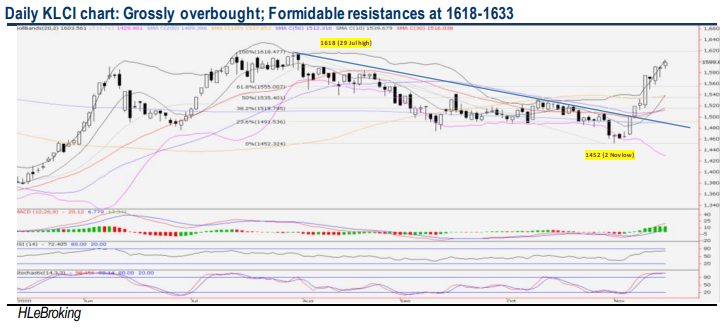

Traders Brief - Formidable resistance at 1618-1633 zones amid grossly overbought indicators

HLInvest

Publish date: Tue, 17 Nov 2020, 09:56 AM

MARKET REVIEW

Global. Most Asian markets ended higher on the back of the positive China factory output and retail sales in Oct, and the signing of the world’s largest Regional Comprehensive Economic Partnership (RCEP) trade deal in Hanoi on 15 Nov. The RCEP members includes China, Japan South Korea, Australia, New Zealand and the ten 10 members of the ASEAN, together encompassing nearly a third of the world’s population (about 2.2bn people) and a combined GDP of USD26.2 trillion. Overnight, the Dow rallied 470 pts to end at an all-time high 29950 after Moderna became the 2nd US company (after Pzifer) to report positive results from its Covid-19 vaccine trial (has shown the efficacy of 94.5%), raising hopes of quicker economic recovery from a pandemic-led recession.

Malaysia. Tracking higher regional markets, KLCI jumped 10 pts to 1599.7, as investors continued migrating to economically-sensitive industries in the banking, logistics, hospitality and plantation, stemming from the expected deployment of the Covid-19 vaccines. There were 776 gainers vs 532 losers, supported by 16.1bn shares worth RM6.7bn (the highest since 28 Aug). Meanwhile, foreign investors resumed selling (net sold RM126m shares) whilst local institutional and retail bought RM111m and RM15m in equities, respectively.

TECHNICAL OUTLOOK: KLCI

The formation of two ‘Hanging man’ candlesticks (11 & 13 Nov) and grossly overbought indicators (after a powerful 148-pt rally from 1452 low) could represent a potential reversal in an uptrend, with upside likely to be capped near 1618 and 1633 (61.8% FR from 1896 and 1208) zones. On the contrary, a breakdown below immediate support at 1578 (76.4% FR) will trigger further selloff towards 1555-1535-1515 levels.

MARKET OUTLOOK

Buoyed by the highly expansionary Budget 2021, vaccines’ optimism, the RCEP signing coupled with the President-elect Joe Biden’s reassuring US presidential election victory, KLCI had rallied 148 pts or 10.2% from a low of 1452 (2 Nov) to 1599.7 yesterday. As technicals are turning grossly overbought now, a pullback is likely in the near term amid lingering concerns about the uneven global economic outlook due to the surging Covid-19 infections worldwide and new lockdowns, expectations of weaker 4Q20 economy and corporate earnings in Malaysia (post CMCO 2.0), ongoing 3Q20 results season, and the Budget 2021 approval (expected to be held on 25 Nov). Key supports are pegged at 1579- 1555-1535 levels whilst resistances are situated near 1618-1633 levels.

Source: Hong Leong Investment Bank Research - 17 Nov 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024