Traders Brief - Upside May be Capped at 1580-1600 Levels Amid a Resumption of Foreign Selling and Overbought Stochastic Reading - MARKET REVIEW

HLInvest

Publish date: Tue, 17 Nov 2020, 06:51 PM

MARKET REVIEW

Global. Asian markets rallied as Pfizer/BioNTech Covid-19 vaccine enthusiasm and growing confidence that US President-elect Joe Biden will promote global growth and reduce trade tensions, fueled optimism about a faster economic recovery in Asia compared with other parts of the world. Wall St ended mixed on easing vaccines euphoria as the mass deployment of a vaccine remains months away and Biden’s warning that the US is still facing a very dark winter as Covid-19 cases continued to surge. The Dow jumped 263 pts or 0.9% to 29420 whilst the S&P 500 eased 0.14% and the Nasdaq slid 1.4%.

Malaysia. Stemming from the upbeat Pfizer-BioNTech Covid-19 vaccine trial, KLCI surged 50.8 pts or 3.3% to 1575.1, led by bargain hunting on the pandemic-recovery theme such as banking, oil & gas, hospitality and utilities sectors. Market breadth was buoyant as gainers edged losers 747 to 609 on heavy trade totaling 12.3bn shares worth a whopping RM8.4bn. Meanwhile, foreign investors net sold RM333m (the largest single-day disposal since 5 Aug RM337m) after three consecutive days of buying whilst local institutional investors and retailers were the net buyers with RM148m and RM185m in equities, respectively.

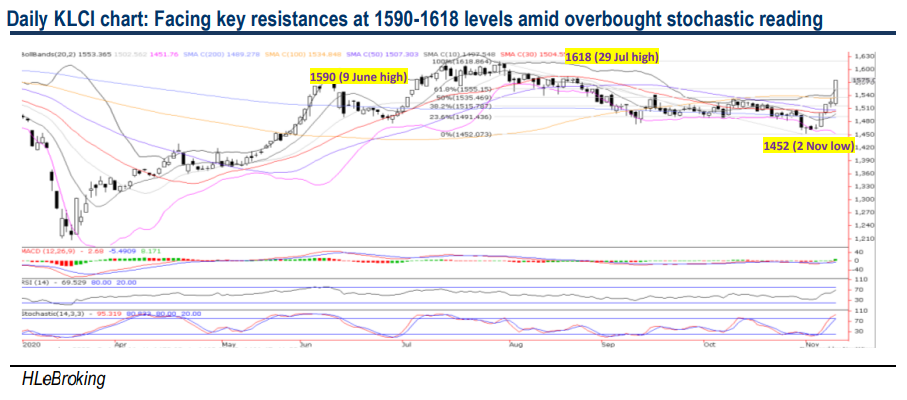

TECHNICAL OUTLOOK: KLCI

Following the unstoppable march above 1535 (50% FR) and 1555 (61.8% FR) overhead resistances before closing at 1575 yesterday, KLCI is poised to retest 1590-1600 next, encouraged by positive daily and weekly RSI and MACD indicators. However, as daily stochatic indicator is steeply overbought, the bechmark could face formidable resistance near YTD high of 1618. Key pullback supports are situated at 1555-1535-1515 levels. A decisive breakdown below 1515 will attract further selling prersures towards 1500 and 1489 (200D SMA) zones

MARKET OUTLOOK

Although the less combative Biden (vs Trump), expansionary Budget 2021 and Covid-19 vaccine optimism are condusive for Bursa Malaysia, lingering concerns about the economic impact from rising CMCOs, ongoing Nov results season, unabated Covid-19 infections worldwide (as the mass deployment of a vaccine remains months away) coupled with the resumption of foreign selling may cap further rally. Key supports are pegged at 1555-1535- 1515 whilst resistances are situated near 1590-1600-1618 levels.

Source: Hong Leong Investment Bank Research - 17 Nov 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024