurdle will lift the index higher towards 1546 (50% FR) and 1564 (61.8% FR) levels next. Conversely, a sharp retreat below the 1509 (30D SMA) and 1497 supports could reignite a risk-off mode, potentially pushing the index lower towards 1488 (lower BB), 1474 (10 Sep low) and 1461 (50% FR) levels.

MARKET OUTLOOK

Despite closing above the critical 200D SMA support (now at 1497) and the major support trendline from 1474 low, KLCI is still likely to engage in a sideways consolidation mode amid rising uncertainties ahead of the US presidential election and stimulus talks impasse coupled with a resurgence in Covid-19 infections globally and in Malaysia, which may dampen our expectations for a 2H20 economic and corporate earnings recovery. Stocks wise, the bright spot should continue to be the healthcare sector, with rub ber glove, PPE and vaccine related stocks seen to benefit from a resurgence in Covid-19 cases worldwide. Key resistances are 1528-1546-1564 whilst supports fall on 1510-1497-1488.

VIRTUAL PORTFOLIO POSITION-FIG1

In the Wake of the Market Uncertainty, We Had Closed Our Position on KRONO (2.6% Gain) yesterday.

Source: Hong Leong Investment Bank Research - 20 Oct 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024